- United States

- /

- Media

- /

- NasdaqGS:MGNI

Is Magnite’s Recent 23% Drop a Long-Term Opportunity for 2025 Investors?

Reviewed by Bailey Pemberton

If you’ve been eyeing Magnite as a potential candidate for your portfolio, you’re not alone. With all the buzz about ad tech and the shifting digital advertising landscape, a lot of investors are sizing up this stock, wondering whether recent bumps in the price are signals to dive in, hold tight, or get out. Magnite has had a wild ride lately, down 12.3% in the last week and off by 23.1% for the month. But step back and take in the bigger picture. Year-to-date, the stock is still up 18.6%, and over the past year it's soared 56.3%. If you zoom out even further, the five year gain stands at 109.8%, and the three year return is a staggering 194.3%.

Some of these moves track closely with broader trends in advertising technology, as investors recalibrate what the “new normal” looks like for programmatic ad spending and connected TV growth. While market sentiment can swing quickly, it’s also fair to wonder whether Magnite’s valuation has kept pace with its long-term potential or if some of those recent dips have actually improved its risk-reward profile.

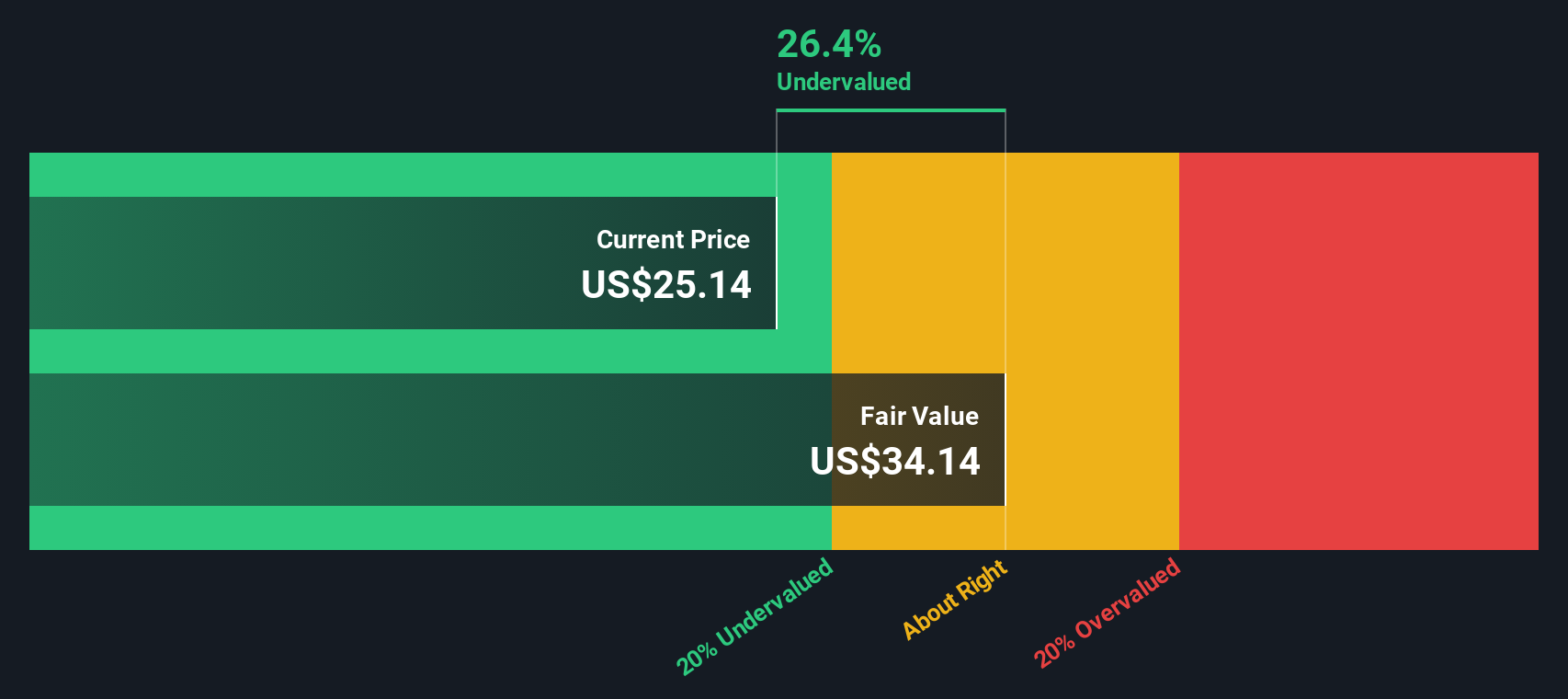

This is exactly where a solid valuation check becomes essential. Magnite currently scores a 3 out of 6 on our value scorecard, which suggests it’s undervalued on half of the key measures we track. But not all valuation methods are created equal. In the next section, we’ll walk through each approach in detail, and by the end, you’ll have an even sharper view of what Magnite is truly worth.

Approach 1: Magnite Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model attempts to estimate a company’s intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach is especially useful for companies like Magnite, where long-term free cash flow is a major driver of value.

Starting with the company’s most recent Free Cash Flow of $175.5 Million, the model uses a 2 Stage Free Cash Flow to Equity approach. Analyst projections expect Free Cash Flow to reach $387 Million by 2027. Beyond that, Simply Wall St extrapolates future cash flows, with projections showing continued growth, such as $985.6 Million by 2035. All figures are in US dollars. These projections are then discounted back to present value using an appropriate discount rate, reflecting both the time value of money and the uncertainties inherent in forecasting so far ahead.

Based on this methodology, Magnite’s estimated intrinsic value stands at $120.06 per share. This is dramatically higher than current trading levels. According to the DCF model, the stock is estimated to be 84.1% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Magnite is undervalued by 84.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

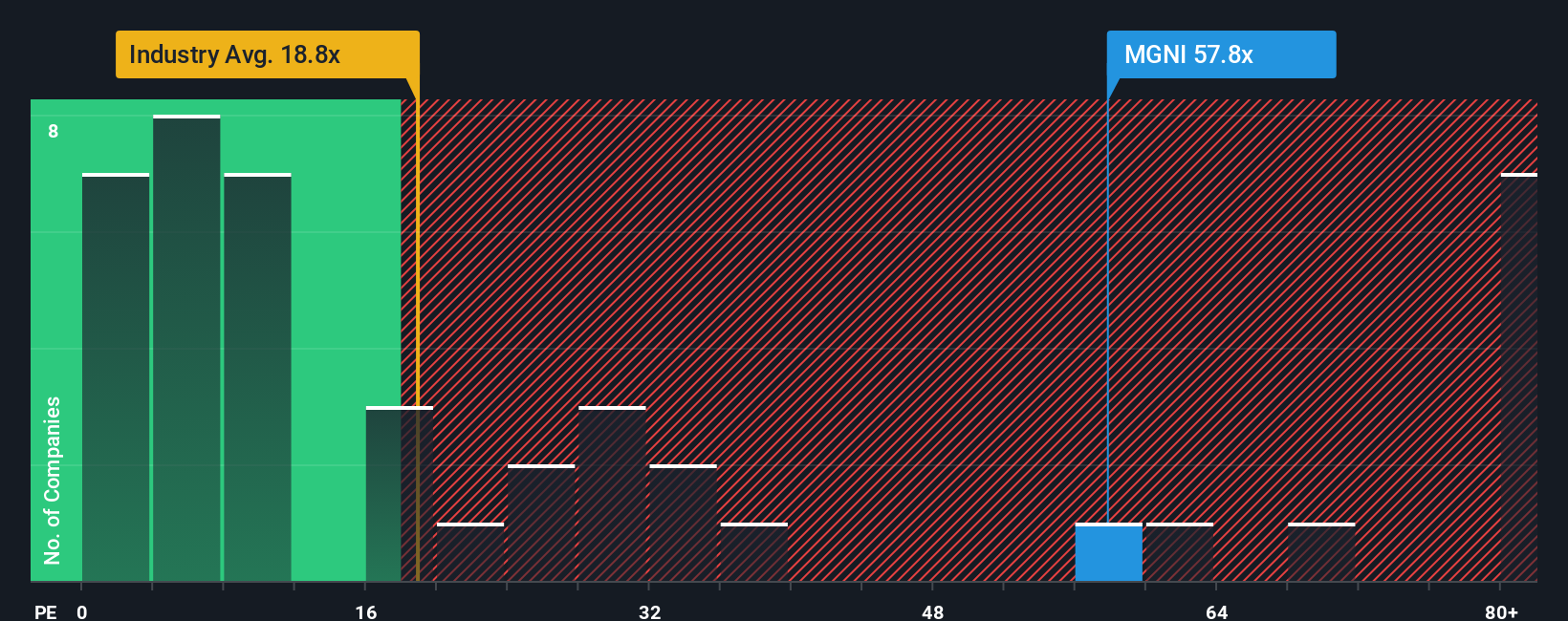

Approach 2: Magnite Price vs Earnings

For profitable companies like Magnite, the Price-to-Earnings (PE) ratio is a widely accepted way to compare value, since it puts the company’s share price in the context of its actual bottom line. The higher a company’s expected growth and profitability, or the lower its perceived risk, the higher its PE ratio tends to be. Growth and quality command a premium.

Currently, Magnite trades at a PE of 63.1x. That is well above the Media industry average of 19.8x and also elevated compared to the average PE of its closest peers at 48.8x. A surface-level comparison might make the stock look expensive, but context matters a lot here.

Simply Wall St's proprietary "Fair Ratio" builds on the basics by factoring in Magnite’s unique growth outlook, profit margin, industry dynamics, company size, and risk profile. This makes it a more tailored and nuanced benchmark than just glancing at peer or industry multiples.

Magnite’s Fair Ratio is calculated at 36.2x. With the current PE at 63.1x, the stock is trading well above what the fundamentals suggest. This points to the shares being overvalued by this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

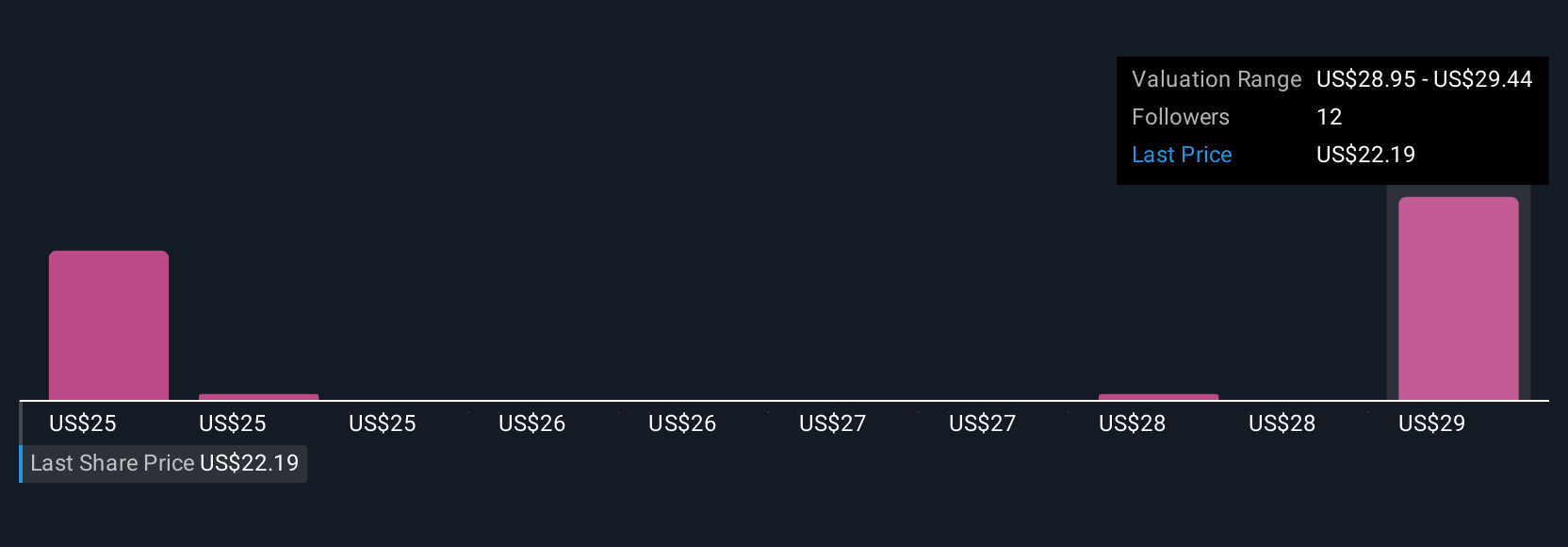

Upgrade Your Decision Making: Choose your Magnite Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own perspective on Magnite’s business and future. It is the story behind the numbers, where you bring together your assumptions about revenue growth, profit margins, and industry trends, then link that story directly to a financial forecast and a Fair Value for the stock.

Millions of investors on Simply Wall St use Narratives on the Community page to easily create and update their investment thesis, helping them decide when to buy or sell by comparing their Fair Value to the latest share price. Narratives are dynamic and update automatically when there’s new information, such as company news or earnings releases, so your view stays current.

For example, one Magnite Narrative might forecast robust CTV growth, margin expansion, and justify a Fair Value of $39.00. A more cautious view focuses on market risks and sets Fair Value at $24.00, illustrating how different investors can interpret the same company through their own lens.

Do you think there's more to the story for Magnite? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGNI

Magnite

Operates an independent omni-channel sell-side advertising platform in the United States and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives