- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:MOMO

Hello Group (MOMO) Valuation Review After Weaker 2025 Results and Cautious Q4 Revenue Guidance

Reviewed by Simply Wall St

Hello Group (MOMO) just posted softer third quarter numbers, with both revenue and net income slipping versus last year, and followed up with fourth quarter guidance that points to another year over year revenue decline.

See our latest analysis for Hello Group.

The muted third quarter and cautious guidance help explain why Hello Group’s share price return is down over the past month and year to date, while the one year total shareholder return is also negative, signalling momentum is still fading rather than turning.

If Hello Group’s recent wobble has you rethinking where growth might come from next, this could be a good moment to explore fast growing stocks with high insider ownership.

With shares trading at a sizable discount to analyst targets despite sliding earnings and cautious guidance, the key debate now is simple: is Hello Group a mispriced value play, or is the market correctly discounting its future growth?

Most Popular Narrative: 32.3% Undervalued

With Hello Group last closing at $6.56 and the most followed narrative pointing to a higher fair value, the gap between sentiment and price stands out.

The adoption of new product innovations and AI-assisted tools within the Momo app is designed to improve user experience, particularly for female users, and increase interaction rates. These refinements are expected to stabilize or enhance the app's revenue and operational efficiency, thereby supporting earnings growth.

Curious how modest top line expectations can still justify a richer earnings multiple ahead, even as margins edge lower and buybacks shrink the share count? Dive in to see which moving parts really power this valuation call.

Result: Fair Value of $9.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained revenue declines at Momo and Tantan, combined with higher overseas payout ratios, could quickly undermine the margin and earnings assumptions behind this valuation.

Find out about the key risks to this Hello Group narrative.

Another View: Market Ratio Signals

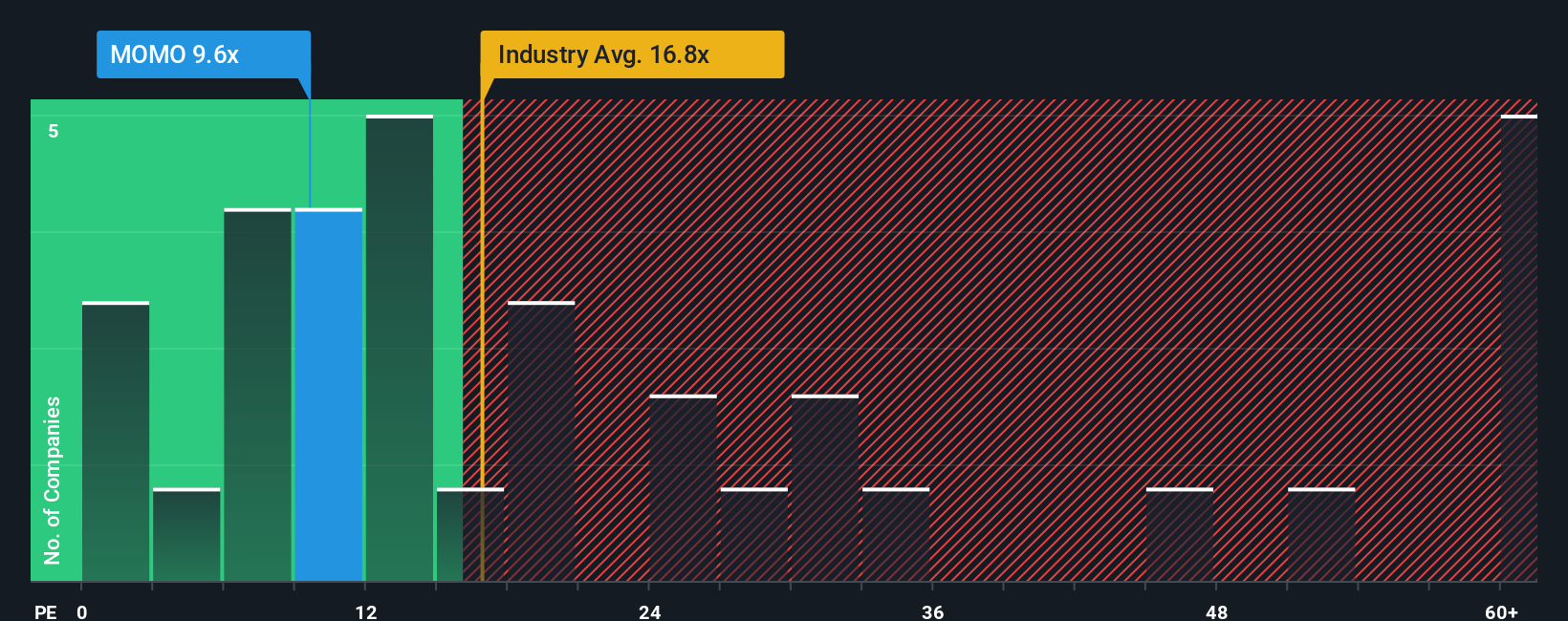

On simple earnings metrics, Hello Group looks cheap. It trades on 9.6x earnings versus 16.8x for the US Interactive Media and Services industry and 23.2x for peers, while our fair ratio sits at 15.9x. Is this a bargain or a warning about future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hello Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hello Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes with Do it your way.

A great starting point for your Hello Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by scanning focused stock ideas built from real fundamentals, not noise, using the Simply Wall Street Screener.

- Uncover potential mispricings by filtering for companies trading below their estimated cash flow value through these 907 undervalued stocks based on cash flows.

- Tap into the next wave of innovation by zeroing in on high potential names across these 24 AI penny stocks.

- Reinforce your portfolio’s income stream by targeting companies with reliable payouts using these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hello Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MOMO

Hello Group

Provides mobile-based social and entertainment services in the People’s Republic of China and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion