- United States

- /

- Entertainment

- /

- NasdaqGS:PLTK

Will Playtika's (PLTK) Retracted NFL Partnership Announcement Reshape Its Content Strategy and Investor Narrative?

Reviewed by Sasha Jovanovic

- In early December 2025, Playtika asked investors to disregard a previously issued release announcing an NFL-themed collaboration for its World Series of Poker free-to-play app, saying the announcement was made in error or contained inaccuracies and offering no updated plans.

- The unusual step of retracting a high-profile NFL partnership announcement introduces fresh uncertainty around Playtika’s content pipeline, execution processes, and communication with investors.

- We’ll now look at how the retracted NFL tie-in for the World Series of Poker app affects Playtika’s broader investment narrative and outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Playtika Holding Investment Narrative Recap

To own Playtika, you need to believe that its portfolio of social casino and casual titles can overcome pressure on aging flagship games and margin strain while new content, D2C channels and M&A support earnings. The retracted NFL collaboration for World Series of Poker clouds near term visibility on the content roadmap and execution quality, but on its own it does not look like a clearly material shift to the core revenue or the most important short term catalyst around stabilizing profitability.

The most relevant recent announcement here is the reaffirmation of 2025 revenue guidance at US$2.70 billion to US$2.75 billion in November 2025, which was issued before the NFL press release error. That guidance implicitly assumes the existing pipeline of live ops and new initiatives can offset Slotomania’s ongoing decline and rising costs, so any repeated communication missteps or delays on partnerships could increase investor focus on whether those targets and margin recovery remain achievable.

Yet against that backdrop, investors should be aware that rising sales and marketing spending and weaker margins could still...

Read the full narrative on Playtika Holding (it's free!)

Playtika Holding's narrative projects $3.0 billion revenue and $249.2 million earnings by 2028.

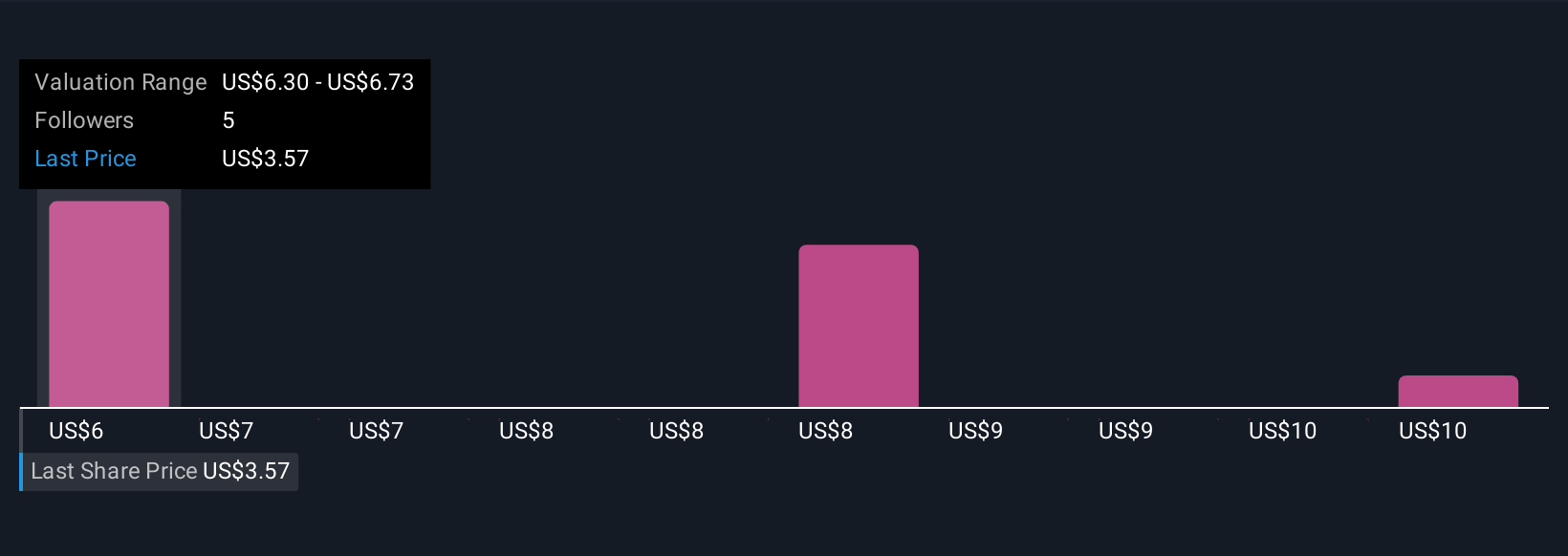

Uncover how Playtika Holding's forecasts yield a $5.92 fair value, a 41% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community value Playtika between US$5.92 and US$18.07 per share, underlining how far opinions can diverge. Set that against concerns over rising sales and marketing costs eroding margins, and you have several different angles on how resilient the business model may prove to be over time.

Explore 3 other fair value estimates on Playtika Holding - why the stock might be worth just $5.92!

Build Your Own Playtika Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Playtika Holding research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Playtika Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Playtika Holding's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTK

Playtika Holding

Develops mobile games in the United States, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Moderate risk and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026