- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta (META): Assessing Valuation as New AI Partnerships and Wearables Signal a Shift Beyond Social Media

Reviewed by Simply Wall St

Meta Platforms (META) has been busy making headlines, and that’s putting its stock in the spotlight for investors trying to decide their next move. In just the past few weeks, the company announced a tech licensing agreement with Midjourney to boost its generative AI, inked a multi-year partnership with Google Cloud, and revealed plans to release new smart glasses soon. This burst of activity signals something bigger. Meta is proactively looking beyond its social media roots, laying the groundwork for new streams of growth in artificial intelligence and hardware.

For all the attention these announcements received, Meta’s stock has moved up nearly 6% in the past month and about 18% in the past three months, extending a strong run that has driven a 45% gain over the last year. Gains remain solid, yet the swings have not been without drama, especially with rising short interest as the company’s spending climbs. Still, positive business momentum is clear, with annual revenue and net income growth both in the double digits and new long-term investments drawing the market’s eye.

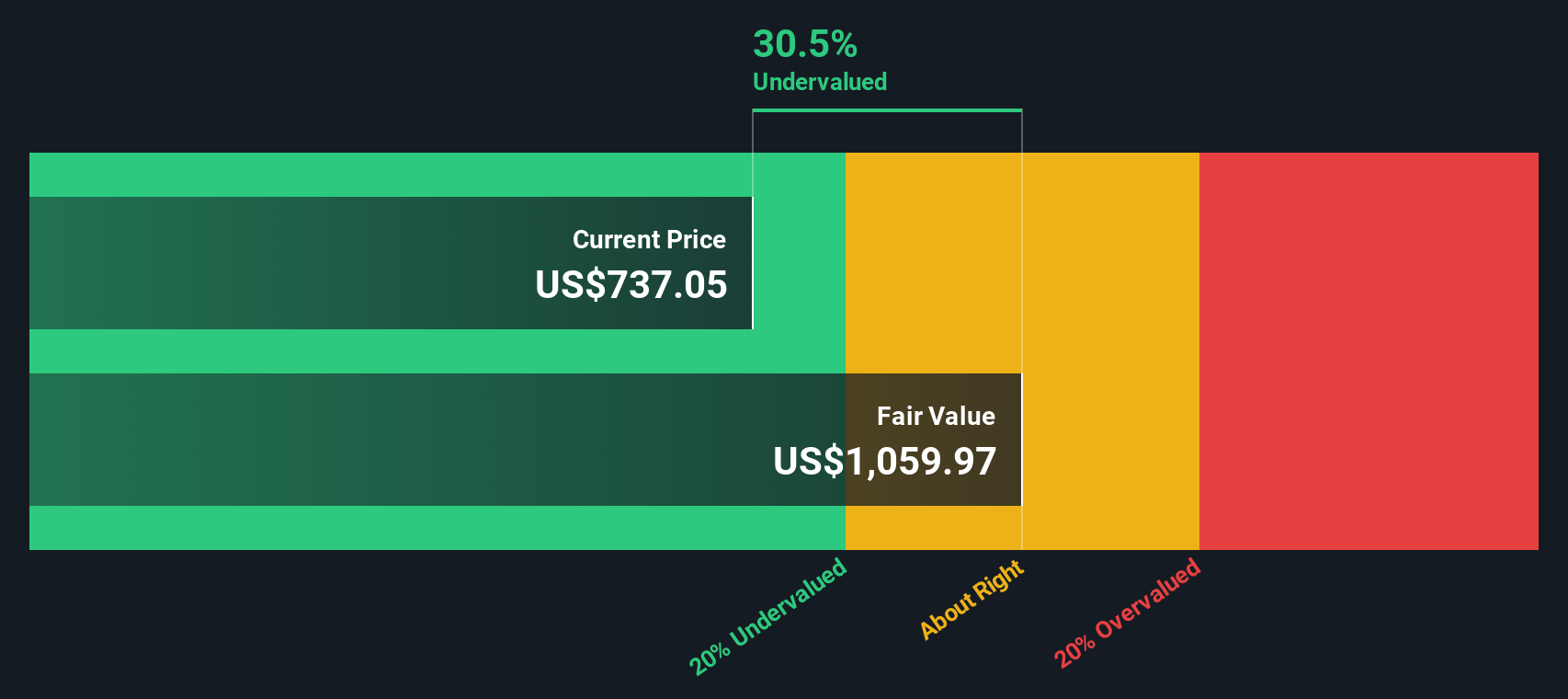

Now the question looms. Is Meta undervalued with all these investments, or is the market already pricing in every bit of future growth?

Most Popular Narrative: 40% Overvalued

According to the narrative by StjepanK, Meta Platforms may be trading above its fair value based on current and projected fundamentals and key assumptions about its future growth, investments, and cost controls.

Meta has already shed about 21,000 employees, incurring short-term severance costs but saving billions in the long run. Along with promoting from within and reducing employee acquisition costs, this “Year of Efficiency” aims to make the organization flatter.

Zuckerberg plans to remove multiple layers of management, stating that a leaner organization will be more enjoyable, fulfilling, and will better attract top talent. In addition, the company plans to use AI to accelerate engineering processes by as much as 50 percent, decreasing engineers’ idle time and increasing output.

What really drives this 40 percent overvaluation claim? The answer lies in ambitious financial projections for growth and profitability, with bold assumptions about how quickly Meta's bottom line can scale as substantial investments begin to yield results. Which operating shift is expected to make the biggest impact, and are the revenue forecasts as aggressive as they appear? Explore the full narrative to uncover the core numbers and the underlying tension in this valuation.

Result: Fair Value of $538.09 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, regulatory pressure or slower than expected consumer adoption of AR and metaverse products could quickly challenge even the most optimistic forecasts for Meta. Find out about the key risks to this Meta Platforms narrative.Another View: The SWS DCF Model Perspective

Looking at Meta through our DCF model, the story shifts. This approach suggests the stock might actually be undervalued compared to the first valuation. Could this method be revealing potential that others miss?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Meta Platforms for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Meta Platforms Narrative

If you want to dig deeper or see things differently, you can use our data tools to craft your own view of Meta’s future in a matter of minutes. Just do it your way.

A great starting point for your Meta Platforms research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not limit themselves to a single opportunity. Expand your horizons now and get ahead of the curve with these hand-picked stock lists curated for exciting growth, resilience, and market momentum. Do not let the next big trend pass you by. Your next great pick could be just a click away.

- Supercharge your income by checking out companies offering dividend stocks with yields > 3%. Tap into businesses with reliable dividend payouts and yields above 3% to power your portfolio’s cash flow.

- Ride the AI wave and uncover potential leaders in healthcare transformation by scanning through innovative firms behind healthcare AI stocks, where artificial intelligence and medical breakthroughs meet.

- Get ahead of emerging technologies and track firms at the forefront of the future by searching for standout quantum computing stocks. These companies are pushing boundaries in computing power and capability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives