- United States

- /

- Interactive Media and Services

- /

- NasdaqGM:RUM

Rumble Inc.'s (NASDAQ:RUM) P/S Is Still On The Mark Following 34% Share Price Bounce

Rumble Inc. (NASDAQ:RUM) shares have had a really impressive month, gaining 34% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 60%.

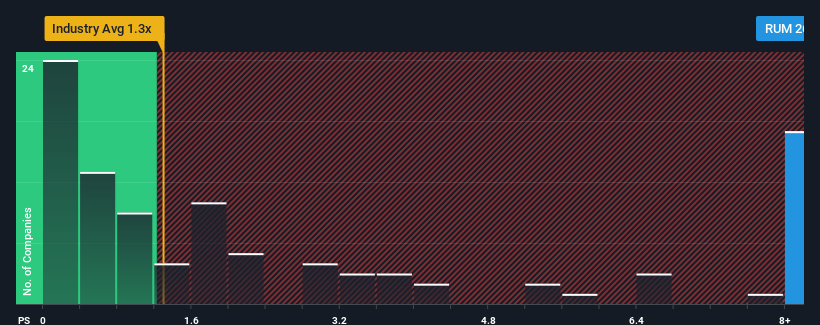

Since its price has surged higher, you could be forgiven for thinking Rumble is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 26x, considering almost half the companies in the United States' Interactive Media and Services industry have P/S ratios below 1.3x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Rumble

What Does Rumble's Recent Performance Look Like?

Recent times haven't been great for Rumble as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Rumble's future stacks up against the industry? In that case, our free report is a great place to start.How Is Rumble's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Rumble's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 6.9%. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 36% per annum over the next three years. With the industry only predicted to deliver 12% each year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Rumble's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Rumble's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Rumble shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Rumble that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:RUM

Rumble

Operates video sharing platforms and cloud services in the United States, Canada, and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives