- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

Etsy gains while Roku and Qualcomm sink - Our lukewarm takes on their earnings

Reviewed by Michael Paige

(“What’s a lukewarm take?” you ask – well, it’s definitely not a hot take – we would like to think it’s a more considered, insightful, and useful take on the news.)

Key Takeaways from This Analysis:

- Roku’s increase in streaming hours will eventually lead to increased revenue.

- Etsy is performing well given the pressure on consumer discretionary budgets.

- Qualcomm’s dividend seems to be safe for now.

Roku has now given up 775% of gains since 2019

Roku’s ( Nasdaq: ROKU ) share price fell to a new 52-week low after the company warned that revenue will be sharply lower than previously expected during the current quarter. The share price has now given up all its gains since February 2019, which at one point amounted to 775%

Revenue for the third quarter was $761 mln, up 12% from a year ago and well ahead of consensus estimates - although those estimates have been lowered significantly over the last few months. On a GAAP basis, the company lost $0.88 a share, which was also much better than expected but compared to positive $0.52 a year ago.

Total net revenue for the fourth quarter is now expected to be about $800 mln, versus estimates of $884 mln (that were closer to $1.2 bln a few months ago).

Our take: There wasn’t much to like about these results, and the immediate future looks bleak. However, there was one metric that is encouraging and worth keeping an eye on going forward.

During the last quarter,

- Active users increased 16% YoY to 65.4 million

- Total hours streamed increased 21% YoY to 21.9 billion

- The average revenue per user increased 10% YoY to $44.25

The increase in active users isn't very exciting, and the increase in ARPU was disappointing. But the total hours streamed continues to rise and it's been rising all year despite the end of lockdown restrictions.

Ad spending is under pressure at the moment, so Roku has obviously struggled to monetize the increase in viewing hours. But the total number of streaming hours will be important when ad spend does begin to increase again. As consumers switch from cable TV to streaming services, advertisers have limited options - and Roku is one of those options.

Our full analysis of ROKU provides a more comprehensive picture of the company’s financials and several risks to be aware of.

Etsy is doing well given the current environment

Shares of Etsy ( Nasdaq: ETSY ) traded as much as 16% higher on Thursday after the e-commerce platform announced better-than-expected sales and raised guidance. Gross merchandise value of $3 billion was down 3.3% YoY, while revenue of $594 mln was 11.7% higher than a year ago. The net loss widened to $963 mln due to an impairment charge.

The good news came in the form of guidance for the fourth quarter as the company expects GMV to increase to between $3.6 and $4 bln.

Revenue rose while gross merchandise sales were flat. This was partly a result of raising the commission Esty charges on transactions, but also due to additional services it provides to customers.

Our take: Etsy’s GMV, revenue, and net income have been relatively flat over the last two years. The jump in the share price was a response to the company beating very low expectations.

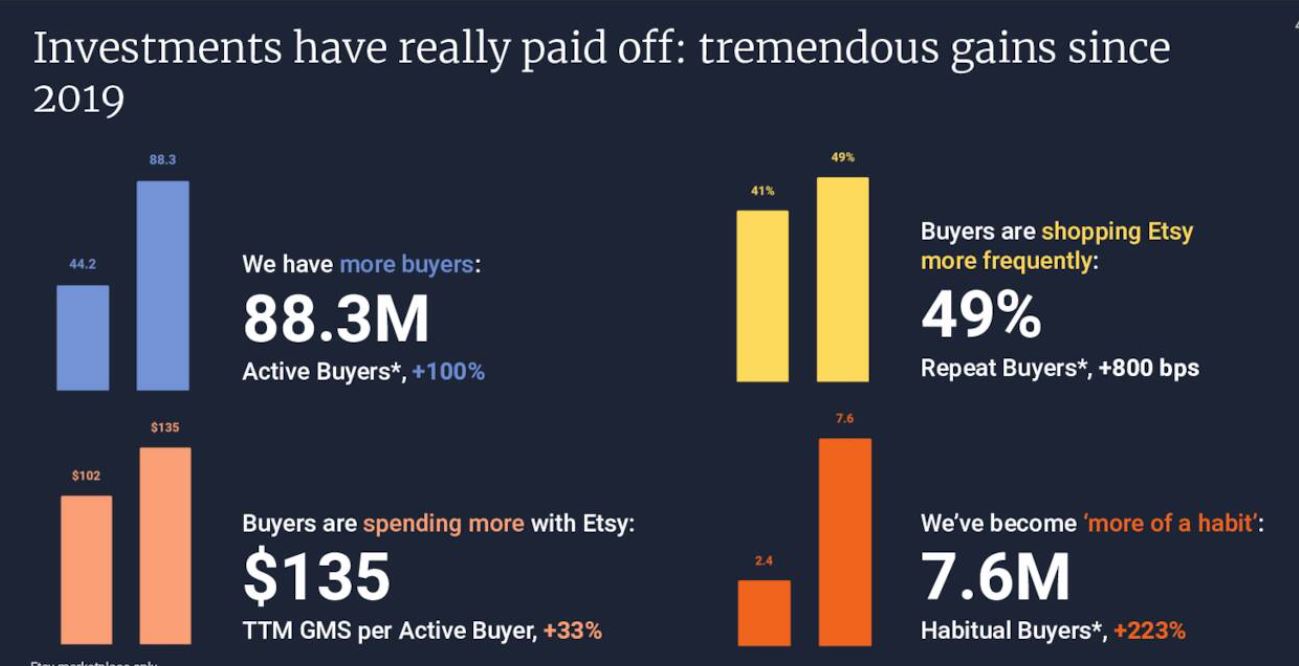

But Etsy did provide some encouraging data which shows that the company is building a loyal customer base.

These numbers suggest that customers are more engaged but are now spending less on each transaction. This makes sense when we consider the effect of inflation on discretionary budgets.

Etsy is a unique platform with a loyal customer base. It's probably going to struggle to grow in the current economic environment but will be a company to watch when conditions change.

Have a look at the full analysis of Etsy for more details.

Qualcomm sinks on falling smartphone demand

Qualcomm ( Nasdaq: QCOM ) reported mixed results, but also lowered guidance for the current quarter. The share price fell 7.45% in response, and it's now down 25% over the last 12 months, and 43% year to date.

Quarterly sales of $11.4 bln were up 22.1% from a year ago and ahead of consensus estimates. Non-GAAP EPS were also up 22% to $ 3.13 which is what analysts expected. GAAP EPS were lower than expected and only 3.8% higher than a year ago.

The company now expects first-quarter revenue of $9.2 to $10 bln, compared to the previous estimate of 12.05 bln. The company also said that smartphone demand was falling and that customers are drawing down on inventory as supply chain restraints have eased.

Our take: Qualcomm stands out amongst its peers due to its strong cash flows and 2.9% dividend yield. The company has managed to increase its dividend every year for the last decade - but you may be wondering how sustainable it is if the company experiences an ongoing slowdown.

The payout ratio is currently 24% of earnings and 49% of cash flow. Free cash flow has already fallen quite a lot over the last year - but the dividend coverage still appears to be sustainable. It would take a very dramatic drop in cash flow to put the current yield at risk.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United states and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives