David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Sinclair, Inc. (NASDAQ:SBGI) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Sinclair

What Is Sinclair's Debt?

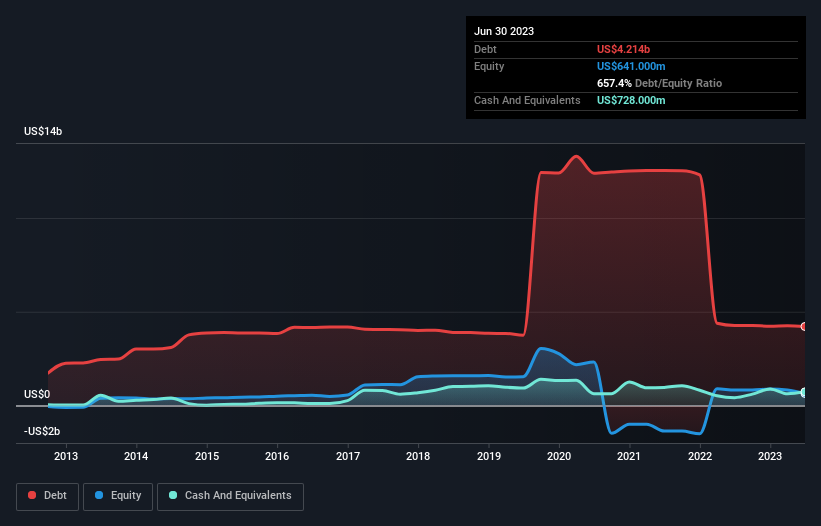

As you can see below, Sinclair had US$4.21b of debt, at June 2023, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has US$728.0m in cash leading to net debt of about US$3.49b.

How Healthy Is Sinclair's Balance Sheet?

The latest balance sheet data shows that Sinclair had liabilities of US$624.0m due within a year, and liabilities of US$4.94b falling due after that. On the other hand, it had cash of US$728.0m and US$588.0m worth of receivables due within a year. So its liabilities total US$4.24b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the US$802.3m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Sinclair would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Weak interest cover of 1.3 times and a disturbingly high net debt to EBITDA ratio of 5.4 hit our confidence in Sinclair like a one-two punch to the gut. The debt burden here is substantial. Even more troubling is the fact that Sinclair actually let its EBIT decrease by 7.5% over the last year. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Sinclair can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, Sinclair actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

On the face of it, Sinclair's interest cover left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. We're quite clear that we consider Sinclair to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Sinclair (of which 2 shouldn't be ignored!) you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SBGI

Sinclair

A media company, provides content on local television stations and digital platforms in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

GameStop will ace the financial crisis wave with its strategic Bitcoin investment and cash reserves

BABA Analysis: Buying the Fear, Holding the Cloud

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale