- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

High Growth Tech Stocks To Watch In September 2024

Reviewed by Simply Wall St

As global markets rebound from recent sell-offs and technology stocks lead the charge, investors are closely watching key indices like the S&P 500 and Nasdaq Composite for signs of sustained growth. With core inflation slightly higher than expected but overall economic indicators showing some stability, now is a crucial time to identify high-growth tech stocks that could benefit from these market dynamics. In this environment, a good stock typically exhibits strong fundamentals, innovative potential in its sector, and resilience against economic fluctuations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.80% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 1293 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Roku (NasdaqGS:ROKU)

Simply Wall St Growth Rating: ★★★★☆☆

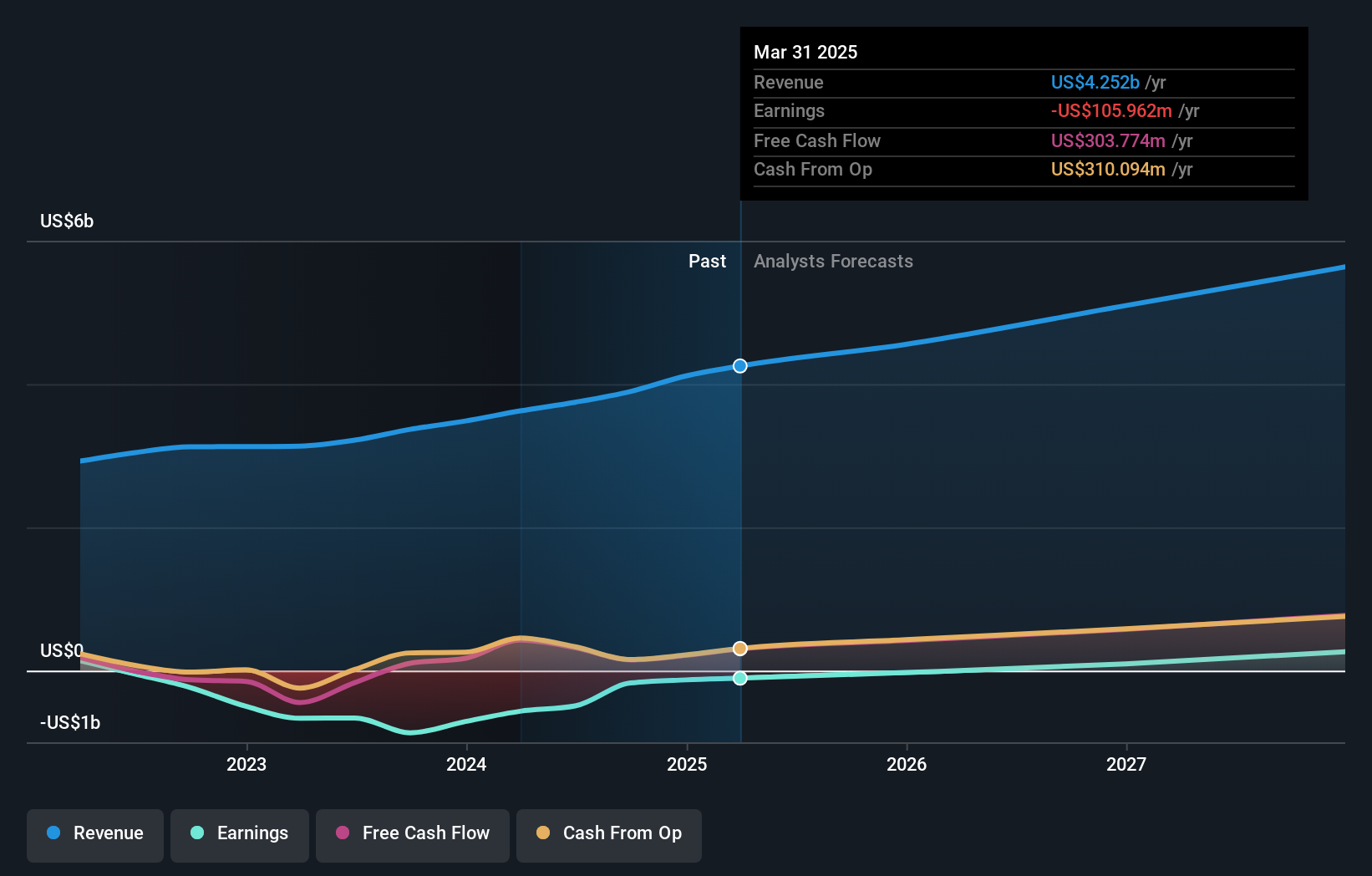

Overview: Roku, Inc., along with its subsidiaries, operates a TV streaming platform in the United States and internationally and has a market cap of $11.19 billion.

Operations: Roku generates revenue primarily through two segments: Devices ($551.17 million) and Platform ($3.19 billion). The company focuses on providing a comprehensive TV streaming platform to users globally.

Roku's trajectory in the tech landscape is marked by strategic expansions and partnerships, alongside a challenging financial performance. Recently, Roku opened a new office in Bengaluru, enhancing its innovation capabilities in key areas like advertising and cloud services, which positions it well within the competitive streaming sector. Financially, while Roku reported a reduced net loss of $33.95 million for Q2 2024 from $107.6 million year-over-year and forecasted revenue growth of 11% to $1.010 billion for the next quarter, it remains unprofitable with shareholder dilution occurring over the past year. This mixed financial outlook is tempered by its robust R&D focus—evident from its strategic hiring and global expansion—that could bolster future profitability as indicated by an expected earnings growth of 71.56% per year.

- Take a closer look at Roku's potential here in our health report.

Understand Roku's track record by examining our Past report.

Seagate Technology Holdings (NasdaqGS:STX)

Simply Wall St Growth Rating: ★★★★★☆

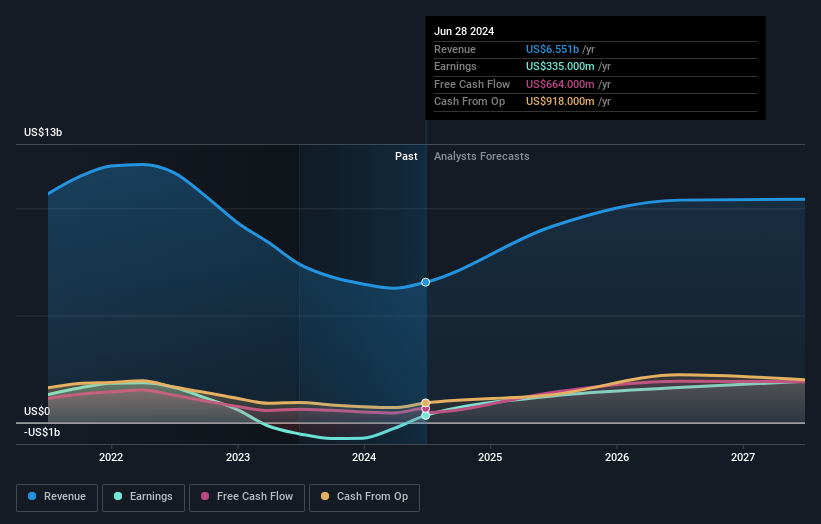

Overview: Seagate Technology Holdings plc provides data storage technology and infrastructure solutions across various regions including Singapore, the United States, and the Netherlands, with a market cap of approximately $21.24 billion.

Operations: The company generates revenue primarily through the manufacture and distribution of storage solutions, amounting to $6.55 billion. Its operations span multiple regions including Singapore, the United States, and the Netherlands.

Seagate Technology Holdings has pivoted impressively this year, transitioning from a net loss to reporting substantial net income of $513 million in Q4 2024, a stark contrast to the previous year's $92 million loss. This turnaround is underscored by a robust annual revenue forecast growth of 13.2%, though slightly slower than the tech industry's average. The firm is also eyeing an earnings expansion at an impressive rate of 26.8% per annum, positioning it favorably against U.S market expectations. Despite these gains, challenges remain as interest payments are not well covered by earnings, reflecting some financial vulnerability amidst its recovery trajectory.

Dynatrace (NYSE:DT)

Simply Wall St Growth Rating: ★★★★☆☆

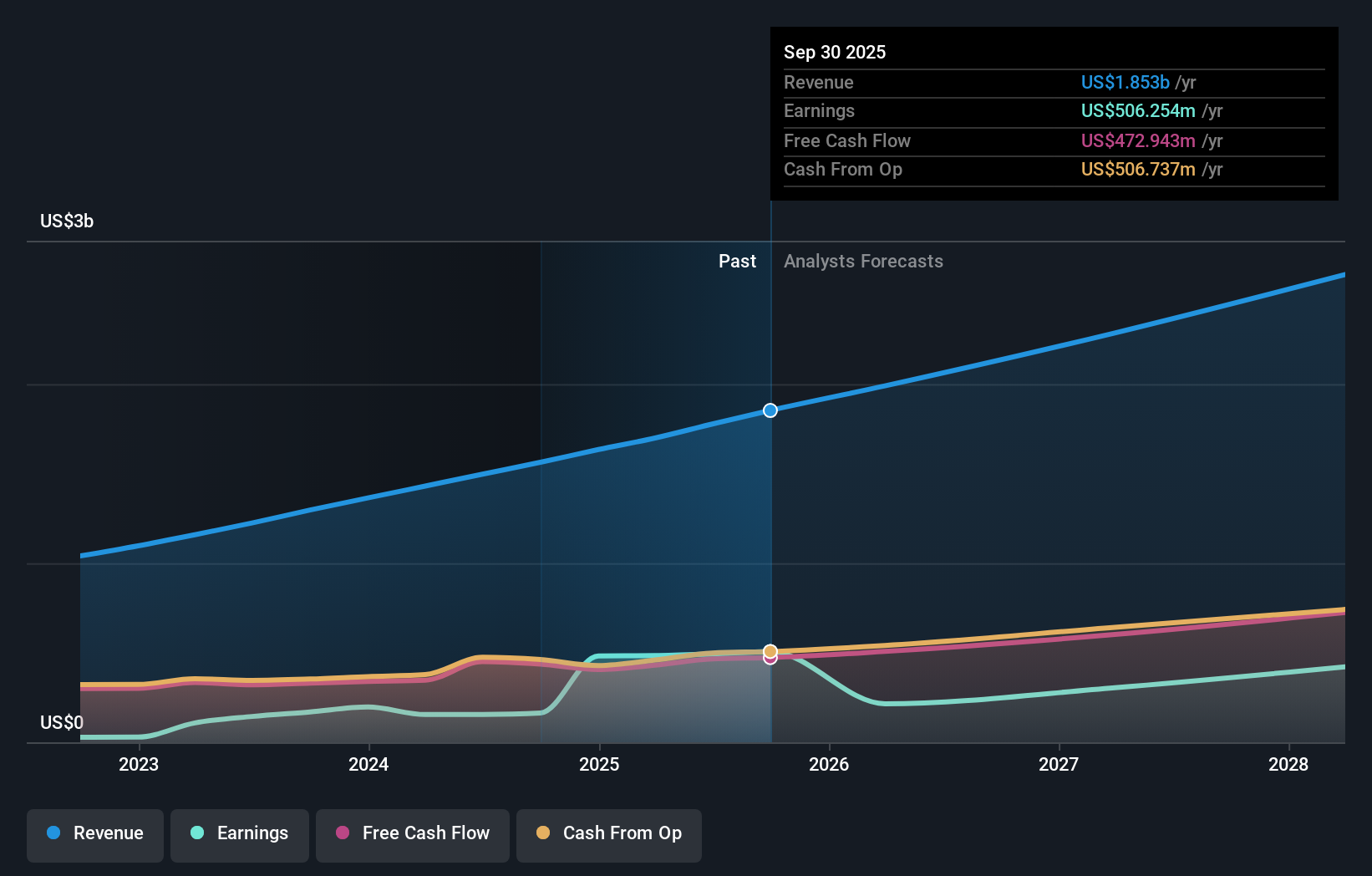

Overview: Dynatrace, Inc. offers a security platform for multicloud environments across various global regions and has a market cap of $15.44 billion.

Operations: Dynatrace, Inc. generates revenue primarily from its Internet Software & Services segment, amounting to $1.50 billion. The company operates across multiple regions including North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Dynatrace, exhibiting robust growth dynamics, forecasts a 13.7% annual revenue increase and a significant 22.4% rise in earnings per year, outpacing the US market's 8.7% and 15.2%, respectively. This financial vigor is underpinned by strategic R&D investments which constituted a substantial portion of their revenue, ensuring continuous innovation and competitive edge in software intelligence solutions. Recent executive additions like Lisa Campbell enhance leadership depth, poised to drive further market penetration and digital transformation initiatives across global platforms.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1290 High Growth Tech and AI Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Moderate, good value and pays a dividend.