- United States

- /

- Media

- /

- NasdaqGS:SIRI

Will Sirius XM (SIRI) Leverage Tech Expertise to Reinvent Its Service Expansion Strategy?

Reviewed by Simply Wall St

- Sirius XM Holdings recently announced that Dave Stephenson, Airbnb’s Chief Business Officer and former CFO, has joined its Board of Directors and will serve on the compensation committee, effective September 18, 2025.

- Stephenson’s extensive experience in scaling technology-driven businesses at both Airbnb and Amazon could influence Sirius XM’s approach to operational efficiency and future service expansion.

- We’ll examine how the appointment of a technology leader with deep financial expertise may impact Sirius XM’s investment narrative going forward.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Sirius XM Holdings Investment Narrative Recap

Owning Sirius XM Holdings requires confidence in its ability to stabilize and grow its subscriber base while managing rising content costs and intense competition from streaming alternatives. The addition of Dave Stephenson to the board adds valuable expertise in technology and financial operations, but this does not represent a material change to the key short-term catalyst, expansion of digital subscription offerings, or to the most pressing risk, ongoing subscriber decline and revenue pressure from streaming competition. Among recent company moves, the August launch of SiriusXM Play, a new low-cost, ad-supported subscription plan, directly targets the short-term catalyst of drawing in more price-sensitive listeners and expanding the addressable market. While this initiative aligns with efforts to reverse subscriber losses, the challenge of attracting and retaining a younger demographic in the face of shifting audio habits still looms large. However, investors should also be aware that even with new initiatives, Sirius XM’s reliance on automakers for distribution remains …

Read the full narrative on Sirius XM Holdings (it's free!)

Sirius XM Holdings is projected to generate $8.5 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes a -0.1% annual revenue decline and a $2.9 billion earnings increase from current earnings of -$1.8 billion.

Uncover how Sirius XM Holdings' forecasts yield a $23.64 fair value, a 3% downside to its current price.

Exploring Other Perspectives

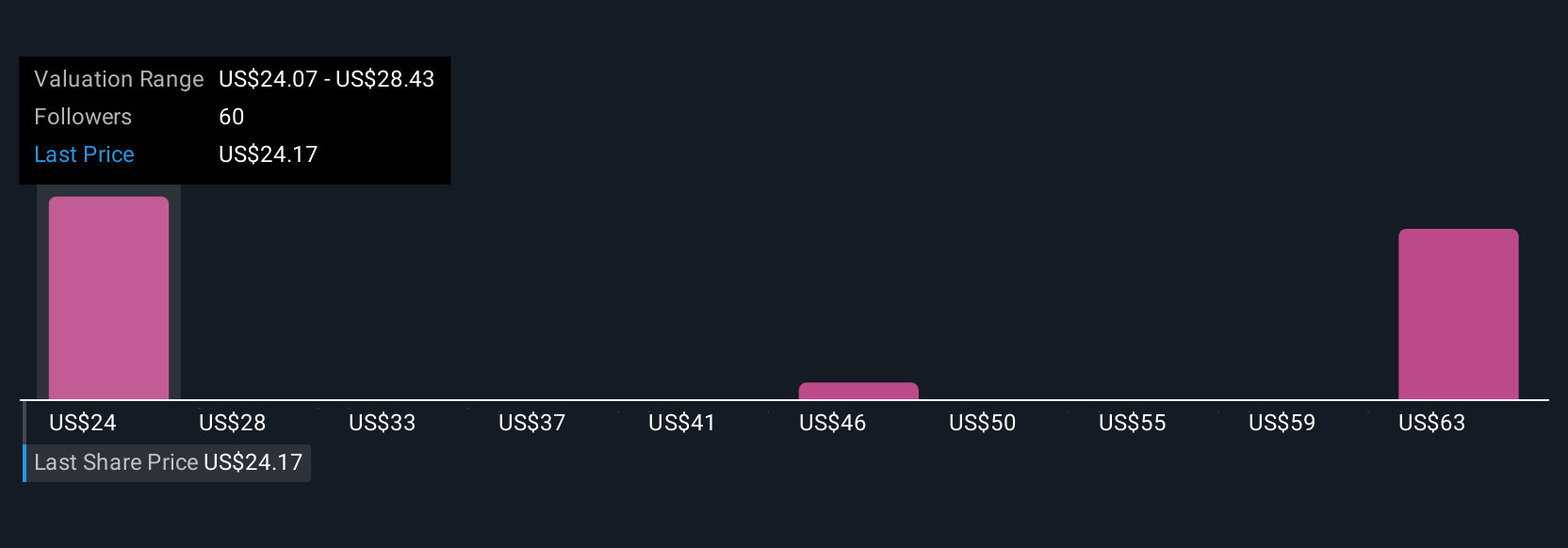

Simply Wall St Community members provided six fair value estimates for Sirius XM Holdings, spanning from US$23.64 to US$68.88. As subscriber growth remains a critical driver, these diverse viewpoints underscore the importance of staying alert to the company’s operational trends and evolving risks.

Explore 6 other fair value estimates on Sirius XM Holdings - why the stock might be worth just $23.64!

Build Your Own Sirius XM Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sirius XM Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sirius XM Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sirius XM Holdings' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIRI

Sirius XM Holdings

Operates as an audio entertainment company in North America.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives