- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta Platforms (NasdaqGS:META) Partners With Groq and Cerebras to Enhance AI Capabilities

Reviewed by Simply Wall St

Meta Platforms (NasdaqGS:META) experienced a price increase of 11% last week, coinciding with significant developments in its AI ecosystem. The announcement of partnerships with Groq and Cerebras to enhance the Llama API’s inference capabilities likely bolstered investor confidence in the company's growth prospects. Moreover, the launch of a stand-alone AI app competing with OpenAI's ChatGPT and others signals the company's aggressive expansion into AI, potentially driving up its share price. These positive events occurred amidst a broader market increase, partially countering declines in other major tech companies affected by weak GDP data and earnings shortfalls.

Every company has risks, and we've spotted 1 weakness for Meta Platforms you should know about.

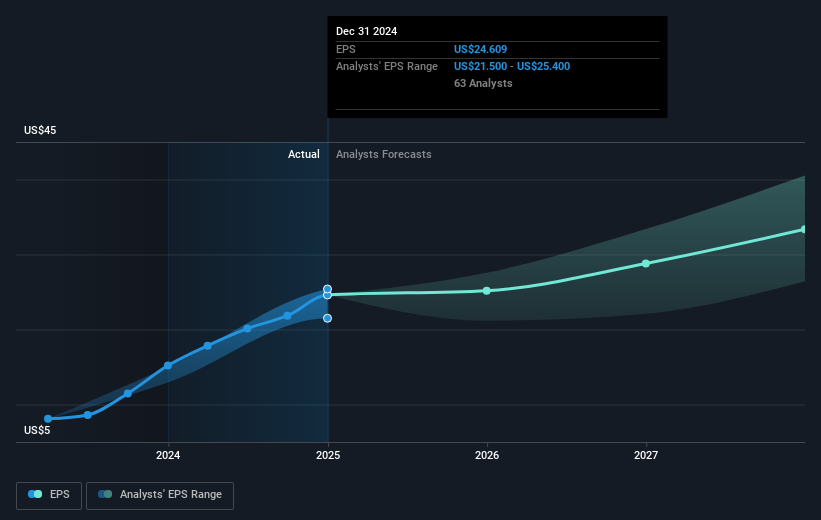

The recent advancements in Meta Platforms' AI ecosystem, highlighted by partnerships with Groq and Cerebras, could significantly influence its future revenue and earnings forecasts. By enhancing the Llama API's inference capabilities and launching an AI app to compete with ChatGPT, Meta is positioning itself to improve user engagement and potentially boost advertising revenue. These developments align with the company's ongoing efforts to expand its Family of Apps, aiming for long-term revenue growth through improved ad monetization and innovative AI-driven products. The strategic focus on AI might place short-term financial pressure due to heavy investments, but it sets a foundation for potential revenue enhancement over the next few years.

Over the past five years, Meta's total shareholder return reached a substantial 169.02%, reflecting strong long-term performance. This figure contrasts with the past year's outperformance relative to the US Market, where Meta's stock exceeded a 9.9% market return. In comparison, the company's earnings have grown by 59.5% over the past year, surpassing the 13.9% increase in the Interactive Media and Services industry.

The recent 11% share price increase narrows the gap to the consensus analyst price target, which stands 30.8% above the current share price of $500.28. While the company's stock is moving closer to this target, it remains important to consider analyst discrepancies and the broader market conditions that could impact future valuation. Navigating regulatory challenges and competition will play a critical role in realizing these revenue and earnings expectations. Overall, sustained innovation and AI investments are poised to shape Meta's growth narrative moving forward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives