- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta Platforms (NasdaqGS:META) Reports Strong Q1 2025 Earnings and Completes Share Buyback

Reviewed by Simply Wall St

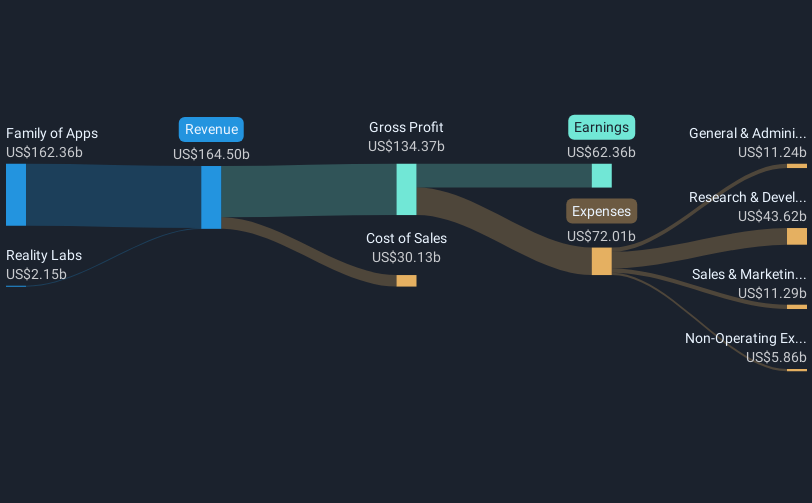

Meta Platforms (NasdaqGS:META) recently reported strong Q1 2025 earnings, with sales and net income rising significantly year-over-year, reflecting robust financial health. This announcement coincided with broader market gains, where major indexes experienced a consistent rise, driven by favorable earnings reports from key tech players. Meta's 2.97% price increase over the past week aligns with this market trend. The company's expansion in AI offerings and reaffirmed capital expenditures, including share buybacks, reinforced investor confidence. Alongside partnerships to enhance AI capabilities, these factors likely contributed positively, adding momentum to the overall market's upward trajectory.

We've identified 1 possible red flag for Meta Platforms that you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent 2.97% increase in Meta Platforms' share price comes in the wake of strong earning results, reflective of the company's strategic moves in AI expansion and robust capital expenditures. These developments may impact Meta's long-term growth narrative, with advanced AI initiatives potentially driving new applications for personalization, boosting user engagement, and enhancing advertising revenue. Analysts project revenue to grow annually at various rates depending on whom you ask, while expected earnings growth appears promising yet mixed due to factors like regulatory challenges and competition. The reaffirmed commitment to share buybacks suggests a potential decline in shares outstanding, which could influence earnings dynamics and shareholder value over time.

Over the past three years, Meta has delivered a total return of approximately 164.83%, a very large increase that underscores its strong performance relative to both its peers and broader market indices. In the past year, Meta's return also exceeded the Interactive Media and Services industry, which experienced a much lower return. However, relative to a consensus analyst price target of US$722.91, the company's current share price of US$500.28 trades at a substantial discount, suggesting potential upside if growth targets are met. This price gap aligns with analysts' bullish outlook, but as always, investors should consider potential risks like high competition and uncertain adoption of new technologies when evaluating future performance.

Dive into the specifics of Meta Platforms here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives