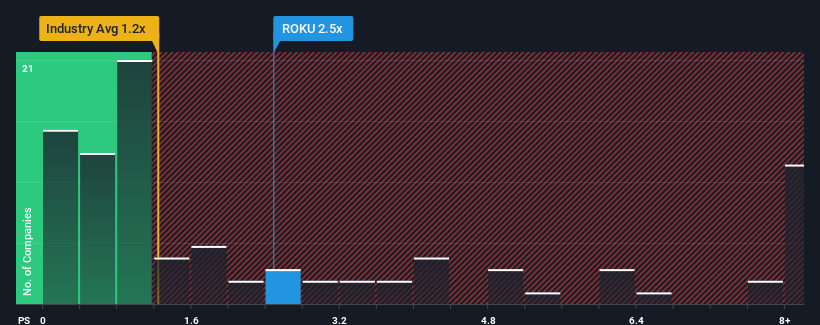

Roku, Inc.'s (NASDAQ:ROKU) price-to-sales (or "P/S") ratio of 2.5x may not look like an appealing investment opportunity when you consider close to half the companies in the Entertainment industry in the United States have P/S ratios below 1.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Roku

What Does Roku's Recent Performance Look Like?

Roku could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Roku.How Is Roku's Revenue Growth Trending?

Roku's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. The strong recent performance means it was also able to grow revenue by 78% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 12% per year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 10% each year growth forecast for the broader industry.

In light of this, it's understandable that Roku's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Roku's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Roku shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Roku that you should be aware of.

If you're unsure about the strength of Roku's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Roku, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United states and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives