- United States

- /

- Media

- /

- NasdaqGS:SATS

Is It Too Late To Consider EchoStar After Its 357% 2025 Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether EchoStar is still a smart buy after its huge run up, or if you have already missed the best part of the move, this breakdown will help you think through whether the current price really makes sense.

- The stock has surged, jumping 39.6% over the last week, 45.9% in the past month, and an eye-catching 357.1% year to date, which has dramatically changed how the market is pricing its future.

- These gains have been driven by a wave of attention around EchoStar's role in satellite communications and its strategic positioning in connectivity infrastructure, especially as investors look for scalable, cash-generative platforms tied to data demand. In addition, growing interest in consolidation and partnerships in the space and telecom ecosystem has added fuel to the story and helped reframe how investors think about its long-term potential.

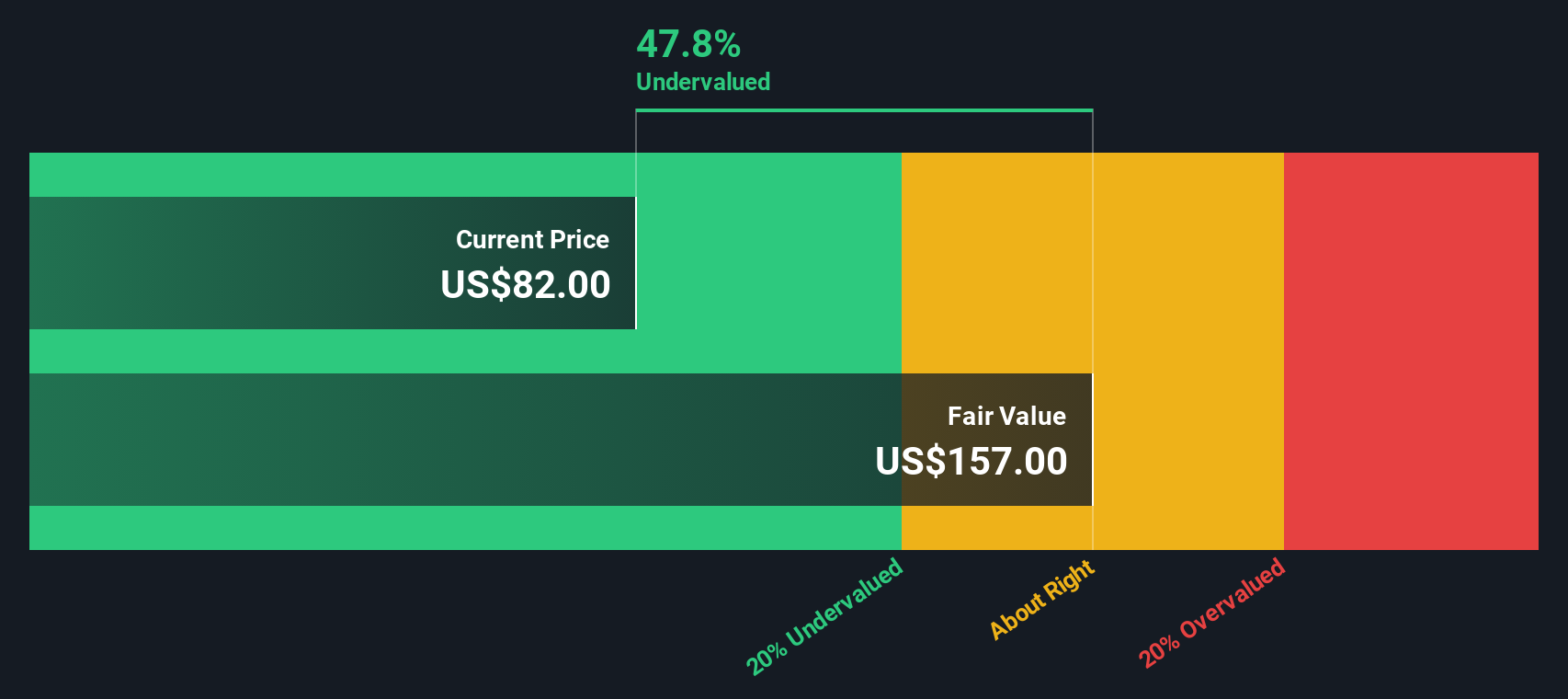

- Despite the excitement, EchoStar only scores a 3 out of 6 on our valuation checks, suggesting that some, but not all, metrics point to undervaluation. This makes it a useful case to walk through different valuation approaches and, later on, a more intuitive way to judge whether the market has really priced this stock appropriately.

Approach 1: EchoStar Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting them back to today in $ terms. For EchoStar, the 2 Stage Free Cash Flow to Equity model starts from a weak base, with last twelve months free cash flow of about $4.4 billion outflow, reflecting heavy investment and restructuring.

Analysts and extrapolated forecasts point to a sharp turnaround, with projected free cash flow recovering into positive territory and reaching around $3.7 billion by 2035. Simply Wall St extrapolates beyond the limited analyst horizon to build a 10 year cash flow curve and then applies a discount rate to convert those future $ cash flows into a single present value estimate.

On this basis, EchoStar’s intrinsic value is estimated at roughly $170.30 per share, implying the stock is trading at a 38.9% discount to its DCF fair value, so the shares appear materially undervalued relative to these cash flow assumptions.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests EchoStar is undervalued by 38.9%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

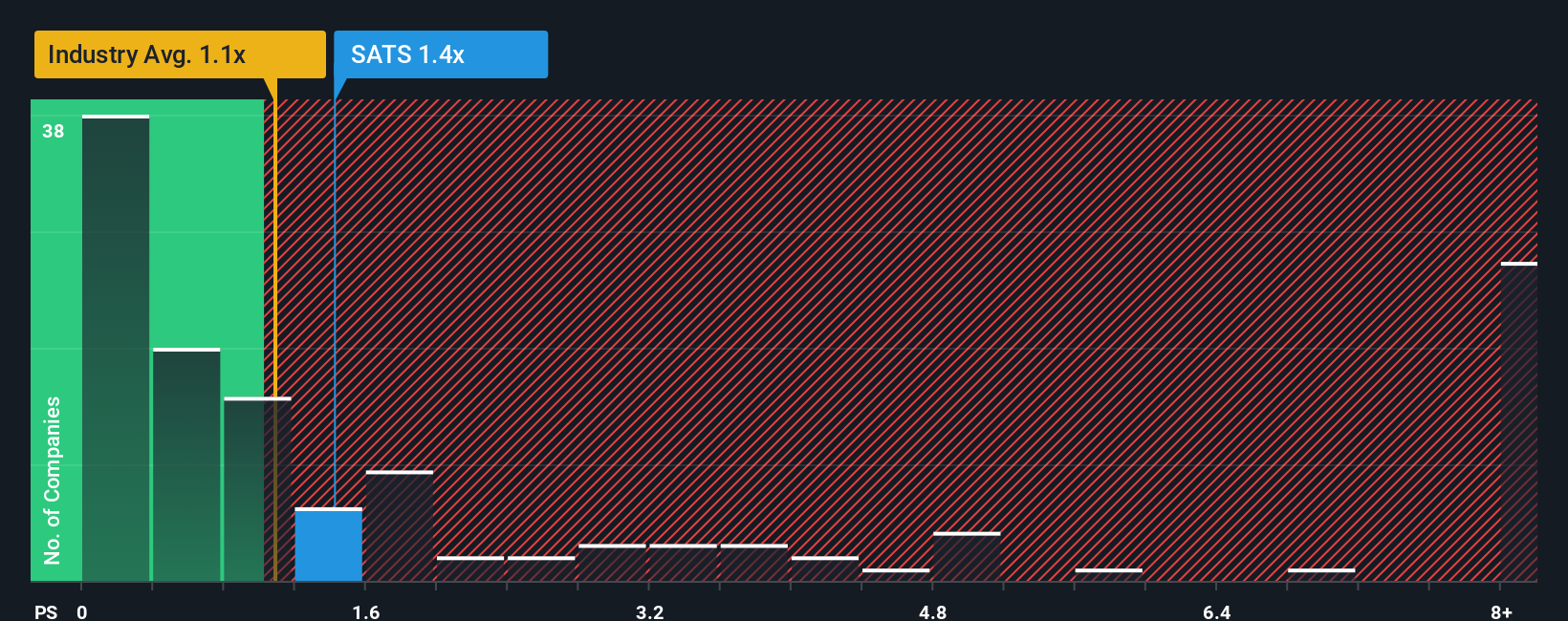

Approach 2: EchoStar Price vs Sales

For companies where profitability is still normalizing, the price to sales ratio is often a cleaner way to compare value, because it focuses on what investors are paying for each dollar of revenue rather than earnings that can be distorted by restructuring or heavy investment.

In general, higher growth and lower risk justify a higher multiple. Slower growth or greater uncertainty should pull a “normal” valuation down. EchoStar currently trades on a price to sales ratio of about 1.97x, which is roughly in line with the broader Media industry average of 1.00x but well below the peer group average of around 4.21x, suggesting the market is cautious despite the recent share price surge.

Simply Wall St’s Fair Ratio is a proprietary estimate of what EchoStar’s price to sales ratio should be once you factor in its growth outlook, profitability profile, industry, market cap and key risks. Because it is tailored to the company’s fundamentals rather than a blunt peer comparison, it offers a more nuanced benchmark. For EchoStar, the Fair Ratio is 1.42x, noticeably below the current 1.97x, indicating that, on this metric, the stock screens as somewhat expensive.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your EchoStar Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, which are simply your story about a company, linked directly to your assumptions for its future revenue, earnings, margins and ultimately what you think a fair value should be. On Simply Wall St’s Community page, used by millions of investors, these Narratives turn that story into a live forecast and fair value that you can compare against the current price to decide whether EchoStar is a buy, hold or sell. The platform dynamically updates your Narrative as new news or earnings arrive so your view never goes stale, and it allows different investors to see how their perspectives diverge. For example, one EchoStar Narrative might lean bullish, assuming long term value closer to the recently updated fair value near $90 per share based on successful monetisation of spectrum and satellite assets. A more cautious Narrative might sit closer to the low analyst target of about $25 per share, reflecting concerns around debt, execution risk and competition. This gives you a clear, numbers based way to choose which story you believe and act on it.

Do you think there's more to the story for EchoStar? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EchoStar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SATS

EchoStar

Provides networking technologies and services in the United States and internationally.

Fair value with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion