- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

Roku (ROKU) Valuation in Focus After Philips Ambilight TV Launch Expands Hardware and Ecosystem Reach

Reviewed by Kshitija Bhandaru

Roku (ROKU) shares moved higher following the launch of the Philips Roku TV featuring Ambilight technology, a first for the U.S. market. This rollout highlights Roku’s latest push to strengthen its hardware footprint and ecosystem.

See our latest analysis for Roku.

Roku’s recent Ambilight TV launch turned heads and helped the share price recover above $100, signaling renewed momentum as the company’s ecosystem expansion continues to win fans. In the bigger picture, Roku’s total shareholder return stands at 37.6% over the past year, an impressive turnaround from longer-term underperformance and a sign investors are warming to its growth potential again.

If hardware innovation like Ambilight has you curious about other cutting-edge tech stories, take the next step and explore See the full list for free.

With Roku’s headline-making rebound, the big question for investors is whether the recent gains leave more room to run, or if the share price now fully reflects the company’s improving outlook and bold expansion. Is now a genuine buying opportunity, or is future growth already priced in?

Most Popular Narrative: Fairly Valued

With Roku’s fair value estimated at $103.27, just a hair above the last close of $103.84, the narrative frames Roku as priced almost perfectly in line with future expectations. The narrative draws a sharp link between current share price and long-range revenue and earnings projections.

Ongoing investments in proprietary content (e.g., The Roku Channel), self-service ad solutions, and performance marketing are boosting user engagement and attracting new cohorts of advertisers (especially SMBs), adding incremental high-margin advertising revenue and broadening usage, which are supporting margin and earnings growth.

Curious what projections justify such a pinpoint valuation? The math behind Roku’s perceived fair price relies on ambitious growth targets and a major shift in how the business monetizes. You might be surprised by which key financial levers are doing the heavy lifting in this tight fair value calculation. Find out what really puts this price within reach.

Result: Fair Value of $103.27 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, as competition in smart TV operating systems intensifies and Roku continues to rely on ad revenue, even the most optimistic forecasts could quickly be challenged.

Find out about the key risks to this Roku narrative.

Another View: What Does the SWS DCF Model Say?

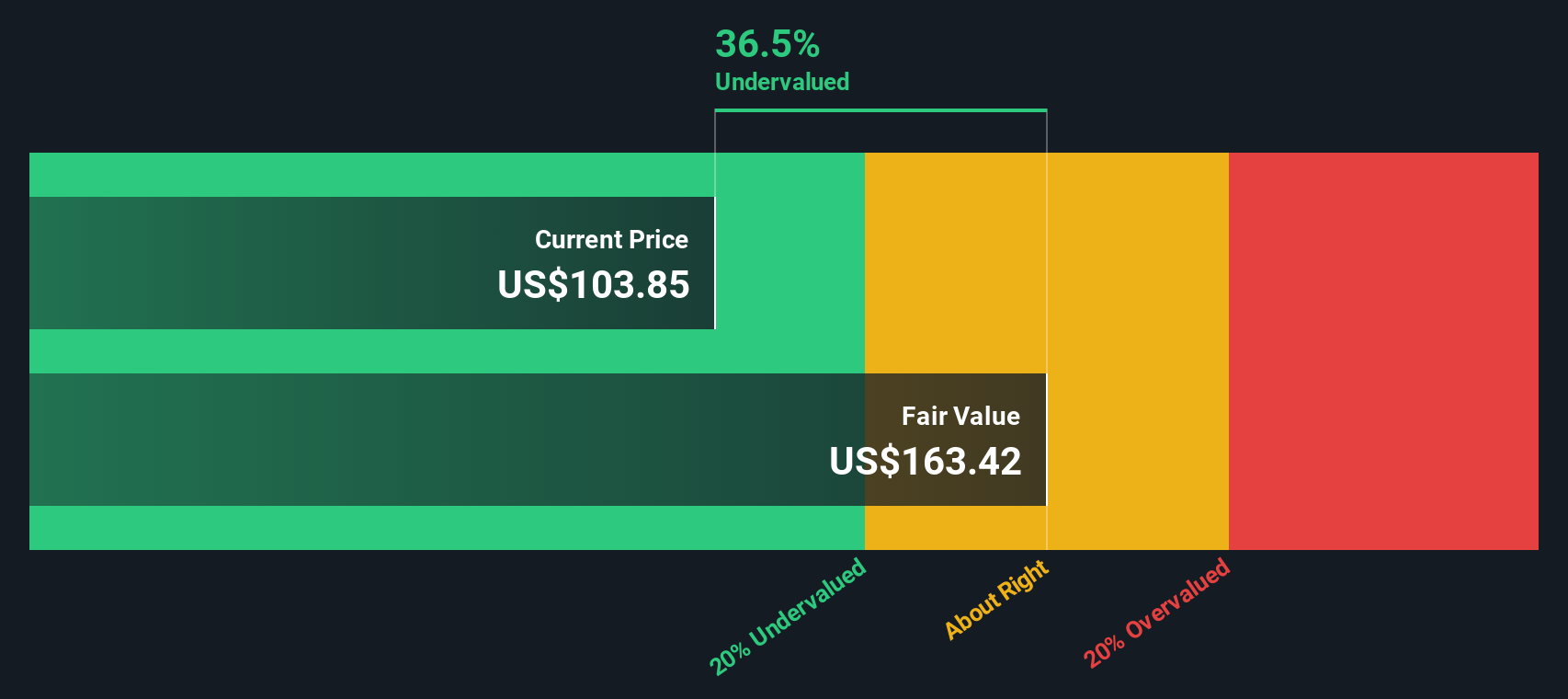

While analysts see Roku as close to fairly valued based on future earnings projections, our SWS DCF model presents a different perspective. By factoring in Roku’s long-term cash flow potential, the DCF method suggests the stock could be trading about 36.5% below its estimated fair value. Does this indicate that Roku offers an overlooked margin of safety, or is there a reason for the disconnect?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Roku for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Roku Narrative

Whether you see things differently or want to follow your own data-driven path, it only takes minutes to craft an independent Roku story. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Roku.

Looking for More Winning Investment Ideas?

Don’t let opportunity pass you by. Uncover stocks with real upside using screener shortcuts designed to pinpoint promising trends and hidden value before the crowd notices.

- Spot undervalued gems with upside potential by checking out these 909 undervalued stocks based on cash flows. This is where pricing power and projected growth come together.

- Target passive income streams by exploring these 19 dividend stocks with yields > 3%. It is packed with stocks offering healthy yields and robust fundamentals.

- Ride the next tech revolution by reviewing these 24 AI penny stocks. This resource connects you directly to companies innovating with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives