- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Netflix (NFLX): Evaluating Valuation After Elon Musk’s Boycott Sparks Surge in Debate and Investor Focus

Reviewed by Kshitija Bhandaru

Netflix (NFLX) finds itself in the spotlight after Elon Musk called on his millions of social media followers to cancel their subscriptions. This has sparked widespread debate about the platform's programming and potential effects on its subscriber base.

See our latest analysis for Netflix.

Despite a rocky week driven by Elon Musk’s highly publicized boycott call and heated debates around Netflix’s content, the company has continued to push into live sports and global partnerships, most notably with AB InBev, to expand its reach, advertising revenue, and brand engagement. While the share price dipped recently, the real story is Netflix’s longer-term total shareholder returns, which remain modest but in positive territory. This signals steady, if unspectacular, momentum as management bets big on new revenue streams and engagement initiatives.

If you’re interested in what’s trending beyond the headlines, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

After a volatile stretch and headline-making controversies, investors face a crucial question: Is Netflix undervalued in light of its recent drops and growth bets, or have markets already accounted for every catalyst?

Most Popular Narrative: 14.6% Undervalued

With Netflix trading at $1,153.32 and the most-followed narrative setting fair value at $1,350.32, there is a notable divergence between market price and this consensus. This widens the debate around what could propel the share price higher.

The wider rollout and promising early metrics of Netflix's proprietary ad tech stack enable global expansion and increased monetization of the ad-supported tier, positioning Netflix to significantly accelerate ad revenues and improve margin leverage with scale as more advertising demand shifts to streaming.

Curious about the secret sauce behind this forecast? The narrative hints at transformative revenue engines and ambitious profit targets. What key numbers do they believe justify a premium far above rivals? Dive deeper to see exactly how analysts think Netflix pulls this off.

Result: Fair Value of $1,350.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and surging content costs could limit Netflix’s future growth. This may challenge the optimistic outlook driving current price targets.

Find out about the key risks to this Netflix narrative.

Another View: Valuation Through the Lens of Real-World Comparisons

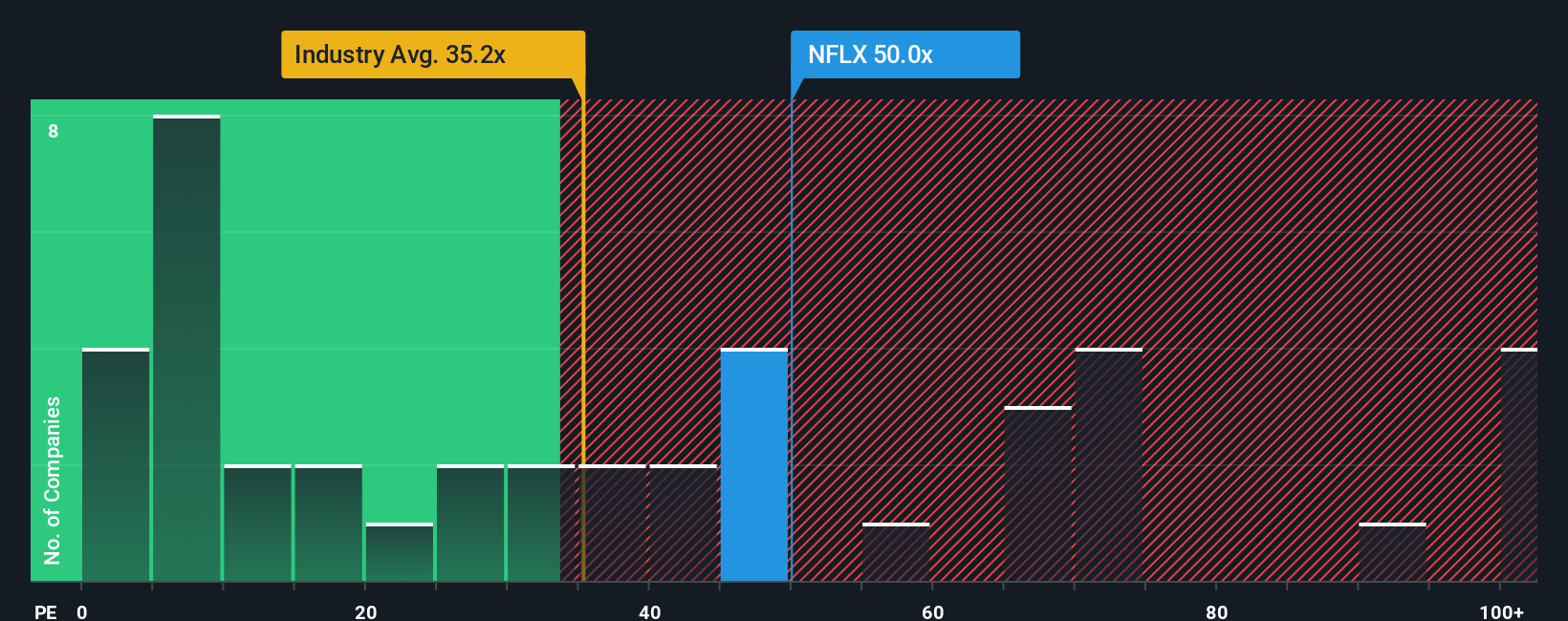

Taking a closer look at Netflix’s valuation using the go-to metric for streaming stocks, its price-to-earnings ratio, tells a different story. Trading at 47.8x earnings, Netflix looks expensive compared to both the US Entertainment industry average of 30.9x and its peers at 75.8x. Even when stacked against a fair ratio of just 37.2x, the current premium signals investors expect faster growth or bigger returns than fundamentals alone might suggest. Does this gap mean Netflix’s momentum is justified, or does it add risk if the story changes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Netflix Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own view of Netflix in just a few minutes, then Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Netflix.

Looking for more investment ideas?

Treat yourself to an edge and move beyond headlines to uncover fresh prospects that have real potential to grow your portfolio in today’s dynamic market.

- Capitalize on yield by reviewing these 19 dividend stocks with yields > 3% offering steady payouts and high income potential in any environment.

- Spot breakthrough innovators early when you tap into these 25 AI penny stocks, a collection of companies transforming entire industries with artificial intelligence.

- Strengthen your core holdings with these 887 undervalued stocks based on cash flows, which have attractive price tags and compelling fundamentals according to our data.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives