- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Can Netflix’s TV Gaming Launch Justify Its Surging 2025 Share Price?

Reviewed by Bailey Pemberton

Thinking about what to do with Netflix stock? You are definitely not alone. Whether you have ridden the incredible wave up—Netflix shares have soared 72.2% in the past year and 404.6% over three years—or you are just now considering if you should jump in at $1,215.35, there is a lot to consider. Year-to-date, the stock is up a remarkable 37.1%, so naturally, everyone is asking the same question: does this momentum have room to run, or are expectations starting to get a little ahead of reality?

Recently, Netflix has been making moves that keep investors talking, from rolling out its lineup of video games to living rooms everywhere to scoring exclusive rights to stream the Yankees-Giants MLB opener. These efforts grab headlines and hint at new revenue streams, potentially shifting how investors view Netflix’s risk and growth potential.

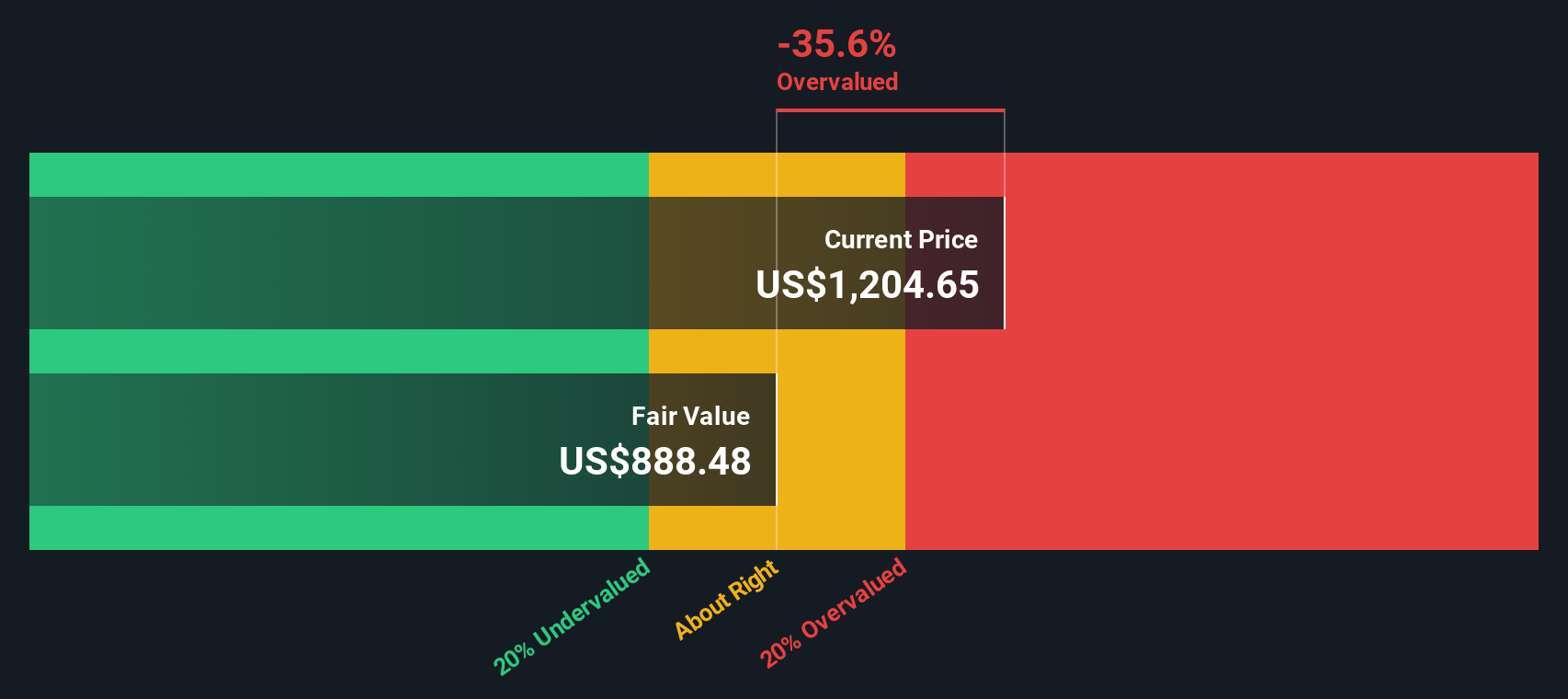

But let’s get to the heart of it: is the stock undervalued or a bit stretched after such a monster run? According to our valuation metrics, Netflix clocks in with a value score of 1 out of 6. In other words, it only ticks one box for being undervalued right now.

With so much action behind the share price and only a single undervalued signal from traditional methods, it is crucial to unpack how those scores are actually calculated. It is just as important to consider why traditional approaches might miss something about Netflix’s story. Let’s dive into each valuation check and explore an even more insightful angle on Netflix’s true value.

Netflix scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Netflix Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to their present value. This fundamental process helps investors decide whether today’s stock price fairly reflects the company’s long-term earning power.

For Netflix, the most recent Free Cash Flow comes in at $8.59 Billion. Looking ahead, analysts project Netflix’s Free Cash Flow could reach $22.63 Billion by 2029. It is important to note that while analyst estimates only stretch a handful of years into the future, additional cash flow projections through 2035 are extrapolated using Simply Wall St's growth assumptions. These projections provide a clearer sense of whether current market expectations are realistic or not.

After discounting those future streams of cash using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value stands at $1,018.20 per share. Compared to Netflix’s latest share price around $1,215, this suggests that the stock is currently about 19.4% overvalued based on cash flow fundamentals.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Netflix may be overvalued by 19.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Netflix Price vs Earnings (PE Ratio)

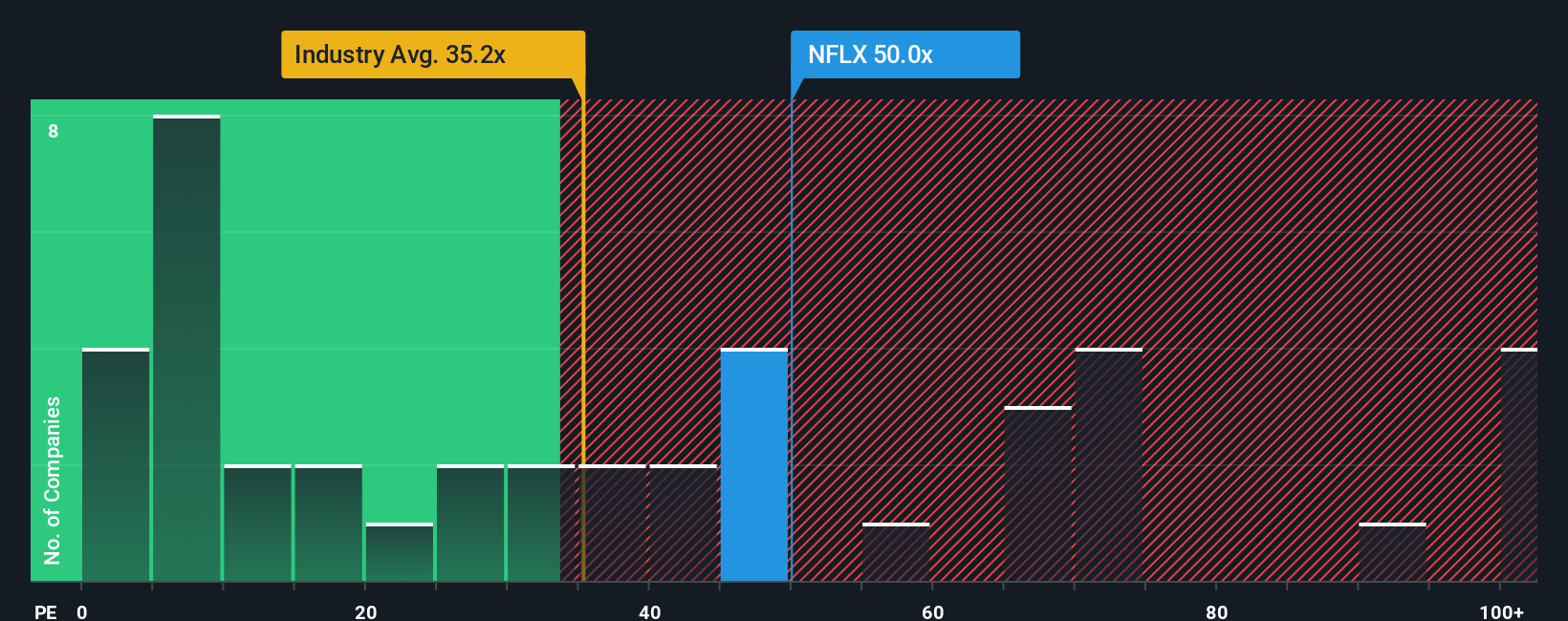

The Price-to-Earnings (PE) ratio is a commonly used valuation metric for profitable companies like Netflix because it provides a snapshot of what investors are willing to pay for each dollar of earnings. A higher PE generally reflects growth expectations or confidence in future earnings, while a lower PE can signal caution or lower growth prospects.

However, what counts as a “normal” or “fair” PE ratio varies quite a bit. Factors such as the company’s projected earnings growth, perceived business risks, brand strength, and broader industry trends all influence whether a higher or lower multiple is justified. Fast-growing, highly profitable companies often trade at richer multiples than slower-moving or more cyclical peers.

Currently, Netflix trades at a PE ratio of 50.4x, well above the Entertainment industry average of 28.1x and higher than its peers, whose average sits at 72.5x. While comparing to these benchmarks can provide useful context, it does not account for company-specific factors such as Netflix’s unique growth profile, operating margins, or market leadership.

That is where Simply Wall St’s “Fair Ratio” comes in. This proprietary metric blends together not just sector norms, but also Netflix’s earnings growth outlook, profitability, risk factors, scale, and industry standing. This provides a more nuanced sense of what multiple is actually justified. For Netflix, the Fair PE Ratio is calculated at 37.5x, significantly below the current market PE but designed to reflect the company's specific financial and competitive characteristics.

Since Netflix's 50.4x PE is noticeably above its Fair Ratio, it appears that the market is currently pricing the stock ahead of what these fundamentals would support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Netflix Narrative

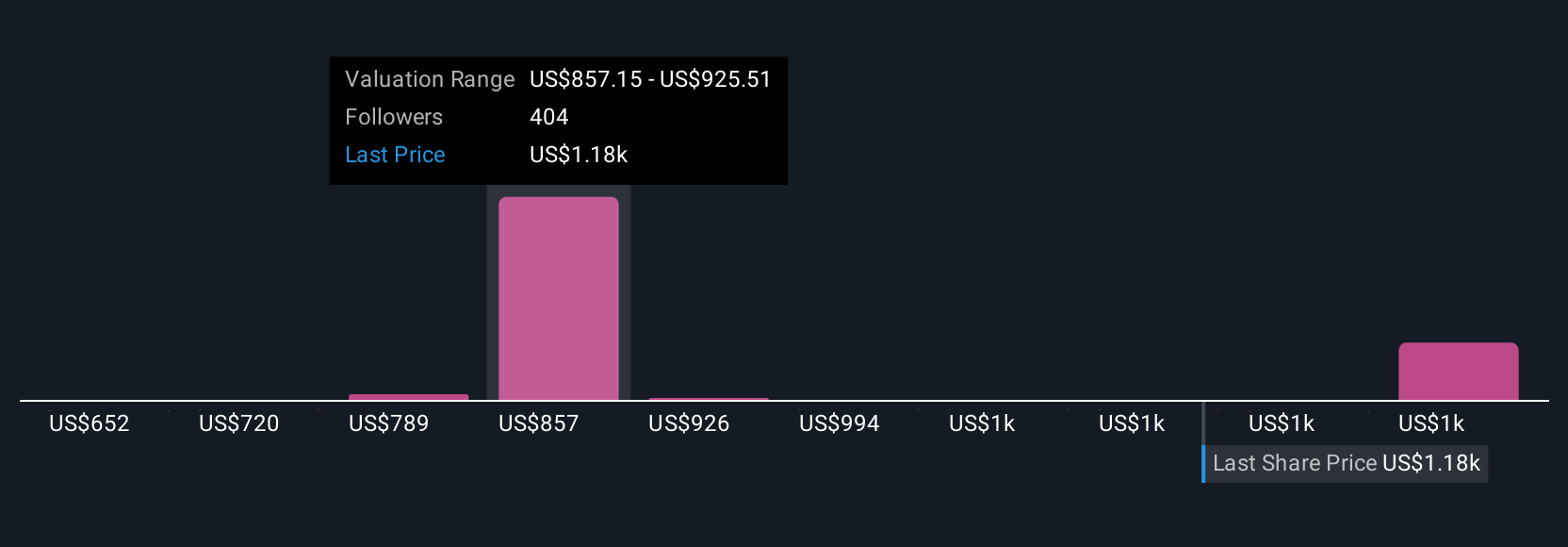

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story behind the numbers, your unique perspective on Netflix’s future, which you translate into your own estimates of its revenue, earnings growth, and eventual fair value.

Narratives work by linking Netflix’s business outlook, industry changes and catalysts, and your assumptions to a financial forecast, which translates into a fair value for the stock. On Simply Wall St’s Community page, millions of investors are already using Narratives to express their views. It is an easy and accessible tool that turns your research, opinions, and the latest news into actionable investment insight.

With Narratives, you can quickly see, in real time, whether your view suggests Netflix is undervalued or overvalued, by comparing your Fair Value to today’s share price. Even better, Narratives update automatically when fresh information like quarterly results or major news hits, keeping your perspective relevant if the story changes.

For example, among recent Narratives on Netflix, some investors see huge upside with a Fair Value as high as $1,600, banking on explosive ad-driven growth, while the most cautious Narrative values shares at just $750, highlighting industry headwinds and profit risk. This shows there is truly more than one way to “see” a stock.

For Netflix, however, we'll make it really easy for you with previews of two leading Netflix Narratives:

Fair Value: $1,350.32

Currently trading at approximately 10% below this fair value.

Forecast Revenue Growth Rate: 12.5%

- Analysts expect global ad tech rollout, international partnerships, and high-quality, localized content to drive robust subscriber and revenue growth for Netflix.

- AI-driven user experience enhancements are anticipated to boost engagement, retention, and operational efficiency, which supports rising profit margins.

- Key risks include intensifying competition, rising content and regulatory costs, and possible market saturation in mature geographies. Consensus sees the company as fairly valued with some potential upside.

Fair Value: $797.74

Current share price is approximately 52% above this fair value.

Forecast Revenue Growth Rate: 13.0%

- While industry consolidation and internal initiatives like ad plans and paid sharing are driving subscriber and revenue growth, the elevated share price suggests the market is pricing in high future expectations.

- Benefits of scale and disciplined spending are supporting expanding profit margins, but there are concerns about declining ARPM in the short term and execution risks as Netflix expands globally.

- Continued competition, increasing production and regulatory costs, and potential missteps in new business initiatives could limit long-term upside and justify a lower fair value.

Do you think there's more to the story for Netflix? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026