- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

What Could Netflix's CPO Departure Mean for Its Soaring Stock Price?

Reviewed by Simply Wall St

Thinking about whether to buy, sell, or hold Netflix stock? You are definitely not alone. Netflix has been on quite a journey lately, with its share price recently closing at $1,188.44, and it has caught the attention of investors who want to understand what is really driving these moves. Over the last year, the stock has delivered a jaw-dropping 70.5% return, powered in part by surprising successes like “KPop Demon Hunters” claiming the top spot at the box office and ongoing rumors about strategic partnerships in the media world. While shares are down around 4.5% over the last week and 4.1% over the past 30 days, these short-term dips are set against a longer-term backdrop of incredible gains. Netflix is up a massive 394.9% over three years and 152.9% over five.

Recent headlines, including the departure of their chief product officer and potential deals with baseball broadcasters, may be adding some short-term uncertainty and excitement. But for long-term investors, this is all about the fundamentals and whether the recent moves signal more growth, a higher risk level, or a bit of both. In terms of valuation, Netflix scores just 1 out of 6 on our undervaluation checklist, hinting there is not a strong signal that the market is missing some hidden value. Still, those numbers only tell one piece of the story. Let us dive into the different ways analysts assess what Netflix is actually worth, and why sometimes looking at valuation scores alone might not give the complete picture.

Netflix scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Netflix Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach estimates the value of a company by projecting its future cash flows and then discounting those amounts back to today's dollars. For Netflix, this involves analyzing how much cash the company is expected to generate over the coming years and translating that into a present-day valuation.

According to the DCF model, Netflix generated $8.59 billion in Free Cash Flow (FCF) over the last twelve months. Analysts expect this annual cash flow to grow rapidly, with projections reaching $21.43 billion by 2029. Forecasts for even further into the future are based on systematic extrapolation, beyond the five-year horizon that experts typically provide. All values are given in US dollars.

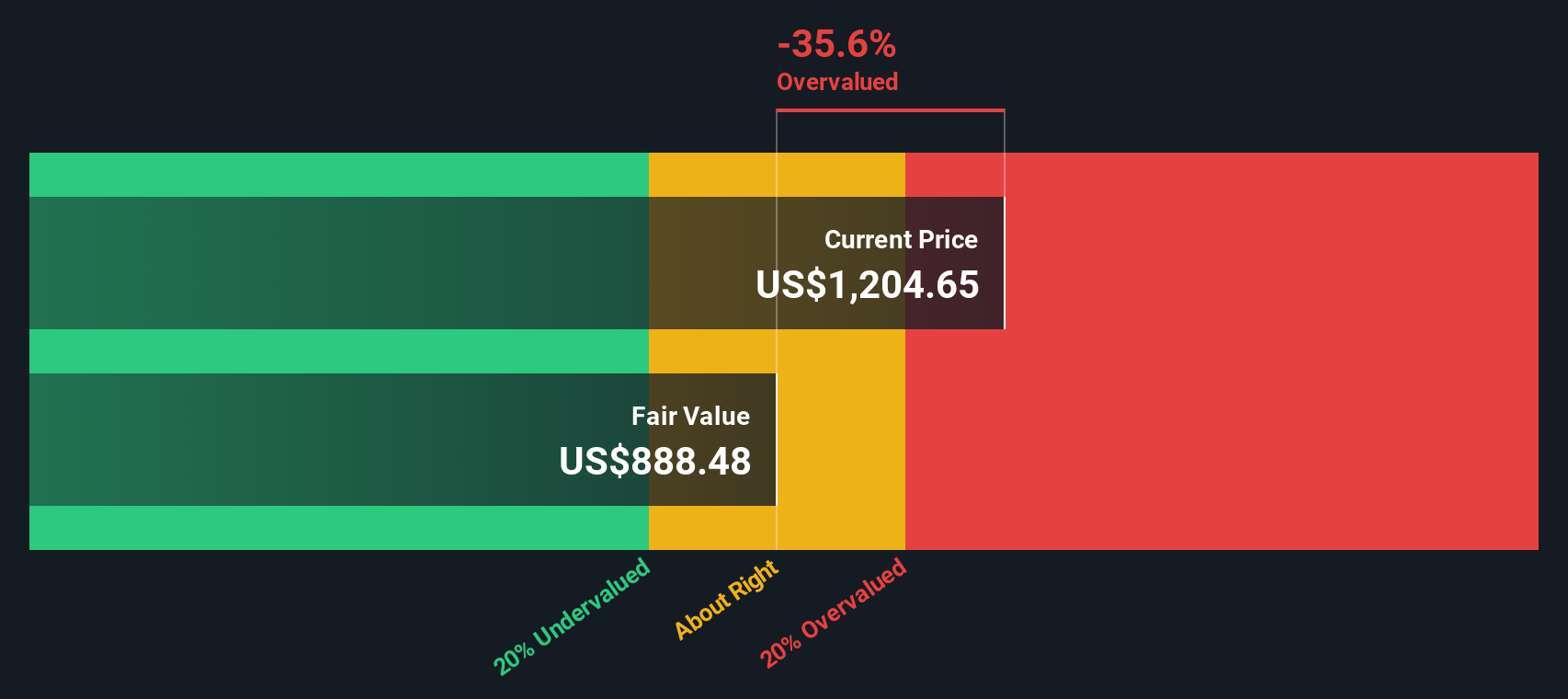

After discounting these projected cash flows to their present value, the DCF model calculates a fair value per share of $891.08 for Netflix. With the recent share price at $1,188.44, the stock is trading at about 33.4% above its estimated intrinsic value. This suggests that Netflix is currently overvalued according to this model.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Netflix.

Approach 2: Netflix Price vs Earnings

The Price-to-Earnings (PE) ratio is widely regarded as a reliable way to value profitable companies like Netflix, because it puts the company’s share price in the context of how much profit it is actually generating. For investors, the PE ratio helps provide a sense of how much they are paying for each dollar of earnings, which is especially relevant for companies with consistent profitability.

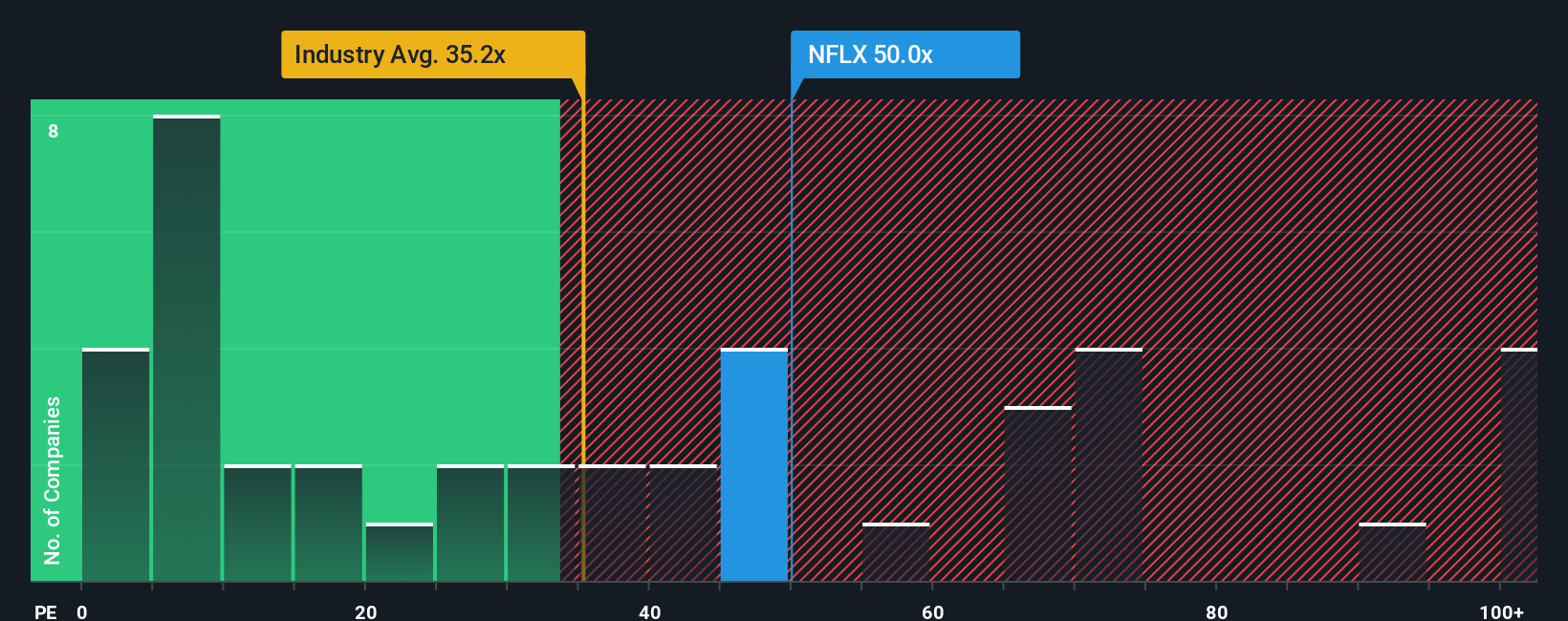

What counts as a “fair” PE ratio can vary depending on the company’s earnings growth, future prospects, and risk profile. Generally, higher growth expectations and lower risks justify a higher PE, while slower growth and elevated risks demand a lower one.

Currently, Netflix's PE ratio is 49.3x, which is notably higher than the entertainment industry average of 35.6x and the peer average of 75.9x. Simply Wall St’s proprietary “Fair Ratio” for Netflix stands at 36.4x. This Fair Ratio is calculated based on factors like Netflix’s earnings growth, profit margins, market capitalization, risk level, and its position within the industry. This approach provides a more tailored view than just comparing against broad industry or peer numbers.

Comparing Netflix’s actual PE ratio to its Fair Ratio suggests the stock is trading well above what would be expected based on its fundamentals and business profile alone. This indicates investors are pricing in high growth or other exceptional factors, meaning Netflix appears overvalued through this lens.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Netflix Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your unique perspective on a company: the story, outlook, and reasoning behind the numbers you believe in, such as your own fair value, future revenue forecasts, earnings, and profit margins. Instead of simply relying on ratios or broad estimates, Narratives help you connect Netflix’s strategy and business outlook directly to financial forecasts and ultimately to a calculated fair value.

This approach is both powerful and approachable. With just a few clicks on Simply Wall St’s Community page, used by millions of investors, you can review, create, or update your own Narrative for Netflix or any company. Narratives make it easy to decide when to buy or sell by letting you compare your Fair Value estimate against the current Price. They also automatically update as new information, such as earnings reports or breaking news, becomes available.

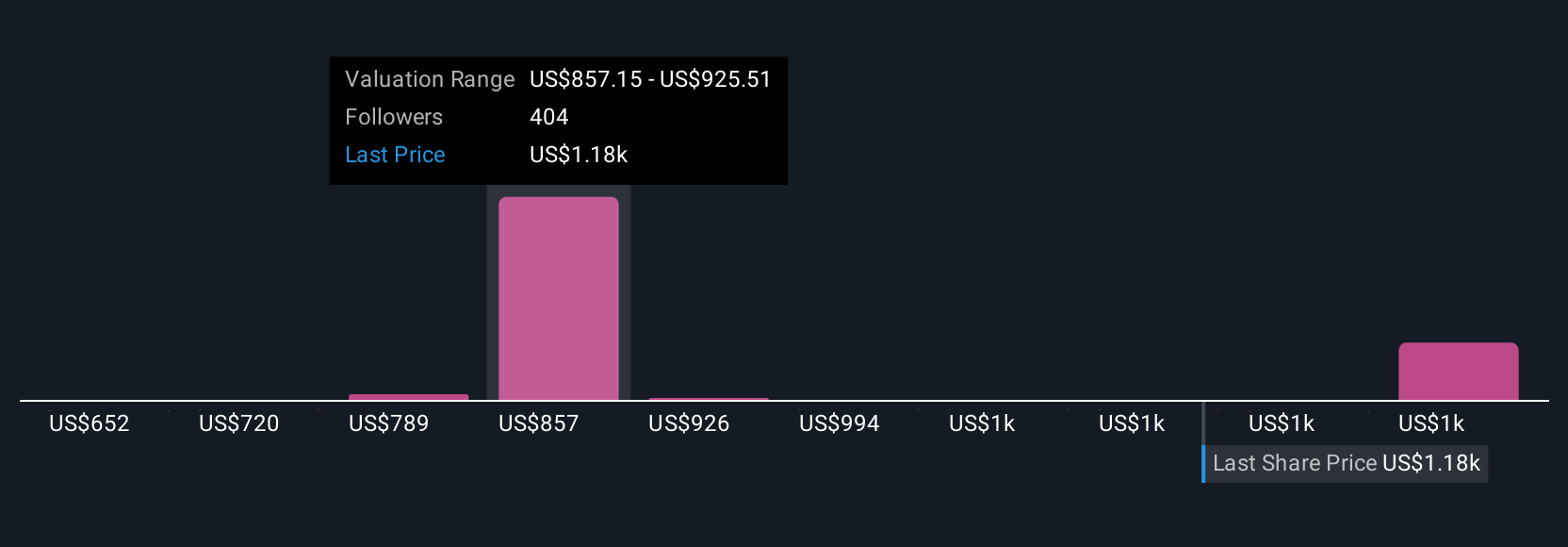

For example, some investors have a Netflix Narrative that values the stock at $797 per share based on steady but modest subscriber and earnings growth. Others expect aggressive advertising and global expansion to push Fair Value as high as $1,350 per share. By crafting your Narrative, you give meaning to the numbers and ensure your decisions reflect what you truly believe about Netflix's future.

For Netflix, you can explore previews of two leading Netflix Narratives:

🐂 Netflix Bull CaseFair Value: $1,350

Current Price vs Fair Value: -12.0%

Forecast Revenue Growth: 12.5%

- Analysts believe global ad tech rollout and international expansion will fuel long-term subscriber and revenue growth.

- Advanced AI-driven user experiences and diversified, localized content will boost engagement and margins. This may counter competition and support higher earnings per share.

- Key risks include intensifying competition, surging content costs, market saturation, regulatory pressures, and shifting viewer habits that could impact future profitability.

Fair Value: $798

Current Price vs Fair Value: +49.0%

Forecast Revenue Growth: 13.0%

- This viewpoint is bullish on Netflix's ability to leverage industry consolidation, scale, and internal initiatives such as ad-plans and paid sharing to drive future subscriber and revenue growth.

- Ad-supported plans and pricing strategies could initially trim per-user revenue, but these are expected to boost engagement, long-term ARPM, and overall profitability as the business scales.

- Risks include heightened competition, execution challenges for new business models, and the potential for profit margin pressure from rising content costs and industry strikes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives