- United States

- /

- Entertainment

- /

- NasdaqGS:SEAT

Why Investors Shouldn't Be Surprised By Vivid Seats Inc.'s (NASDAQ:SEAT) 29% Share Price Plunge

To the annoyance of some shareholders, Vivid Seats Inc. (NASDAQ:SEAT) shares are down a considerable 29% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 67% loss during that time.

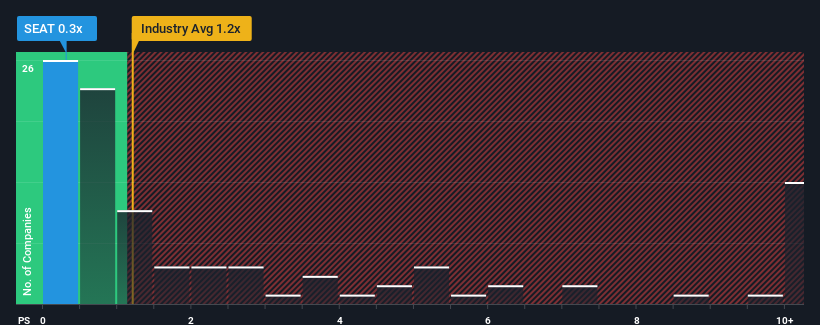

After such a large drop in price, Vivid Seats' price-to-sales (or "P/S") ratio of 0.3x might make it look like a buy right now compared to the Entertainment industry in the United States, where around half of the companies have P/S ratios above 1.2x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Vivid Seats

How Vivid Seats Has Been Performing

With revenue growth that's inferior to most other companies of late, Vivid Seats has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Vivid Seats' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Vivid Seats?

Vivid Seats' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Although pleasingly revenue has lifted 36% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 0.3% per year during the coming three years according to the twelve analysts following the company. With the industry predicted to deliver 12% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Vivid Seats' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Vivid Seats' P/S Mean For Investors?

The southerly movements of Vivid Seats' shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Vivid Seats maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Vivid Seats you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SEAT

Vivid Seats

Operates an online ticket marketplace in the United States, Canada, and Japan.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives