- United States

- /

- Media

- /

- NasdaqGS:SBGI

High Growth Tech Stocks To Watch In September 2024

Reviewed by Simply Wall St

Over the last 7 days, the market has remained flat, but it is up 32% over the past year with earnings forecast to grow by 15% annually. In this environment, identifying high growth tech stocks that can capitalize on these trends is crucial for investors seeking robust returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.46% | 66.34% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.37% | ★★★★★★ |

| Clene | 71.89% | 60.05% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.80% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 254 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Zai Lab (NasdaqGM:ZLAB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zai Lab Limited develops and commercializes therapies to treat oncology, autoimmune disorders, infectious diseases, and neuroscience, with a market cap of approximately $1.99 billion.

Operations: Zai Lab Limited generates revenue primarily from its biotechnology segment, amounting to $322.71 million. The company's focus spans oncology, autoimmune disorders, infectious diseases, and neuroscience therapies.

Zai Lab, amidst a challenging landscape for unprofitable biotechs, shows promise with its aggressive R&D focus and innovative pipeline. The company's R&D expenses have been substantial, aligning with its strategic priorities in developing treatments like ZL-1503 for atopic dermatitis, showcased at the recent EADV Congress. This focus on novel biologics is crucial as it navigates a 32.8% expected annual revenue growth and a projected leap to profitability within three years. Moreover, Zai Lab's recent approval of efgartigimod SC in China underscores its potential to tap into significant markets, further bolstered by a 65.9% forecasted earnings growth rate annually. This blend of rigorous research investment and strategic market entries encapsulates Zai Lab’s approach to overcoming current unprofitability and positioning itself in the high-stakes biotech arena.

- Delve into the full analysis health report here for a deeper understanding of Zai Lab.

Explore historical data to track Zai Lab's performance over time in our Past section.

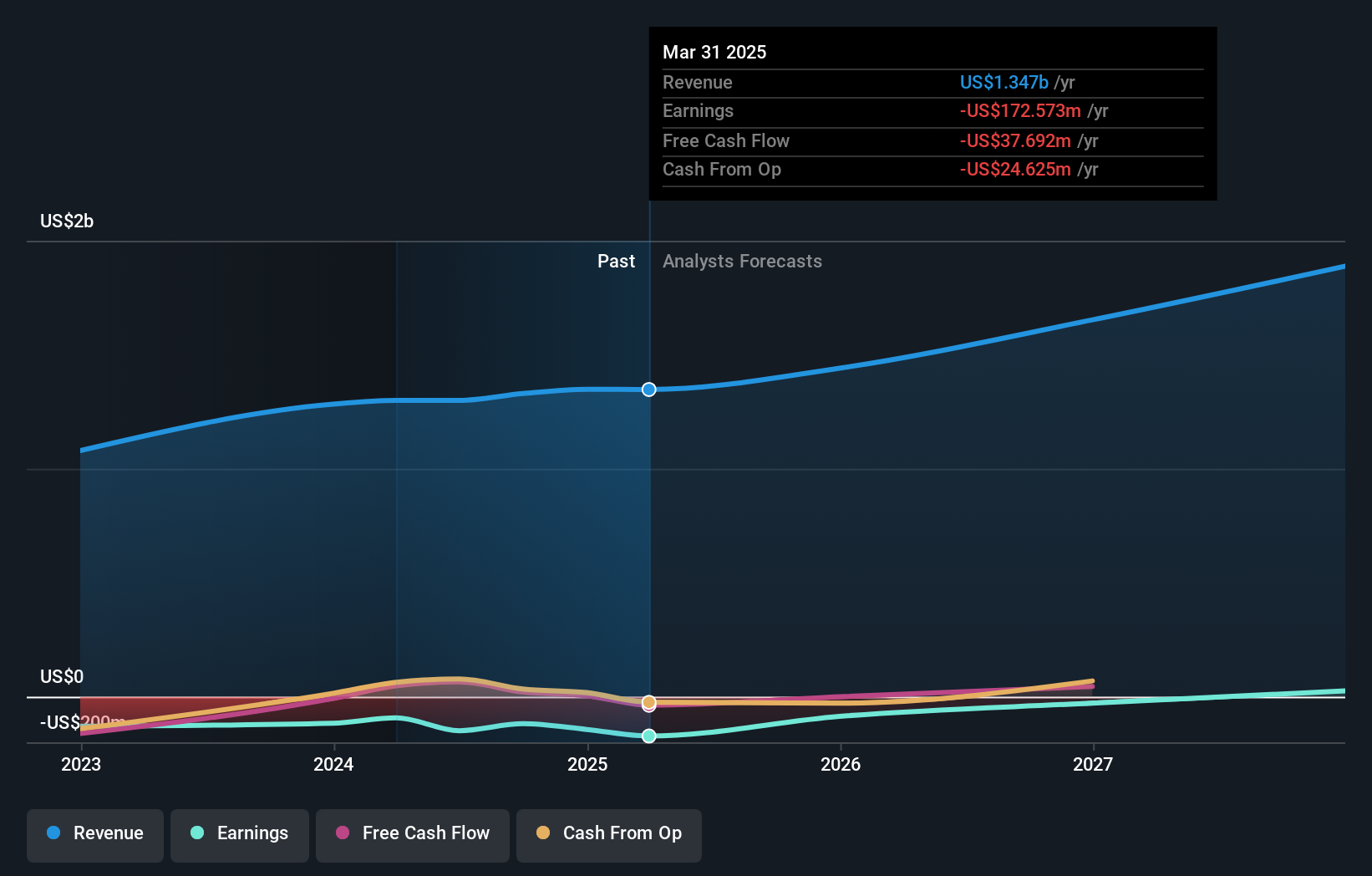

Sinclair (NasdaqGS:SBGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sinclair, Inc. (NasdaqGS: SBGI) is a media company that delivers content through local television stations and digital platforms across the United States, with a market cap of approximately $980.17 million.

Operations: Sinclair generates revenue primarily from its Local Media segment, which brought in $2.94 billion, and also has significant contributions from its Tennis segment at $243 million. The company operates within the media industry by providing content through television stations and digital platforms across the U.S.

Sinclair, despite facing a projected annual revenue dip of 0.5%, is strategically positioning itself through innovative partnerships and content acquisitions. The collaboration with Saankhya Labs to integrate Direct-to-Mobile broadcast capabilities using indigenous chipsets underscores its commitment to technological evolution, potentially revitalizing its market stance. Moreover, adding iconic shows like Saturday Night Live to its network could enhance viewer engagement significantly. With earnings poised to grow by 46.44% annually and a robust return on equity forecast at 73.2%, Sinclair is navigating its challenges by leveraging strategic content curation and advanced broadcast technology, setting the stage for potential profitability in the evolving media landscape.

- Take a closer look at Sinclair's potential here in our health report.

Evaluate Sinclair's historical performance by accessing our past performance report.

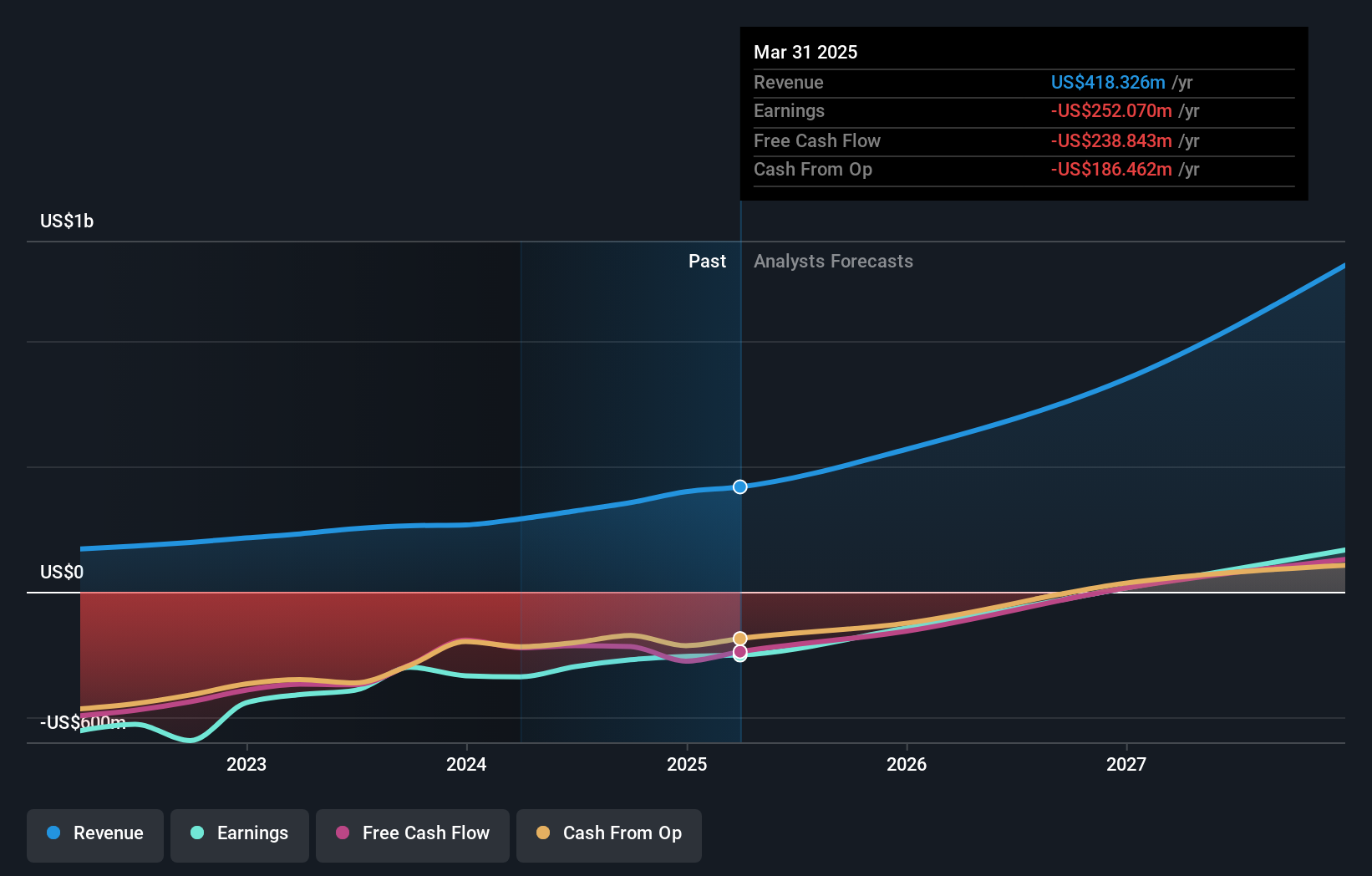

WEBTOON Entertainment (NasdaqGS:WBTN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: WEBTOON Entertainment Inc. operates a global storytelling platform and has a market cap of $1.41 billion.

Operations: WEBTOON Entertainment Inc. generates revenue primarily from its motion pictures segment, which contributed $1.30 billion. The company operates a global storytelling platform that reaches audiences worldwide.

WEBTOON Entertainment, recently added to the S&P TMI Index, is navigating through a challenging phase with its IPO marred by legal issues and misleading statements regarding revenue growth deceleration in advertising and IP adaptations. Despite these setbacks, the company reported a substantial sales increase to $320.97 million in Q2 2024 from $320.66 million year-over-year, though it faced a significant net loss increase to $76.89 million from $20.12 million. Looking ahead, WEBTOON anticipates revenue growth between 12.5% to 14.5% for Q3 2024 on a constant currency basis, showcasing resilience and potential recovery in its operational strategy amidst ongoing challenges.

Seize The Opportunity

- Click this link to deep-dive into the 254 companies within our US High Growth Tech and AI Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBGI

Sinclair

A media company, provides content on local television stations and digital platforms in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives