- United States

- /

- Media

- /

- NasdaqGS:SATS

EchoStar (SATS): Assessing Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for EchoStar.

EchoStar's steady climb this month stands out, but it is really just the latest push in a year defined by gradual gains and bursts of volatility. The 1-year total shareholder return is modest at just over 2 percent, which suggests that while recent momentum is positive, investors are still weighing longer-term growth prospects alongside headline shifts.

If you are interested in trends that blend momentum with insider confidence, now is a perfect moment to discover fast growing stocks with high insider ownership.

With shares edging closer to analyst targets and recent gains far outpacing profit growth, investors have to ask: is EchoStar undervalued at these levels, or is the market already pricing in all its future potential?

Most Popular Narrative: 8.9% Undervalued

EchoStar’s narrative fair value implies a price nearly 9% above the latest closing price of $76.78, suggesting analyst expectations have not yet been fully realized. This outlook stands out as the clearest expression of market optimism so far. Here is the central catalyst underpinning that view:

EchoStar's investment in a unique wideband LEO direct-to-device satellite constellation, leveraging its global S-band and AWS-4 spectrum rights, positions it to address skyrocketing global demand for ubiquitous connectivity across consumer, enterprise, government, and IoT applications, likely to create new, high-margin wholesale revenue streams and accelerate long-term revenue growth.

Want to know what’s fueling this valuation? There is a steady growth runway, a powerful shift in profit potential, and bullish revenue upgrades anchoring the story. Dive in to uncover what surprising combination of forecasted profitability, industry multiples, and a new vision for broadband drives this price target.

Result: Fair Value of $84.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainty and EchoStar’s mounting debt load remain significant headwinds. These factors could quickly shift sentiment and dampen growth expectations.

Find out about the key risks to this EchoStar narrative.

Another View: Caution from the Sales Ratio

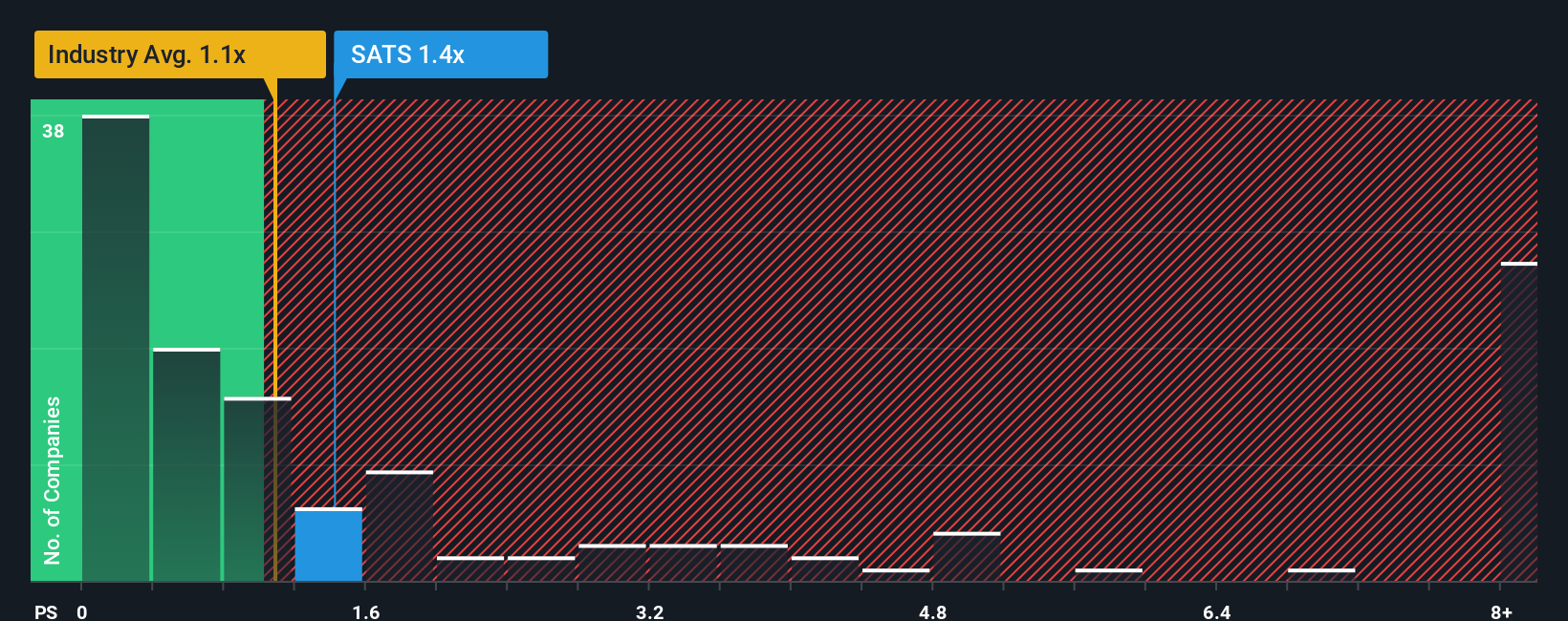

When we look at EchoStar alongside its industry, its price-to-sales ratio stands at 1.4 times, which is higher than the US Media industry average of 1.1 times and perfectly in line with its own fair ratio. This signals that the market has already priced in much of EchoStar’s perceived potential, leaving less margin for error if growth slows or expectations shift.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EchoStar Narrative

If these perspectives don’t capture your own outlook, or if you want to follow your own reasoning, you can craft a personalized narrative in just a few minutes by using Do it your way.

A great starting point for your EchoStar research is our analysis highlighting 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your strategy by tapping into handpicked lists designed for strong results. Don’t let incredible opportunities slip by while others gain an edge.

- Capture the potential of emerging tech by starting with these 25 AI penny stocks focused on artificial intelligence breakthroughs and rapid adoption trends.

- Maximize your income strategy by targeting stable yields with these 19 dividend stocks with yields > 3% offering robust returns above 3%.

- Position your portfolio early as tomorrow’s winners emerge from these 3573 penny stocks with strong financials primed with solid financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EchoStar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SATS

EchoStar

Provides networking technologies and services in the United States and internationally.

Slight risk and overvalued.

Similar Companies

Market Insights

Community Narratives