- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:MOMO

Hello Group Inc.'s (NASDAQ:MOMO) Business And Shares Still Trailing The Industry

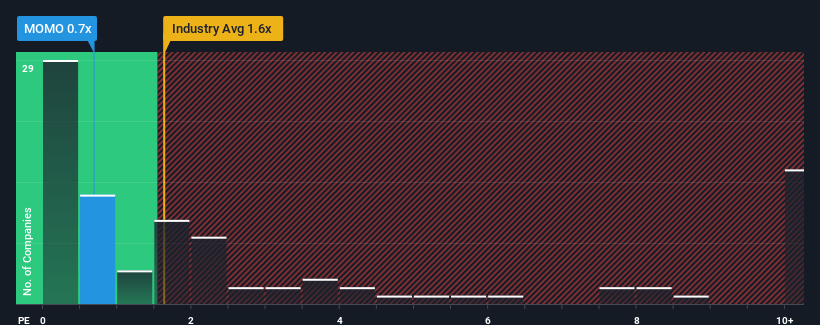

Hello Group Inc.'s (NASDAQ:MOMO) price-to-sales (or "P/S") ratio of 0.7x might make it look like a buy right now compared to the Interactive Media and Services industry in the United States, where around half of the companies have P/S ratios above 1.6x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Hello Group

How Hello Group Has Been Performing

While the industry has experienced revenue growth lately, Hello Group's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Hello Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Hello Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.2%. As a result, revenue from three years ago have also fallen 23% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue growth is heading into negative territory, declining 2.5% over the next year. With the industry predicted to deliver 14% growth, that's a disappointing outcome.

With this in consideration, we find it intriguing that Hello Group's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Hello Group's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that Hello Group maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Hello Group, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Hello Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hello Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MOMO

Hello Group

Provides mobile-based social and entertainment services in the People’s Republic of China and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives