- United States

- /

- Entertainment

- /

- NasdaqCM:MSGM

Motorsport Games Inc. (NASDAQ:MSGM) Might Not Be As Mispriced As It Looks After Plunging 30%

The Motorsport Games Inc. (NASDAQ:MSGM) share price has softened a substantial 30% over the previous 30 days, handing back much of the gains the stock has made lately. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 50% share price drop.

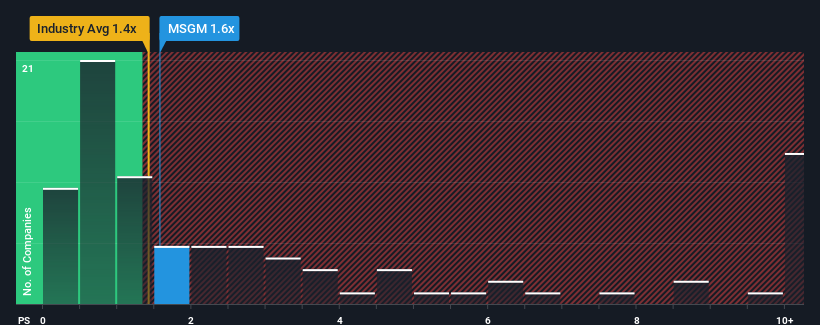

Even after such a large drop in price, there still wouldn't be many who think Motorsport Games' price-to-sales (or "P/S") ratio of 1.6x is worth a mention when the median P/S in the United States' Entertainment industry is similar at about 1.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Motorsport Games

How Motorsport Games Has Been Performing

Motorsport Games could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Motorsport Games' future stacks up against the industry? In that case, our free report is a great place to start.How Is Motorsport Games' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Motorsport Games' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 32% decrease to the company's top line. As a result, revenue from three years ago have also fallen 13% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 47% per annum as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 10% per annum growth forecast for the broader industry.

In light of this, it's curious that Motorsport Games' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Motorsport Games' P/S Mean For Investors?

Motorsport Games' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, Motorsport Games' P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

There are also other vital risk factors to consider and we've discovered 5 warning signs for Motorsport Games (3 are potentially serious!) that you should be aware of before investing here.

If you're unsure about the strength of Motorsport Games' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MSGM

Motorsport Games

Develops and publishes multi-platform racing video games in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026