- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

Roku (ROKU) Taps Ambilight for Philips TVs Is Product Innovation the Key to User Engagement?

Reviewed by Sasha Jovanovic

- On October 1, 2025, Roku announced the launch of the Philips Roku TV featuring Philips' exclusive Ambilight technology, now available for the first time in the U.S. through Sam’s Club in models ranging from 43 to 65 inches.

- This marks the entry of Ambilight, a unique LED-based immersive backlighting feature, into the U.S. market via Roku TV OS, expanding Roku's hardware lineup and visual appeal.

- Let's explore how introducing Ambilight to the U.S. market refreshes Roku's investment narrative around product differentiation and user engagement.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Roku Investment Narrative Recap

To be a shareholder in Roku, you must believe in the continued migration of TV viewing from linear to streaming, with Roku capitalizing as a leading connected TV platform. The Philips Roku TV launch featuring Ambilight technology in the U.S. is unlikely to materially change the most important short-term catalyst, advertising revenue growth, or resolve the biggest risk, which remains intensifying competition from major ecosystem players pressuring device and platform engagement.

Another recent announcement closely related to Roku’s hardware innovation is the launch of the first Roku TV smart projector. This product, like the Ambilight-powered TV, also broadens the accessible hardware lineup and supports Roku’s efforts to stand out through differentiated user experiences, bolstering its core growth drivers in a crowded market.

But on the other hand, investors should keep a close eye on how increased competition from other streaming OS providers ...

Read the full narrative on Roku (it's free!)

Roku's narrative projects $6.1 billion revenue and $372.1 million earnings by 2028. This requires 11.4% yearly revenue growth and a $433.6 million increase in earnings from -$61.5 million.

Uncover how Roku's forecasts yield a $103.27 fair value, in line with its current price.

Exploring Other Perspectives

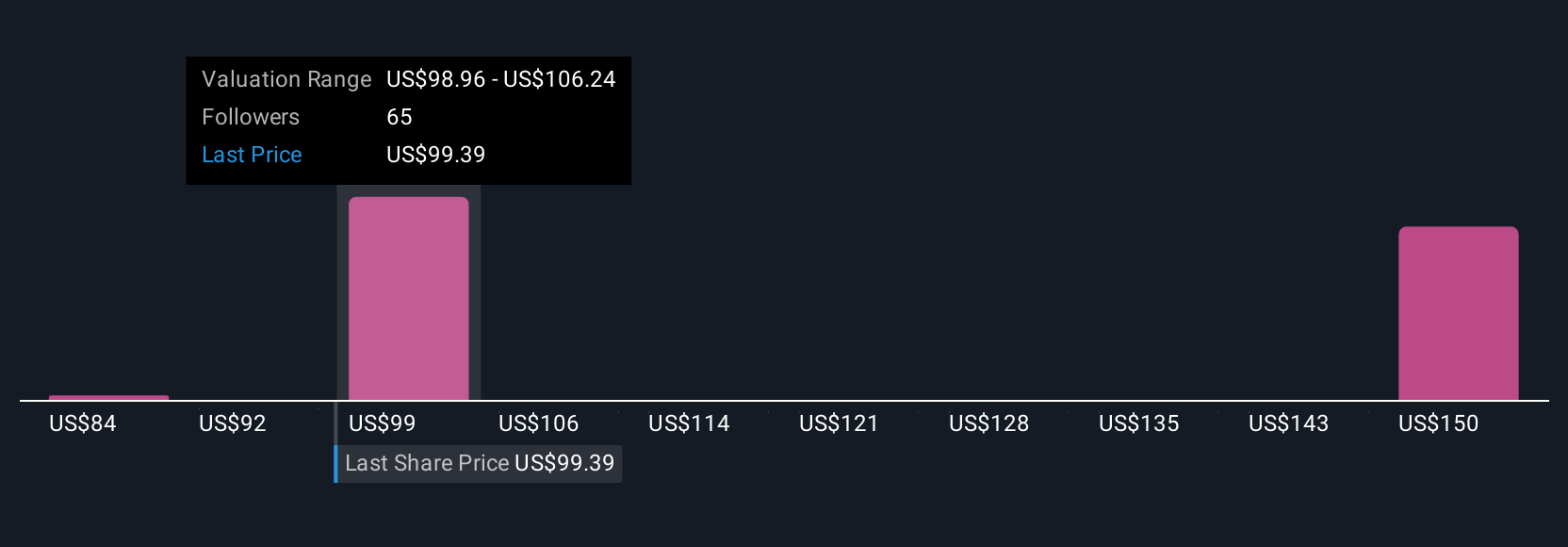

Across 11 community-sourced fair value estimates from the Simply Wall St Community, forecasts range from US$84.40 to US$163.48. As hardware differentiation grows, the risk of streaming OS competition remains a key consideration for those weighing long-term growth and margin stability.

Explore 11 other fair value estimates on Roku - why the stock might be worth 19% less than the current price!

Build Your Own Roku Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roku research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Roku research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roku's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives