- United States

- /

- Media

- /

- NasdaqGS:MGNI

Magnite (NASDAQ:MGNI) shareholder returns have been decent, earning 89% in 5 years

While Magnite, Inc. (NASDAQ:MGNI) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 30% in the last quarter. But at least the stock is up over the last five years. In that time, it is up 89%, which isn't bad, but is below the market return of 105%.

Since it's been a strong week for Magnite shareholders, let's have a look at trend of the longer term fundamentals.

Our free stock report includes 2 warning signs investors should be aware of before investing in Magnite. Read for free now.While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

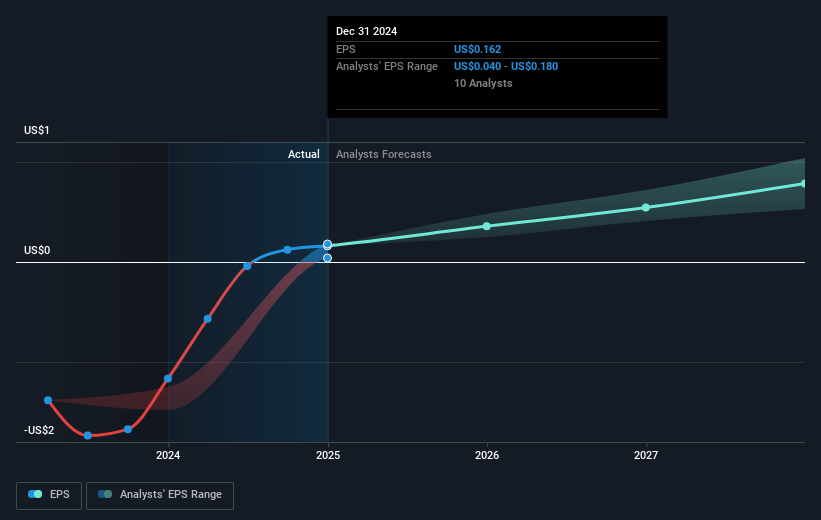

During the last half decade, Magnite became profitable. That would generally be considered a positive, so we'd hope to see the share price to rise. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the Magnite share price is up 22% in the last three years. Meanwhile, EPS is up 579% per year. This EPS growth is higher than the 7% average annual increase in the share price over the same three years. So you might conclude the market is a little more cautious about the stock, these days. Of course, with a P/E ratio of 76.32, the market remains optimistic.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Magnite has grown profits over the years, but the future is more important for shareholders. This free interactive report on Magnite's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Magnite shareholders have received a total shareholder return of 39% over one year. That gain is better than the annual TSR over five years, which is 14%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Magnite is showing 2 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MGNI

Magnite

Operates an independent omni-channel sell-side advertising platform in the United States and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives