- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Should You Reassess Meta After a 22% Rally and AI Investment Headlines?

Reviewed by Bailey Pemberton

If you’ve been eyeing Meta Platforms recently, you’re in good company. With a share price closing at $732.17 and a year-to-date gain of 22.2%, it’s only natural to wonder if now’s the right moment to jump in or lock in gains. Anyone watching Meta over the last few years has witnessed some impressive milestones, as the three-year return sits at a staggering 435.7%. Even in the short term, the story has been dynamic: a 3.3% bump in the last week, but also a pullback of nearly 6% over the past month.

So why all the swings? The stock’s trajectory isn’t just about quarterly numbers; it’s about how Wall Street sees Meta’s future opportunities and risks. Lately, headlines have buzzed around Meta’s investments in artificial intelligence, bold projects in virtual and augmented reality, and changes in the social media landscape. Each of these influences how investors size up Meta, not just as the owner of Facebook and Instagram but as a potential leader in the next generation of tech.

If you’re looking for a hard number on value, Meta scores 4 out of 6 on our under/overvaluation checks, suggesting much of the market still sees upside potential but is keeping a close eye on risks. How do we score that? Next, let’s break down the classic valuation approaches, and stick around because by the end, we’ll show you an even more insightful way to weigh Meta’s true worth.

Why Meta Platforms is lagging behind its peers

Approach 1: Meta Platforms Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) analysis estimates a company's intrinsic value by projecting its future cash flows and discounting them back to present-day value. For Meta Platforms, this involves forecasting how much cash the business is expected to generate over the coming years, then calculating what that future cash is worth today.

Meta's latest reported Free Cash Flow sits at approximately $57.6 Billion. Analyst estimates are available up to 2029, predicting that annual Free Cash Flow could grow to about $108.6 Billion by the end of that year. Beyond these analyst projections, Simply Wall St extrapolates further cash flow growth to build out a full 10-year cash flow picture. This model accounts for contributions from Meta's established advertising businesses as well as investments in new technologies, such as artificial intelligence and virtual reality.

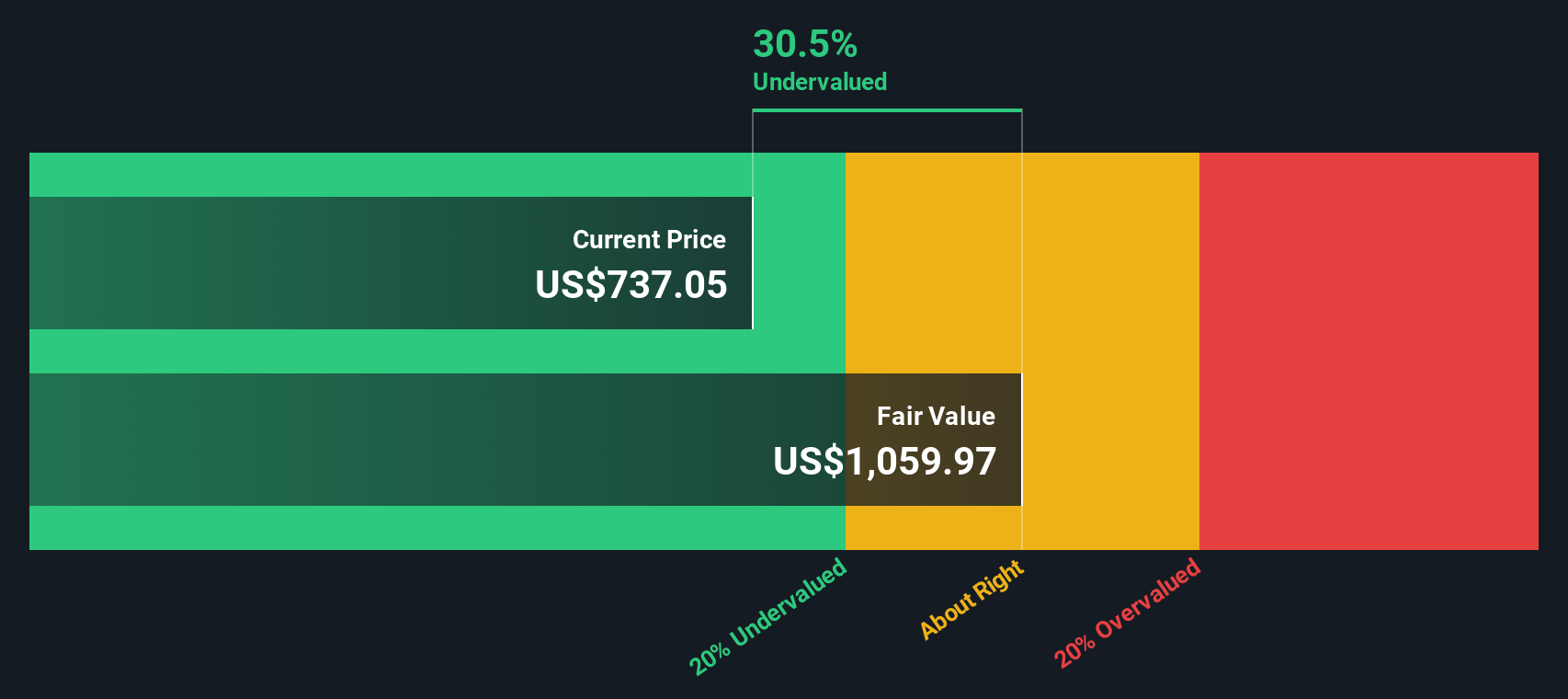

Based on these projections and using the 2 Stage Free Cash Flow to Equity method, Meta's estimated intrinsic value is $975.18 per share. With shares currently trading at $732.17, this analysis suggests that Meta is trading at an attractive discount of 24.9 percent to its underlying value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Meta Platforms is undervalued by 24.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Meta Platforms Price vs Earnings

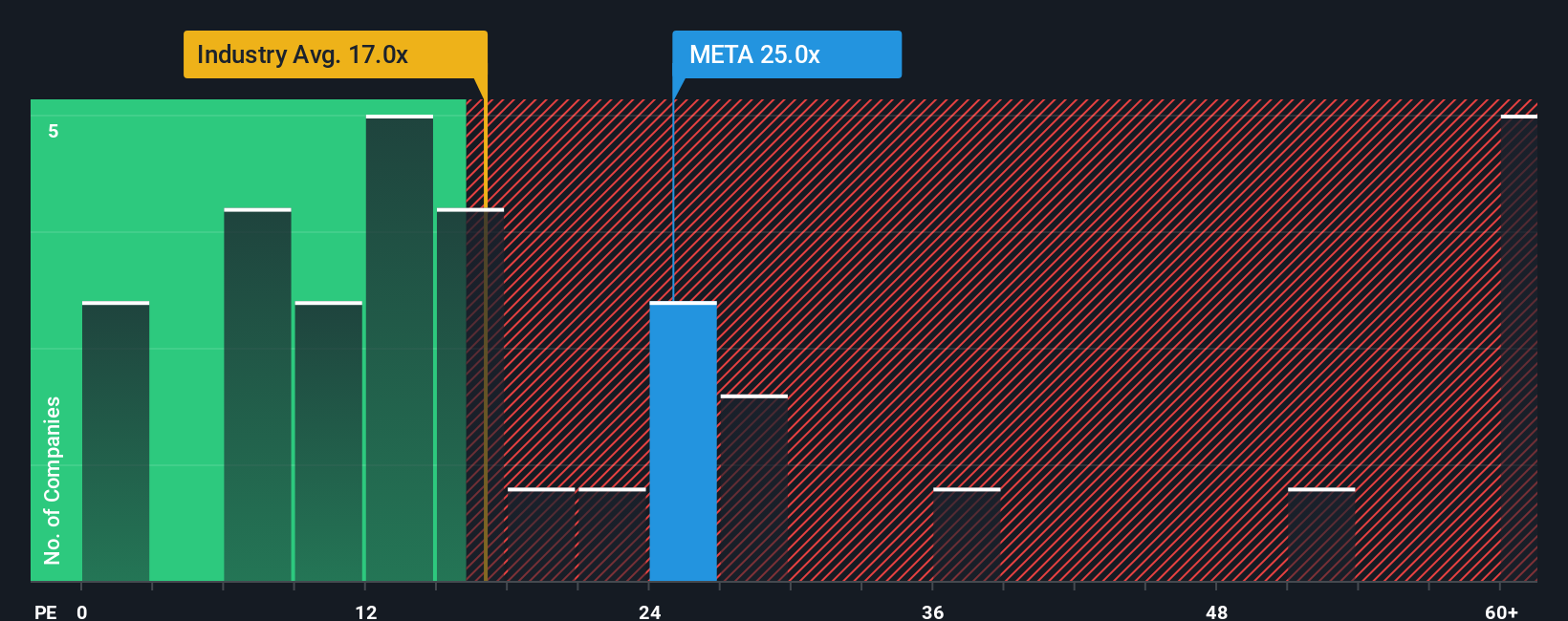

For well-established and profitable companies like Meta Platforms, the price-to-earnings (PE) ratio is a go-to valuation multiple. This metric lets investors quickly compare how much they are paying for one dollar of the company’s earnings, which is particularly relevant for a tech giant generating consistent profits. The PE ratio is especially useful because it reflects the market’s outlook on a company’s future performance and the risks it faces.

In general, higher growth expectations and lower perceived risks lead to a higher “normal” or fair PE ratio, since investors are willing to pay more for promising future earnings. Conversely, companies with slower growth or higher risks should trade at lower PE ratios.

Meta currently trades at a PE ratio of 25.7x, which is noticeably higher than the Interactive Media and Services industry average of 15.6x, but below the average of its direct peers at 38.8x. To provide a more nuanced perspective, Simply Wall St calculates a “Fair Ratio” based on Meta’s own growth, profit margins, market cap, and the risks it faces. For Meta, the Fair Ratio is 39.3x.

Unlike basic peer or industry comparisons, the Fair Ratio offers a more complete assessment, specifically tuning expectations to Meta’s growth profile, scale, and profitability. Because it captures more company-specific and market context, it is a more reliable way to judge if the current price makes sense.

With Meta’s actual PE ratio of 25.7x sitting well below its Fair Ratio of 39.3x, this valuation approach signals the stock is undervalued by market standards.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

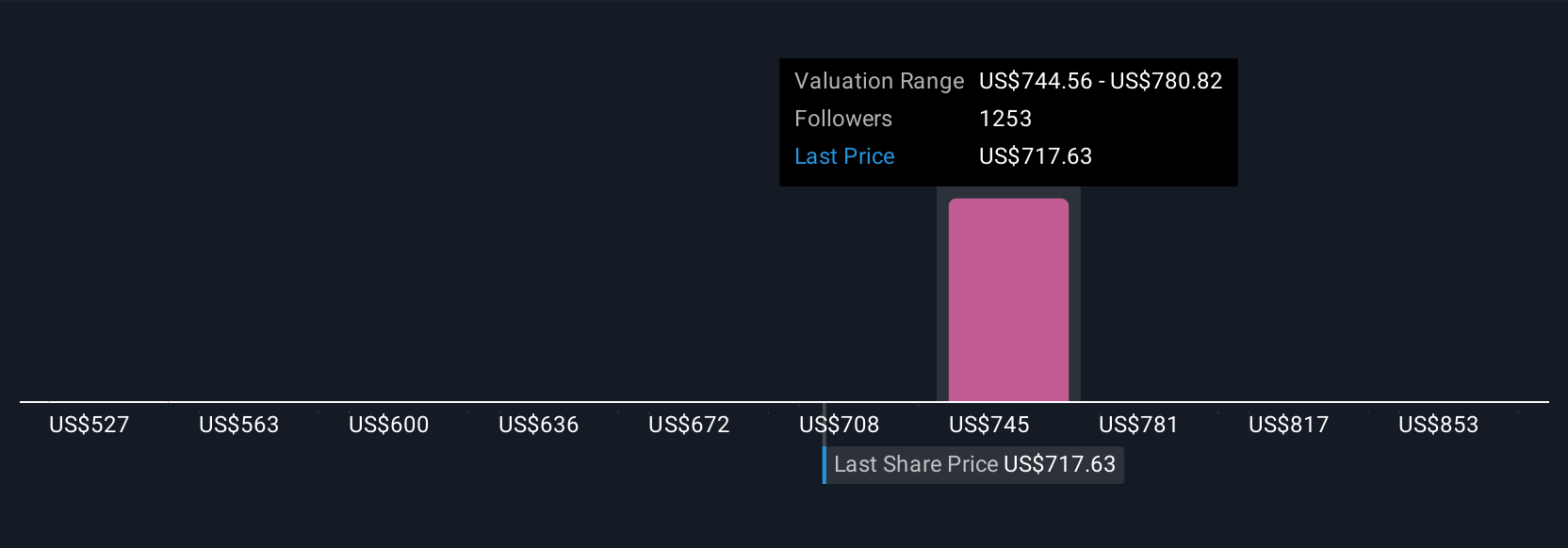

Upgrade Your Decision Making: Choose your Meta Platforms Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. In short, a Narrative is your story about a company; it is how you tie together your assumptions about Meta’s future revenue, profit margins, and risks to build your own forecast and fair value.

Rather than just analyzing numbers in isolation, Narratives connect a company’s unique story or thesis directly to a dynamic financial estimate and an actionable fair value. On Simply Wall St’s platform, you can access Narratives right from the Community page. Millions of investors already use these interactive tools to visualize their own expectations for companies like Meta.

Narratives make it easy to compare your fair value to the market price and decide if you think it’s time to buy, hold, or sell. They are kept up to date automatically as new information, such as earnings releases or major news, comes in so your view always reflects current reality.

For example, in Meta’s case, one investor might project rapid growth from AI and hardware and arrive at a fair value near $1,086 per share; another focusing on heavier risks and costs could estimate a much lower fair value around $658. This illustrates how Narratives let you transparently see and evaluate different investment viewpoints.

For Meta Platforms, however, we'll make it really easy for you with previews of two leading Meta Platforms Narratives:

Fair value: $863.20

Meta is estimated to be undervalued by 15.2% compared to its current price.

Analyst consensus revenue growth: 15.6%

- AI-powered ad personalization is supporting stronger user engagement and new revenue streams, helping drive robust long-term growth across Meta's ecosystem.

- Platform strength and ecosystem effects position Meta to benefit from growing digital ad budgets and expanded monetization in messaging and commerce as global internet connectivity rises.

- Main risks stem from heavy investment in AI and metaverse initiatives, regulatory pressures, and uncertain timelines for new product monetization, potentially impacting margins and free cash flow.

Fair value: $538.09

Meta is estimated to be overvalued by 36.1% compared to its current price.

Revenue growth expectation: 10.5%

- Meta should maintain dominance in social media and advertising through AI and hardware innovation, but Reality Labs may only become profitable by 2026 as diversification continues.

- Strong AI-driven ad growth and efficiency initiatives could boost revenues and profit margins. Ongoing investments and cost-cutting are expected to lift profitability over time.

- Main risks are regulatory hurdles, dependence on advertising, high AR/VR execution risk, and exposure to cybersecurity threats and uncertain macroeconomic conditions affecting ad revenues.

Do you think there's more to the story for Meta Platforms? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion