- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Netflix (NASDAQ:NFLX) Takes On Some Risk With Its Use Of Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Netflix, Inc. (NASDAQ:NFLX) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Netflix

What Is Netflix's Net Debt?

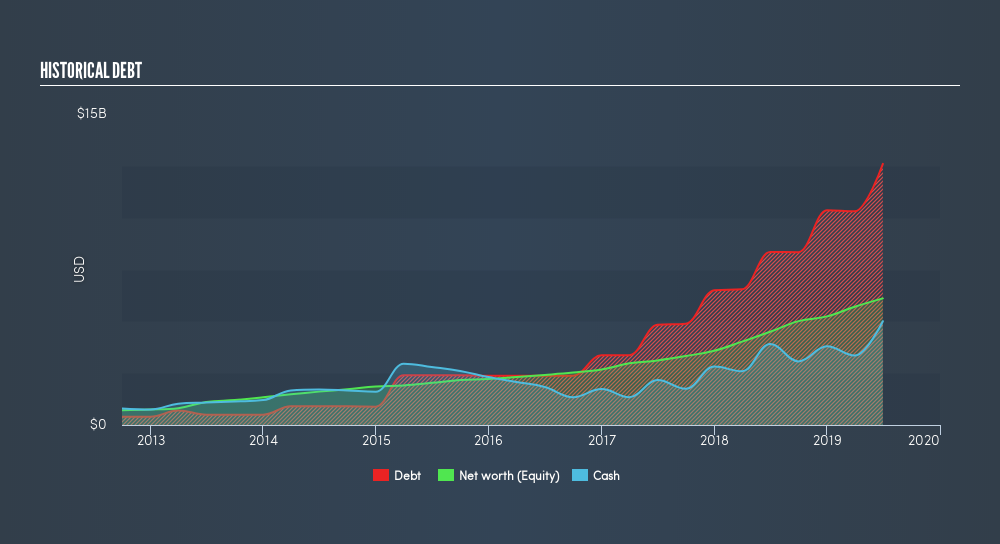

The image below, which you can click on for greater detail, shows that at June 2019 Netflix had debt of US$12.6b, up from US$8.34b in one year. However, it does have US$5.00b in cash offsetting this, leading to net debt of about US$7.59b.

How Strong Is Netflix's Balance Sheet?

According to the last reported balance sheet, Netflix had liabilities of US$6.93b due within 12 months, and liabilities of US$17.1b due beyond 12 months. Offsetting this, it had US$5.00b in cash and US$492.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$18.6b.

Since publicly traded Netflix shares are worth a very impressive total of US$128.6b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Netflix's debt is 3.9 times its EBITDA, and its EBIT cover its interest expense 4.0 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. The good news is that Netflix grew its EBIT a smooth 37% over the last twelve months. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Netflix can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Netflix saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Netflix's conversion of EBIT to free cash flow and net debt to EBITDA definitely weigh on it, in our esteem. But its EBIT growth rate tells a very different story, and suggests some resilience. Looking at all the angles mentioned above, it does seem to us that Netflix is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Netflix's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives