- United States

- /

- Interactive Media and Services

- /

- NasdaqCM:SLE

Investors Continue Waiting On Sidelines For Super League Enterprise, Inc. (NASDAQ:SLE)

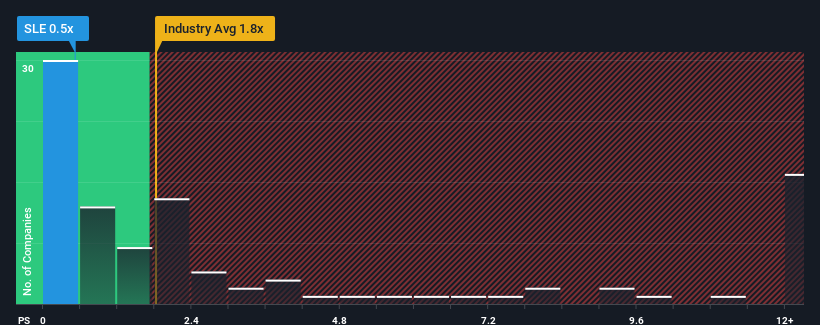

You may think that with a price-to-sales (or "P/S") ratio of 0.5x Super League Enterprise, Inc. (NASDAQ:SLE) is a stock worth checking out, seeing as almost half of all the Interactive Media and Services companies in the United States have P/S ratios greater than 1.8x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Super League Enterprise

What Does Super League Enterprise's Recent Performance Look Like?

Super League Enterprise certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Super League Enterprise will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Super League Enterprise?

In order to justify its P/S ratio, Super League Enterprise would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 47% over the next year. That's shaping up to be materially higher than the 14% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Super League Enterprise's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Super League Enterprise currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Super League Enterprise (of which 1 doesn't sit too well with us!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SLE

Super League Enterprise

Super League Enterprise, Inc. creates and publishes content and media solutions across immersive platforms in the United States and internationally.

Slight and fair value.