- United States

- /

- Interactive Media and Services

- /

- NasdaqCM:SLE

Super League Enterprise, Inc. (NASDAQ:SLE) Stock's 34% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, Super League Enterprise, Inc. (NASDAQ:SLE) shares are down a considerable 34% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 90% share price decline.

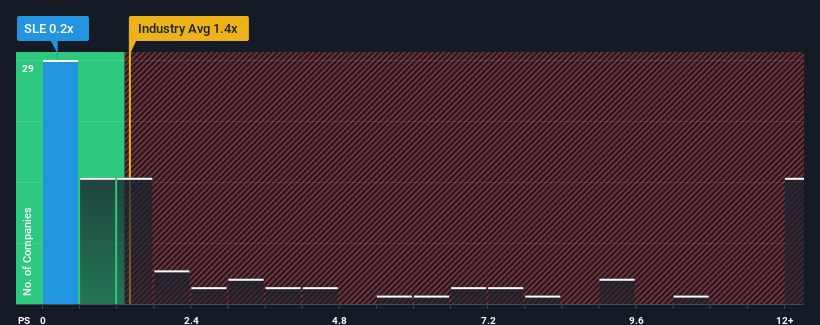

Following the heavy fall in price, Super League Enterprise's price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Interactive Media and Services industry in the United States, where around half of the companies have P/S ratios above 1.4x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Super League Enterprise

How Has Super League Enterprise Performed Recently?

Super League Enterprise certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Super League Enterprise's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Super League Enterprise would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 35% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 36% over the next year. That's shaping up to be materially higher than the 13% growth forecast for the broader industry.

With this information, we find it odd that Super League Enterprise is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The southerly movements of Super League Enterprise's shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Super League Enterprise's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Super League Enterprise (2 can't be ignored) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SLE

Super League Enterprise

Super League Enterprise, Inc. creates and publishes content and media solutions across immersive platforms in the United States and internationally.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives