- United States

- /

- Entertainment

- /

- NasdaqGS:NTES

NetEase's (NASDAQ:NTES) three-year earnings growth trails the respectable shareholder returns

It hasn't been the best quarter for NetEase, Inc. (NASDAQ:NTES) shareholders, since the share price has fallen 12% in that time. But that doesn't change the fact that the returns over the last three years have been pleasing. In the last three years the share price is up, 54%: better than the market.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for NetEase

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

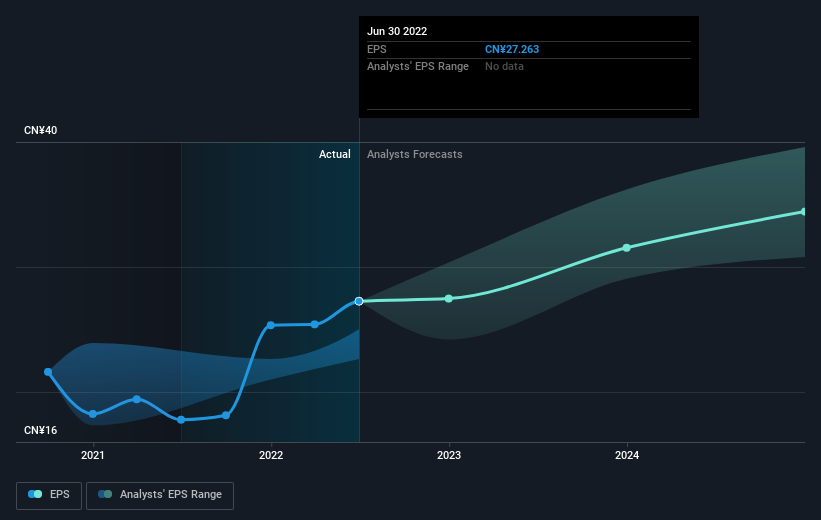

NetEase was able to grow its EPS at 17% per year over three years, sending the share price higher. We note that the 15% yearly (average) share price gain isn't too far from the EPS growth rate. Coincidence? Probably not. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that NetEase has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for NetEase the TSR over the last 3 years was 63%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While it's certainly disappointing to see that NetEase shares lost 16% throughout the year, that wasn't as bad as the market loss of 19%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 10% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. Before forming an opinion on NetEase you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you're looking to trade NetEase, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NetEase might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NTES

NetEase

Engages in online games, music streaming, online intelligent learning services, and internet content services businesses in China and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives