- United States

- /

- Media

- /

- NasdaqGS:PSKY

Is There Still Value in Paramount Skydance After Free Press Acquisition News?

Reviewed by Bailey Pemberton

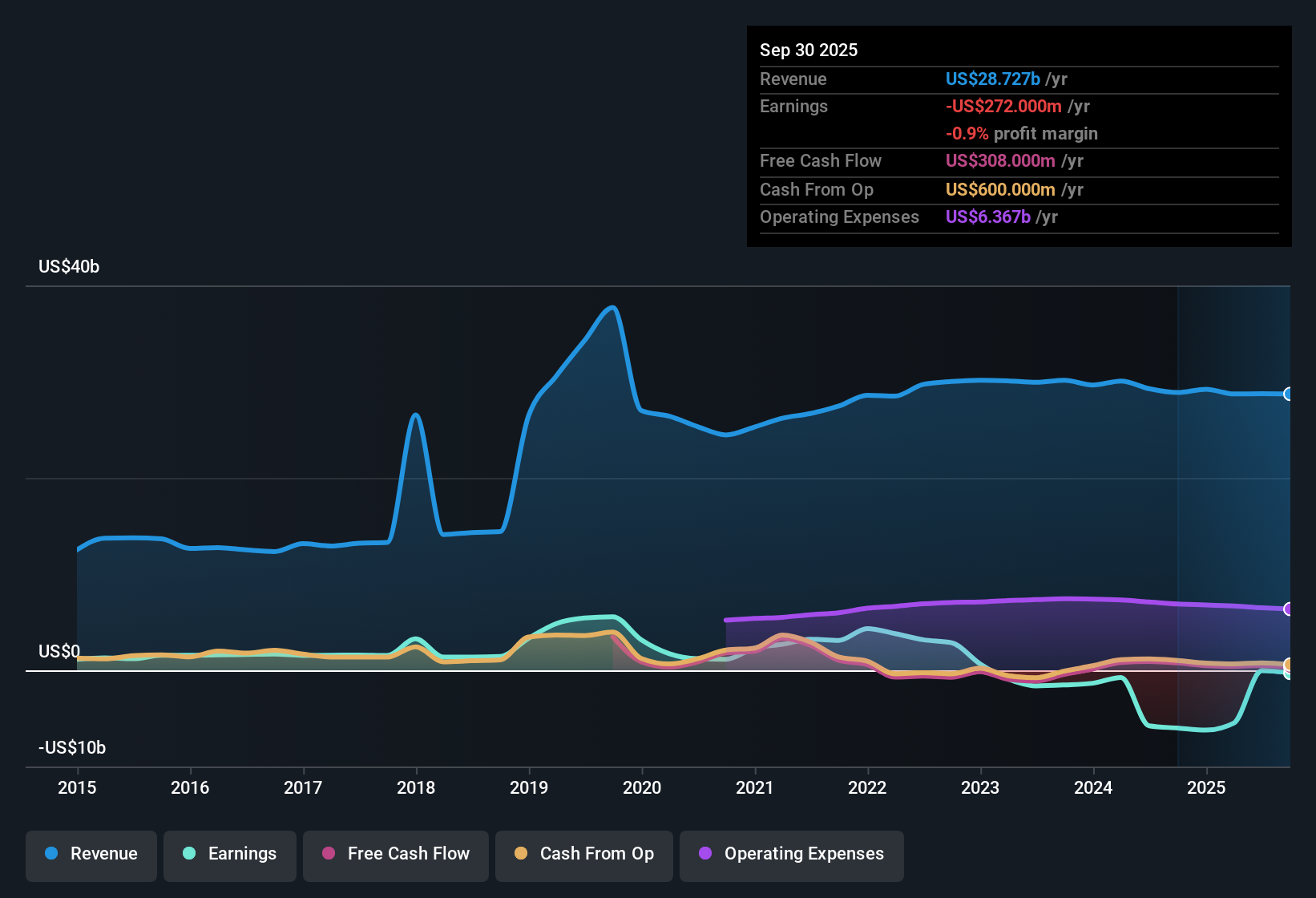

If you are standing at the crossroads wondering what to do with Paramount Skydance stock right now, you are not alone. After closing at $18.62, the company’s shares have soared an impressive 76.0% year-to-date and remain up a staggering 81.0% over the past twelve months. The last month alone has delivered a 28.8% gain, which has captured the attention of both long-term holders and fence-sitters alike. Admittedly, there was a small pullback of 1.6% in the past week, but that barely dented one of the hottest runs in the media sector.

So why the renewed buzz around Paramount Skydance? A wave of strategic news has been rolling in. The company is reportedly close to acquiring The Free Press, a digital upstart valued at $150M, and rumors are swirling about transformative leadership changes. Bari Weiss, the influential founder of The Free Press, is slated to become the new head of CBS News. Meanwhile, ongoing speculation about a Warner Bros. Discovery bid continues to fuel excitement, even if no formal move has materialized yet. All these headlines hint at a company actively reshaping its future, and the market is clearly responding.

With all that in mind, does the stock still offer value after such an epic run? According to a detailed valuation scorecard, Paramount Skydance checks five out of six major “undervalued” boxes for a total value score of 5. Next, let’s dive into how these different valuation methods stack up. Stick around, because I will also show you a smarter and more nuanced way to assess where Paramount Skydance really stands by the end of this article.

Approach 1: Paramount Skydance Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them to today's dollars. This approach helps investors gauge whether the current share price reflects the company's long-term earning power.

For Paramount Skydance, the current Free Cash Flow (FCF) is $477.7 Million. Analysts provide estimates for the next five years, projecting rapid growth, and further projections beyond 2029 are extrapolated. By 2029, FCF is estimated to reach $2.53 Billion, indicating a strong upward trajectory in the company’s potential cash generation.

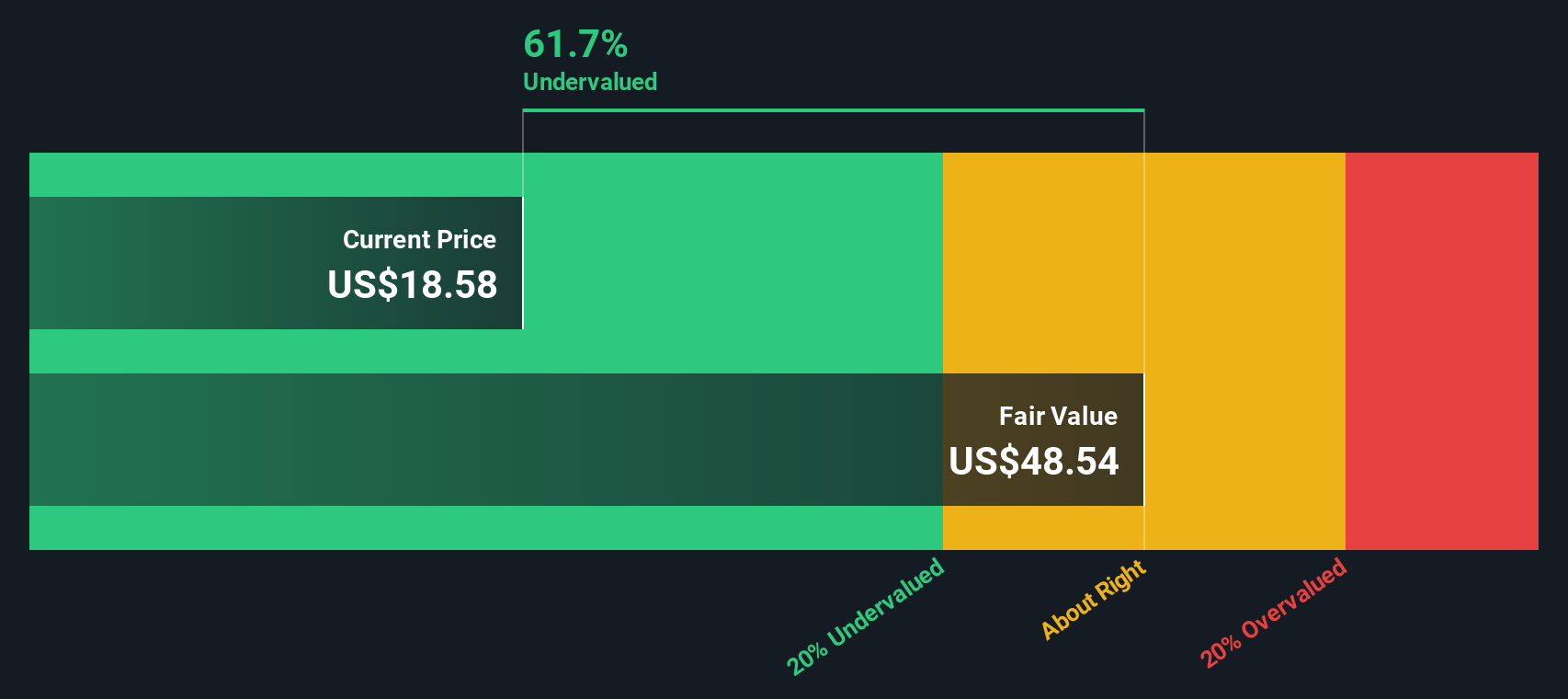

Using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value for Paramount Skydance is $55.76 per share. Compared to the recent share price of $18.62, this suggests the stock is trading at a significant 66.6% discount to its intrinsic value, making it appear substantially undervalued based on cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Paramount Skydance is undervalued by 66.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

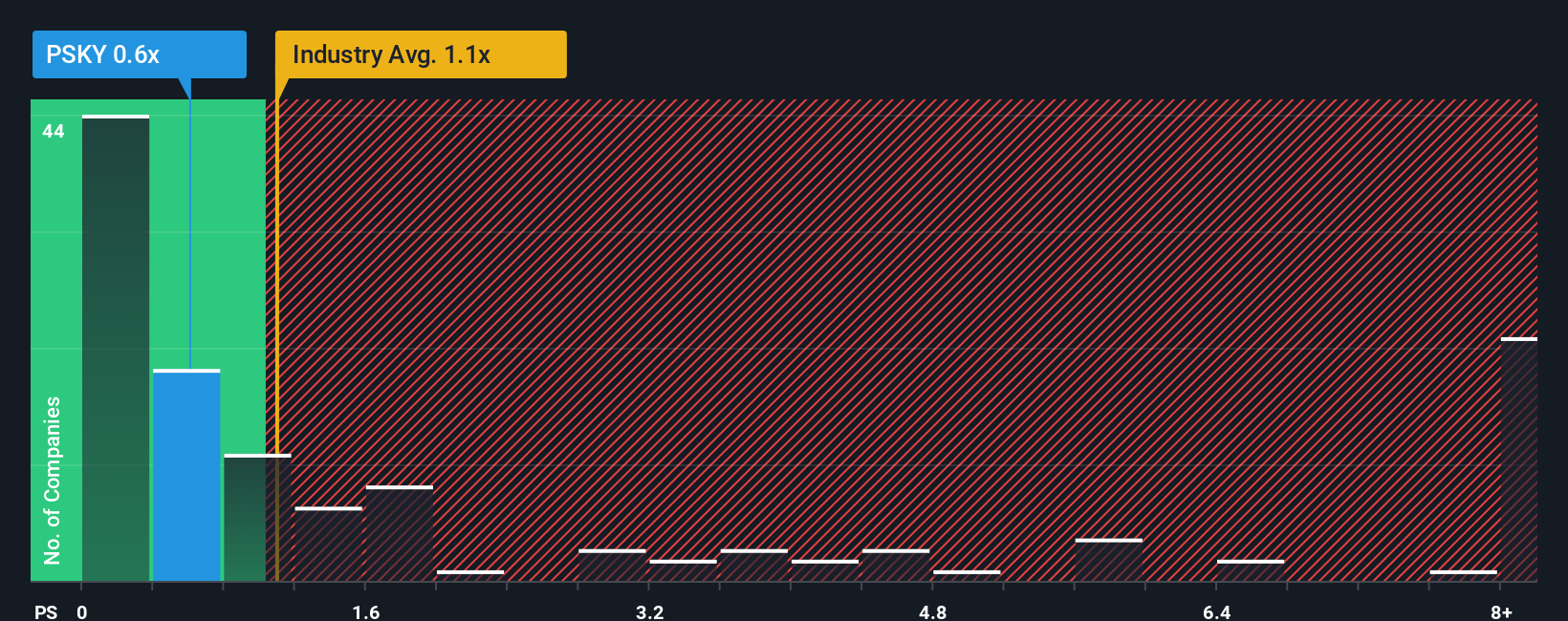

Approach 2: Paramount Skydance Price vs Sales

For companies in the media sector, the Price-to-Sales (PS) ratio is often a reliable valuation yardstick. This is especially true when earnings are negative or volatile but sales trends remain steady and predictable. Sales reflect the true scale of a company’s operations, and using the PS ratio helps to factor out any short-term swings in profit.

Determining what constitutes a “normal” PS ratio depends on expectations for future growth and the risks a company faces. Higher growth prospects and lower risks typically justify a higher multiple, while intense competition or structural headwinds usually compress it.

Paramount Skydance currently trades at a PS ratio of 0.71x. This is notably below both the media industry average of 1.05x and its peer group average of 3.22x. At first glance, this makes the stock appear attractively priced compared to its sector and peer benchmarks.

Simply Wall St’s Fair Ratio offers a more tailored assessment by adjusting for Paramount Skydance’s unique growth outlook, profit margins, risks, industry, and market capitalization. This proprietary measure goes beyond broad averages by reflecting the reality of the business today. It allows investors to sidestep blanket comparisons that may not capture the full picture.

With a Fair Ratio of 1.83x, which is more than 1x above the stock’s actual PS ratio, Paramount Skydance looks undervalued based on this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Paramount Skydance Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique story about a company, where you explain not just what the numbers are, but why you believe they matter. It’s a simple tool that lets you connect your perspective, forecasts for things like revenue and margins, and your assumed fair value, all in one place.

Narratives link the big-picture story of a business to a financial forecast and then tie that directly to a fair value, giving you a powerful foundation for investment decisions. This approach is both intuitive and accessible, and you can explore or create Narratives right on Simply Wall St’s Community page, which is trusted by millions of investors.

By using Narratives, you can easily see when fair value is above or below the current price, helping you decide when to buy, sell, or hold. Best of all, Narratives update dynamically whenever new information, such as breaking news or quarterly earnings, comes in, keeping your view fresh and actionable.

For Paramount Skydance, you might find optimistic Narratives forecasting much higher fair values than today’s price, while more cautious perspectives may set lower estimates, proving that every investor’s story and valuation can be different.

Do you think there's more to the story for Paramount Skydance? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PSKY

Paramount Skydance

Operates as a media and entertainment company worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026