- United States

- /

- Media

- /

- NasdaqCM:QMMM

QMMM Holdings (QMMM): Valuation in Focus After Bold Pivot to Crypto, AI, and Blockchain Technologies

Reviewed by Simply Wall St

If you’ve been following QMMM Holdings (NasdaqCM:QMMM), you probably didn’t miss the market fireworks after the company announced its dramatic pivot into cryptocurrency, artificial intelligence, and blockchain. QMMM plans to build a $100 million digital asset treasury anchored by Bitcoin, Ethereum, and Solana, aiming to power a decentralized data marketplace and next-generation analytics for crypto traders. The reaction from investors was swift, sending shares on a rollercoaster ride that has everyone from retail speculators to sector analysts asking what’s next for the company.

In the wake of this announcement, QMMM’s stock price exploded as much as 1,700% before retreating with equal intensity, landing far above where the year began but also highlighting just how quickly risk sentiment can shift. The past month’s price action has seen sharp momentum swings, as the company’s strategic transformation set off a wave of market speculation and debate. For investors looking at both explosive returns and wild volatility, this marks one of the more dramatic pivots in the listed crypto and AI space in recent memory.

With all that energy in the stock and a bold new strategy in play, is QMMM Holdings now trading at a discount as the dust settles, or has the market already priced in every bit of future growth it can imagine?

Price-to-Book Ratio of 1087.2x: Is it justified?

Based on the price-to-book multiple, QMMM Holdings trades at a substantial premium compared to both its direct peers and the broader US Media industry. The current price-to-book ratio stands at 1087.2x. Peer companies trade at an average of just 10.2x, and the industry average is much lower at 1.3x.

Price-to-book ratio is a widely used metric for measuring how a company’s market value compares to its net asset value. In sectors with tangible assets or where earnings reliability is uncertain, this multiple can be especially telling.

Such a steep price-to-book premium raises questions about whether investors are overestimating QMMM's future growth prospects relative to the value of its net assets. When compared with the market and industry benchmarks, this valuation appears difficult to justify, especially given the company's unprofitable status and recent losses.

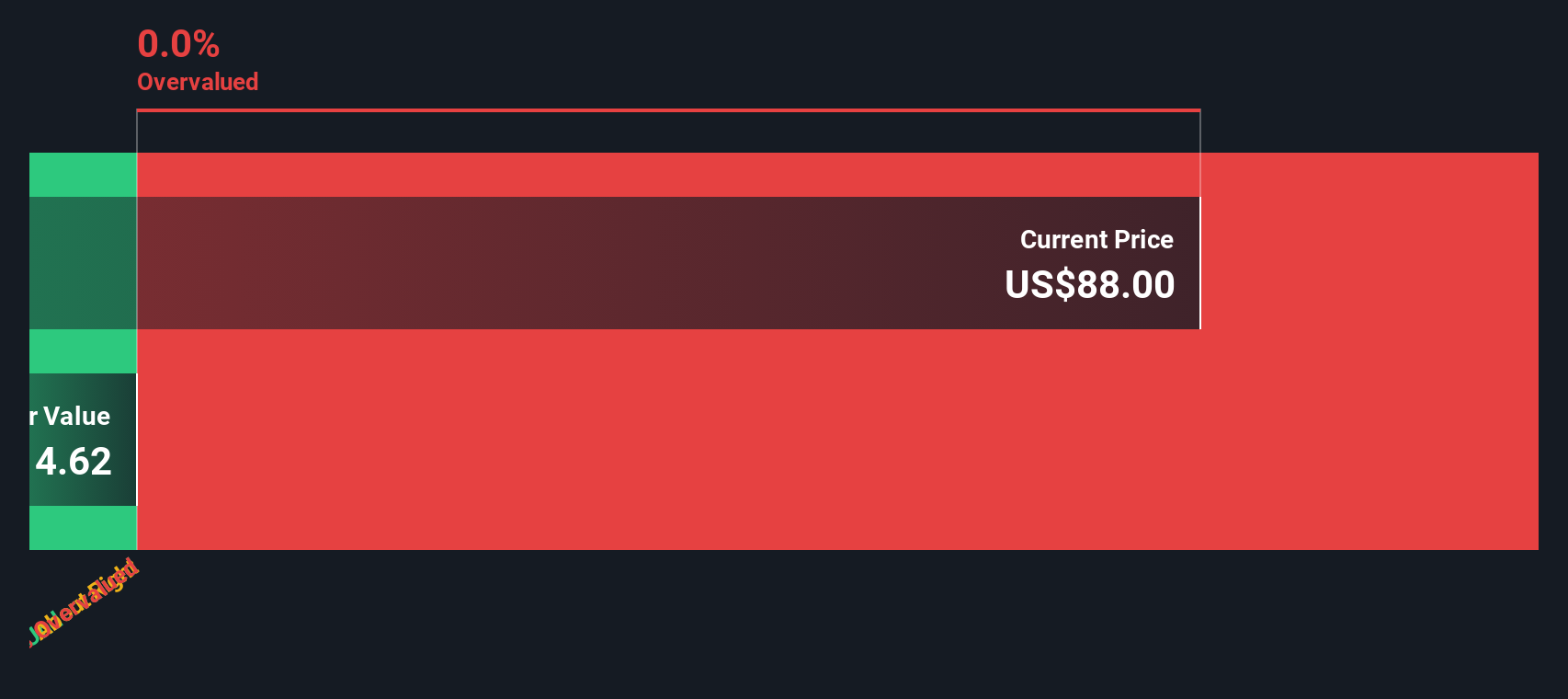

Result: Fair Value of $74.22 (OVERVALUED)

See our latest analysis for QMMM Holdings.However, the company remains unprofitable, and its path to consistent revenue growth is still unproven. This leaves significant uncertainty around its premium valuation.

Find out about the key risks to this QMMM Holdings narrative.Another View: No Discount in Sight?

Switching methods, our DCF model currently cannot provide a fair value for QMMM due to insufficient data. This means there is no evidence of hidden value. Could this lack of clarity signal that more caution is needed?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own QMMM Holdings Narrative

If you see things differently or want to dig deeper for yourself, the data is available for you to piece together your own perspective in just a few minutes. So why not Do it your way?

A great starting point for your QMMM Holdings research is our analysis highlighting 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep searching for the next big opportunity. Use the Simply Wall Street Screener right now and you might spot winning trends before everyone else does.

- Unlock potential in tomorrow’s megatrends by tapping into quantum computing stocks where quantum innovation is transforming the landscape.

- Tap into steady cash flow with dividend stocks with yields > 3%, your go-to for standout companies offering robust yields above 3%.

- Stay ahead of market hype by zeroing in on genuine value opportunities using undervalued stocks based on cash flows and uncovering shares trading well below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QMMM Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:QMMM

QMMM Holdings

Through its subsidiaries, provides digital media advertising and marketing production services primarily in Hong Kong.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives