- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Netflix (NFLX): Examining Valuation Ahead of Anticipated Q3 Earnings and Ad Growth Momentum

Reviewed by Simply Wall St

Netflix (NFLX) is set to deliver its third-quarter earnings report this week, and there is plenty of buzz in the market. Recent attention centers on the company’s surging ad revenue, strong subscriber growth, and improving margins.

See our latest analysis for Netflix.

Investor excitement has been building as Netflix’s advertising and subscriber growth stories have taken center stage, helping fuel a year-to-date share price return of nearly 40%. Even as market buzz grows ahead of the Q3 earnings report, momentum has moderated slightly in recent weeks. However, the long-term picture shines brighter, with a remarkable 1-year total shareholder return of 62% and an impressive three-year total shareholder return above 325%.

If Netflix’s momentum has you searching for more high-potential names, consider expanding your radar to See the full list for free.

With expectations soaring and analysts projecting further upside, the key question now is whether Netflix’s strong fundamentals and upbeat forecasts leave room for additional gains, or if future growth is already fully reflected in the share price.

Most Popular Narrative: 8.3% Undervalued

Compared with Netflix’s last close price of $1,238.56, the most widely discussed narrative sets a fair value at $1,350.32. This target implies that current prices do not yet fully account for the future potential outlined by analysts and provides the foundation for further upside if the assumptions hold.

The wider rollout and promising early metrics of Netflix's proprietary ad tech stack enables global expansion and increased monetization of the ad-supported tier. This positions Netflix to significantly accelerate ad revenues and improve margin leverage with scale as more advertising demand shifts to streaming.

How exactly does Netflix aim to turn ad technology and global partnerships into new streams of profit? Underneath this valuation prediction are bullish assumptions about the rate of future earnings growth, improved margins, and unusually high profit multiples that only a select few streaming giants have achieved. Want to find out if these projections hold the key to breaking through current highs? Dive in for a clear look at the numbers and logic behind this compelling valuation story.

Result: Fair Value of $1,350.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, escalating content costs and fierce competition could slow Netflix’s growth momentum. This raises questions about the sustainability of its premium valuation.

Find out about the key risks to this Netflix narrative.

Another View: Multiples Signal Price Risk

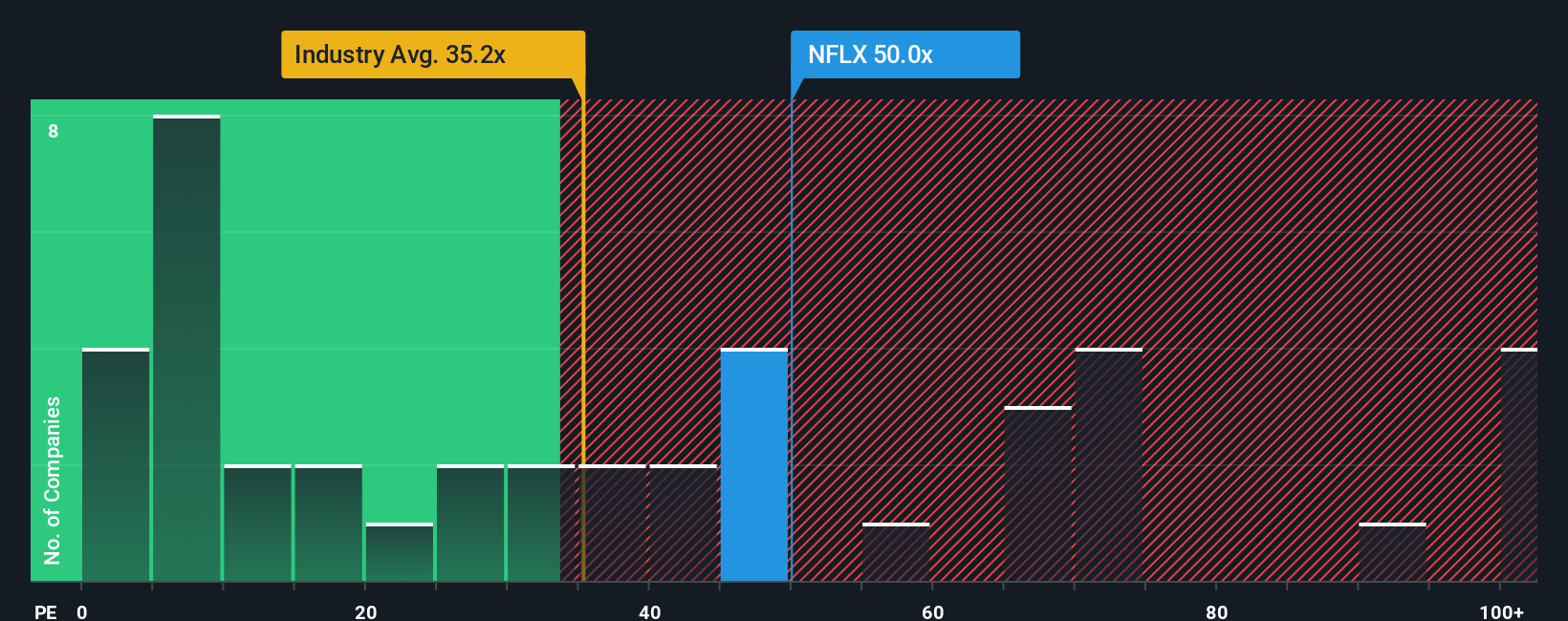

Taking a different approach, let's examine Netflix using its price-to-earnings ratio. Shares trade at 51.4x earnings, nearly double the US Entertainment industry’s 26.4x average and well above the 37.2x fair ratio the market could move toward. Compared to similar peers, Netflix also appears pricey, carrying a valuation well above the peer average of 72.6x.

While headline growth impresses, these high multiples suggest there is little room for disappointment. Could investors be paying too much for future promises?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Netflix Narrative

You can always dig into the numbers yourself, challenge the consensus, and build a data-driven narrative to suit your own perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Netflix.

Looking for more investment ideas?

Smart investors never settle for the obvious picks alone. Use the Simply Wall Street Screener to seize new opportunities and stay ahead of the crowd in today’s fast-moving market.

- Tap into high-yield opportunities by accessing these 17 dividend stocks with yields > 3%. This can give your portfolio the benefit of consistent income and attractive returns.

- Ride the artificial intelligence wave and position yourself early by checking out these 24 AI penny stocks, which highlights tomorrow’s industry leaders today.

- Catch undervalued gems before the crowd by browsing these 874 undervalued stocks based on cash flows, so you never miss a chance for growth at the right price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives