- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

Roku (ROKU) Valuation in Focus After Brazil Launch, AI Upgrades, and New Hardware Rollout

Reviewed by Kshitija Bhandaru

Roku (ROKU) shares moved higher after the company launched its connected TV advertising platform in Brazil, expanded its suite of AI-powered voice features, and introduced new hardware, continuing its push into key growth markets.

See our latest analysis for Roku.

Against a backdrop of steady international expansion and popular product launches, Roku’s share price has climbed 26% year to date and its 1-year total shareholder return stands at an impressive 17.7%. Recent upgrades, including AI-driven features, fresh hardware, and deepened advertising partnerships, have helped build positive momentum after a rocky few years. With the company turning the corner toward profitability and outpacing the broader market, investors are gaining confidence in Roku’s growth story.

If you’re curious which other innovative tech and entertainment stocks are showing promise, now is a smart time to explore the possibilities with our See the full list for free.

Yet with shares already up double digits this year and optimism running high around new launches and AI features, the key question remains: Is Roku stock still undervalued, or is the market now fully pricing in the company’s next leg of growth?

Most Popular Narrative: 10.4% Undervalued

Roku’s current price of $94.21 sits well below the most widely followed narrative’s fair value assessment of $105.12, hinting at ongoing upside even after this year’s rally. Let’s see what could be fueling market optimism behind the latest valuation.

The accelerating shift away from traditional linear TV toward streaming continues to expand Roku's total addressable market. This supports long-term growth in active users and increases demand for its connected TV platform, which is expected to drive sustained double-digit platform revenue growth.

Curious about the forecasts baked into this bullish fair value? Discover what aggressive profit margin expansion and a bold future earnings profile could really mean for Roku’s long-term valuation. The underlying growth story might surprise even seasoned investors.

Result: Fair Value of $105.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges remain if intensified competition or tightening global data rules hinder Roku’s platform growth or reduce margins, which could potentially dampen this bullish outlook.

Find out about the key risks to this Roku narrative.

Another View: Price-to-Sales Ratio Raises Flags

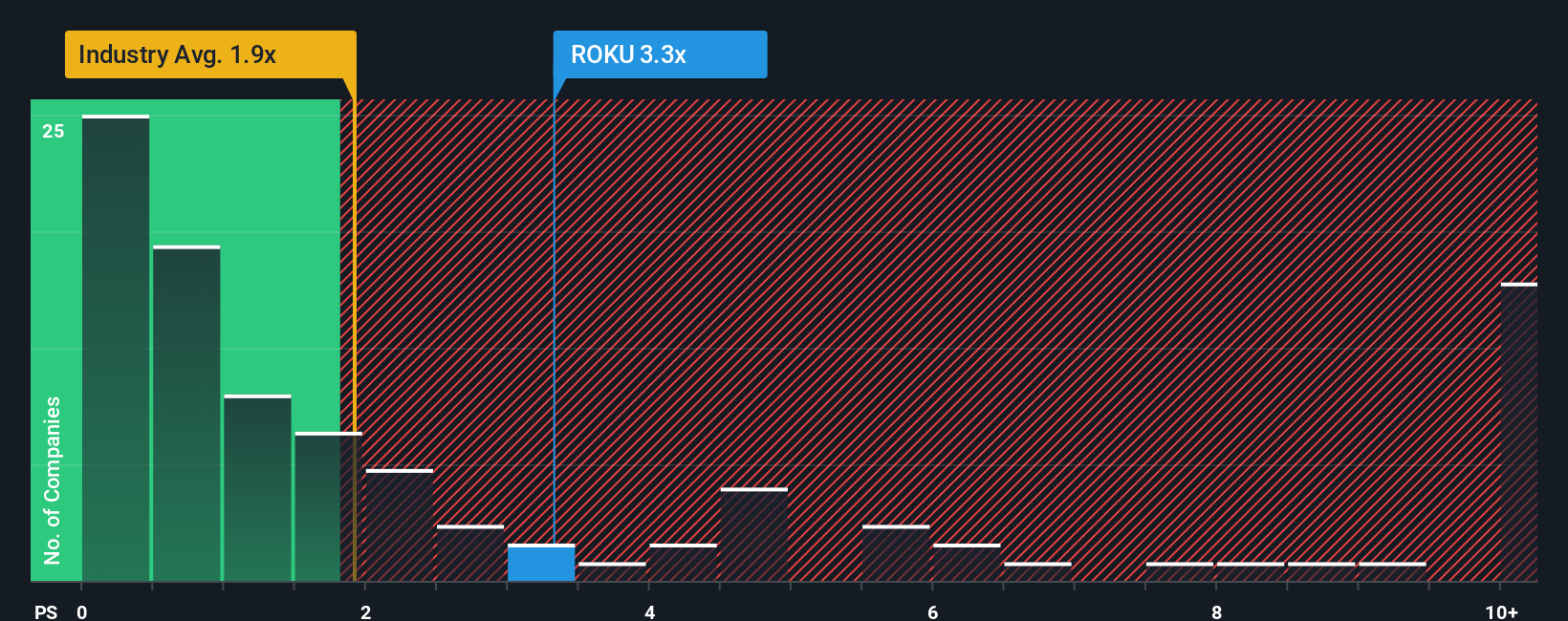

Looking at Roku through the lens of the price-to-sales ratio presents a different perspective. Roku trades at 3.2 times its sales, which is well above the US Entertainment industry average of 1.8x and also higher than its fair ratio of 2.6x. This premium suggests investors are paying more for each dollar of Roku’s revenue than for competitors, or what our data indicates it should be worth. Does this higher valuation signal strong future growth expectations, or could it reflect increased risk if those expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Roku Narrative

If you see things differently or want to investigate Roku’s valuation for yourself, it only takes a few minutes to craft your own perspective. Use the same core data as a starting point: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Roku.

Looking for More Investment Ideas?

Don't get left behind while others uncover untapped opportunities. Take the initiative now to broaden your investment playbook with unique stock ideas using these powerful tools:

- Tap into long-term potential and generate income by reviewing these 18 dividend stocks with yields > 3%, which offers yields above 3% and stable fundamentals.

- Maximize your growth strategy by targeting these 24 AI penny stocks, as these are reshaping industries through game-changing artificial intelligence.

- Take advantage of market inefficiencies by searching for these 878 undervalued stocks based on cash flows, whose current prices don’t reflect their true cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives