- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

Roku (NASDAQ:ROKU) is Trading at Old Valuations With Improved Fundamentals

It isn't a secret that the Tech sector can produce some spectacular volatility, but few large-cap stocks have done it better than Roku, Inc.(NASDAQ: ROKU).

In the last 5 years, the stock regularly fluctuated over 100% in any given year.

See our latest analysis for Roku

Q4 Earnings Results

- GAAP EPS: US$0.17 (beat by US$0.13)

- Revenue: US$865.3m (miss by US$28.77m)

- Revenue growth: +33.1% Y/Y

Other highlights

- Total active users – 60.1 million (net increase 8.9 million)

- The average revenue per user – US$41.03 (+43% Y/Y)

- Streaming hours Y/Y increase – 14.4b

- Q1 guidance: Total net revenue US$720m vs. 756m consensus

While the company missed the revenue mark, the market is likely more concerned about the downbeat guidance that missed the consensus by 5%. While the growth looks solid on the Y/Y basis, we notice it is slowing down compared to the last year's peak.

Reflecting on the issues, CEO Anthony Wood mentioned that supply chain challenges drove the decline in Player revenue. Additionally, higher logistic costs and lower ad spending as the supply chain issues rippled through advertisers who face their problems.

While the company explores the idea of manufacturing their own televisions, the current environment might delay that idea. However, this does spark an idea about a possible merger or an acquisition in the future.

What Is Roku's Debt?

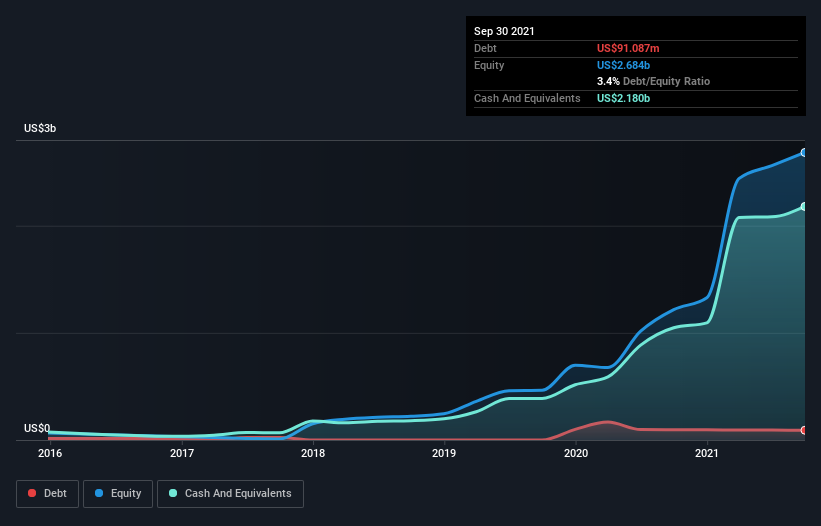

The image below, which you can click on for greater detail, shows that Roku had a debt of US$91.1m, a reduction from US$96.0m over a year. But it also has US$2.18b in cash to offset that, meaning it has US$2.09b net cash.

How Strong Is Roku's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Roku had liabilities of US$668.1m due within 12 months and liabilities of US$560.6m due beyond that. Offsetting this, it had US$2.18b in cash and US$643.6m in receivables that were due within 12 months. So it has US$1.59b more liquid assets than total liabilities. This surplus suggests that Roku has a conservative balance sheet and could probably eliminate its debt without much difficulty.

It was also good to see that despite losing money on the EBIT line last year, Roku turned things around during the previous 12 months, delivering an EBIT of US$281m. There's no doubt that we learn most about debt from the balance sheet.

Yet, it is future earnings, more than anything, that will determine Roku's ability to maintain a healthy balance sheet in the future. So if you're focused on the future, you can check out this free report showing analyst profit forecasts.

While Roku has net cash on its balance sheet, it's still worth looking at its ability to convert earnings before interest and tax (EBIT) to free cash flow to help us understand how quickly it is building (or eroding) that cash balance. Roku generated free cash flow during the last year, amounting to a very robust 95% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Summing up

Roku's decline led the stock down to the levels where it was in 2019 and 2020. Yet, it is doing much better compared to those times, with 2.5x revenues, positive EBIT, and an account growth of 50%.

Furthermore, with US$2b cash on hand and a good handle on its debt, the company is well-positioned for expansions into projects like TV manufacturing or a possible acquisition in the same space. The latter would likely be a faster way for the company to turn the trend around.

While the balance sheet is the area to focus on when you are analyzing debt, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Roku that you should be aware of before investing here.

If, after all that, you're more interested in a fast-growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives