- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:MTCH

Match Group (MTCH): Is AI Innovation the Key to Sustaining Growth Amid Regulatory Pressures?

Reviewed by Sasha Jovanovic

- Earlier this week, Match Group reported Q2 2025 revenue that exceeded expectations, citing strong momentum at Hinge and the rollout of new AI-powered discovery features, while also guiding higher for Q3 and announcing a US$50 million reinvestment focused on product innovation and expansion.

- Despite facing concerns from U.S. lawmakers over user safety and the prevalence of romance scams on its platforms, Match Group highlighted recent enhancements to fraud detection and ongoing safety initiatives to address regulatory scrutiny.

- We'll explore how Match Group's upbeat revenue guidance and focus on AI-driven product updates influence its investment narrative and growth outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Match Group Investment Narrative Recap

If you’re considering Match Group as a shareholder, the investment case centers on the company’s ability to revive core user growth and boost payer conversion through continuous product innovation, like the recent AI-powered features. The latest upbeat revenue guidance and Hinge’s momentum appear to support the short-term catalyst of product-led engagement gains, while persistent concerns over user trust and regulatory scrutiny remain a primary risk to business performance, though the impact of this week’s news does not materially shift those risks in the immediate term.

Most relevant to this moment, Match Group’s Q3 revenue guidance of US$910 million to US$920 million stands out, reflecting management’s confidence in near-term growth as AI initiatives and reinvestment plans roll out. Investors may see this as support for renewed user monetization, but also know that successful turnaround of Tinder’s payer trends and further product gains are being closely watched catalysts.

Yet, alongside these promising developments, investors need to keep in mind that growing political pressure around user safety could still...

Read the full narrative on Match Group (it's free!)

Match Group's narrative projects $4.0 billion in revenue and $811.8 million in earnings by 2028. This requires 5.0% yearly revenue growth and a $274 million increase in earnings from $537.8 million.

Uncover how Match Group's forecasts yield a $38.47 fair value, a 6% upside to its current price.

Exploring Other Perspectives

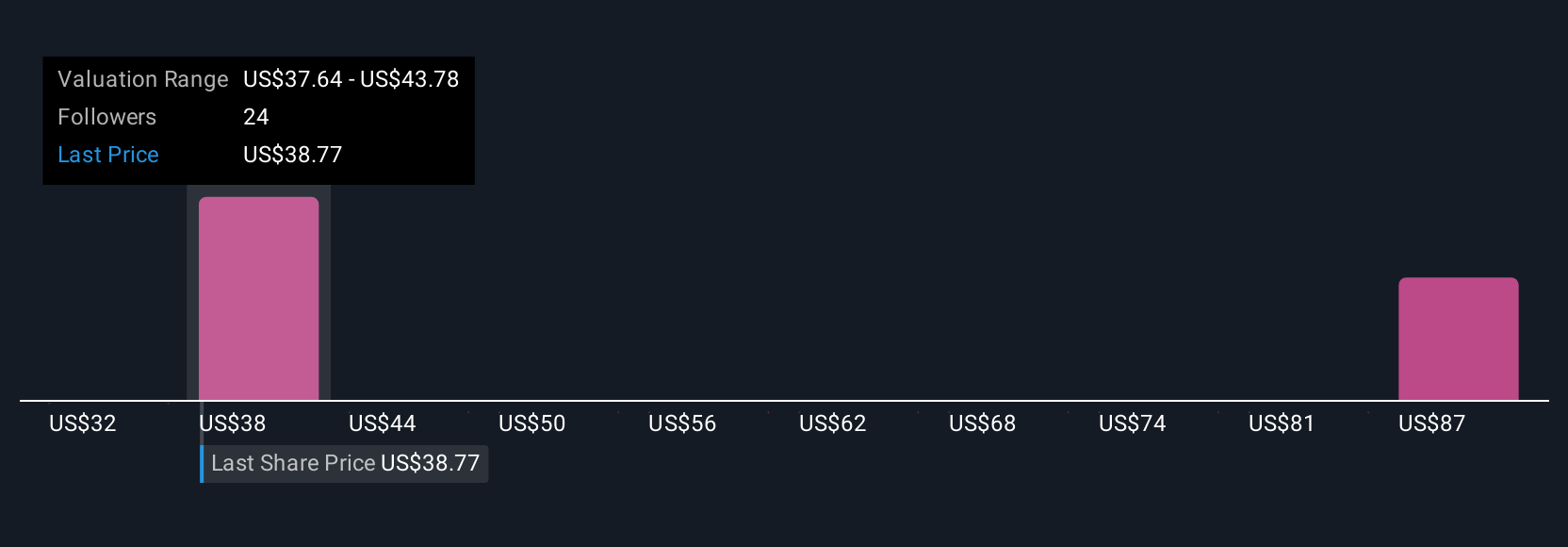

Four different fair value estimates from the Simply Wall St Community show a range from US$31.51 to US$92.05 per share. With the company’s growth strategy increasingly hinging on AI-led innovation, it’s clear that views on future performance can vary widely, explore these perspectives for a fuller picture.

Explore 4 other fair value estimates on Match Group - why the stock might be worth over 2x more than the current price!

Build Your Own Match Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Match Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Match Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Match Group's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MTCH

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.