- United States

- /

- Media

- /

- NasdaqGS:SIRI

Should Taylor Swift’s Exclusive Channel Launch Prompt Action From Sirius XM (SIRI) Investors?

Reviewed by Sasha Jovanovic

- On September 18, 2025, SiriusXM Canada announced the launch of Taylor's Channel 13, a limited-run SiriusXM channel exclusively dedicated to Taylor Swift, coinciding with the release of her new album and airing across North America from September 20 through October 19.

- This collaboration is expected to attract significant fan engagement, providing SiriusXM with an opportunity to leverage one of music's most influential artists to strengthen its premium content lineup.

- We'll explore how this exclusive Taylor Swift channel partnership could influence SiriusXM’s premium content appeal and ongoing subscriber trends.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Sirius XM Holdings Investment Narrative Recap

For investors in Sirius XM Holdings, the core belief centers on the company's ability to counter structural pressures in audio with compelling exclusive content and new digital offerings. While the high-profile launch of Taylor's Channel 13 highlights SiriusXM’s power to secure marquee talent, its effect on reversing weak subscriber trends and top-line revenue challenges is likely limited at this stage. The most pressing risk remains declining subscription and ad revenue, particularly as competition for listeners intensifies.

Of the company’s recent announcements, the launch of SiriusXM Play, an ad-supported, lower-priced subscription, directly targets the expansion of its addressable market. By making its platform accessible to more price-sensitive consumers, SiriusXM aims to broaden potential subscriber bases, though the benefits will depend on overcoming entrenched headwinds in revenue growth.

Yet, against this backdrop, investors should be aware that mounting content and subscriber acquisition costs could still...

Read the full narrative on Sirius XM Holdings (it's free!)

Sirius XM Holdings is expected to generate $8.6 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes an annual revenue decline of 0.1% and a $2.9 billion increase in earnings from the current level of -$1.8 billion.

Uncover how Sirius XM Holdings' forecasts yield a $23.64 fair value, a 5% upside to its current price.

Exploring Other Perspectives

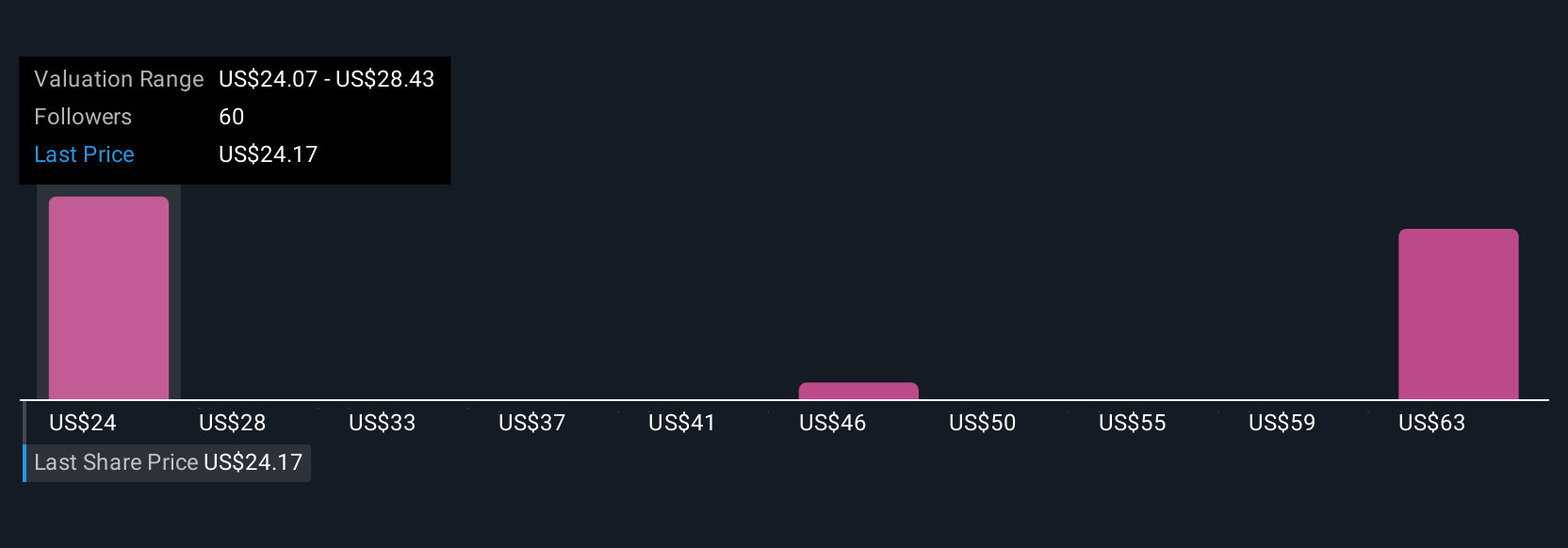

Six Simply Wall St Community fair value estimates for Sirius XM range from US$23.64 to US$67.20 per share, revealing wide valuation viewpoints. As subscription and advertising revenue continue to slip, this diversity underscores how differently you may assess future challenges and opportunities.

Explore 6 other fair value estimates on Sirius XM Holdings - why the stock might be worth just $23.64!

Build Your Own Sirius XM Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sirius XM Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sirius XM Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sirius XM Holdings' overall financial health at a glance.

No Opportunity In Sirius XM Holdings?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIRI

Sirius XM Holdings

Operates as an audio entertainment company in North America.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives