- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Is Meta Still Attractive After AI Spending Push and 471% Three Year Share Surge?

Reviewed by Bailey Pemberton

- Wondering if Meta Platforms is still a smart buy after its huge run, or if the real upside has already been priced in? This breakdown is designed to help you figure out what the stock is actually worth.

- The share price has climbed to around $647.10, with returns of 2.1% over the last week, 1.5% over the past month, 8.0% year to date, 5.8% over 1 year, 134.3% over 5 years, and 471.5% over 3 years. This performance signals a powerful long-term uptrend that investors may want to pay attention to.

- Recent headlines have focused on Meta doubling down on AI infrastructure and expanding its advertising and Reels monetization. This reinforces the narrative that it is not just a social media company but a broader tech and data platform. At the same time, ongoing scrutiny around regulation, privacy, and the metaverse strategy continues to shape how investors think about the risk side of the story.

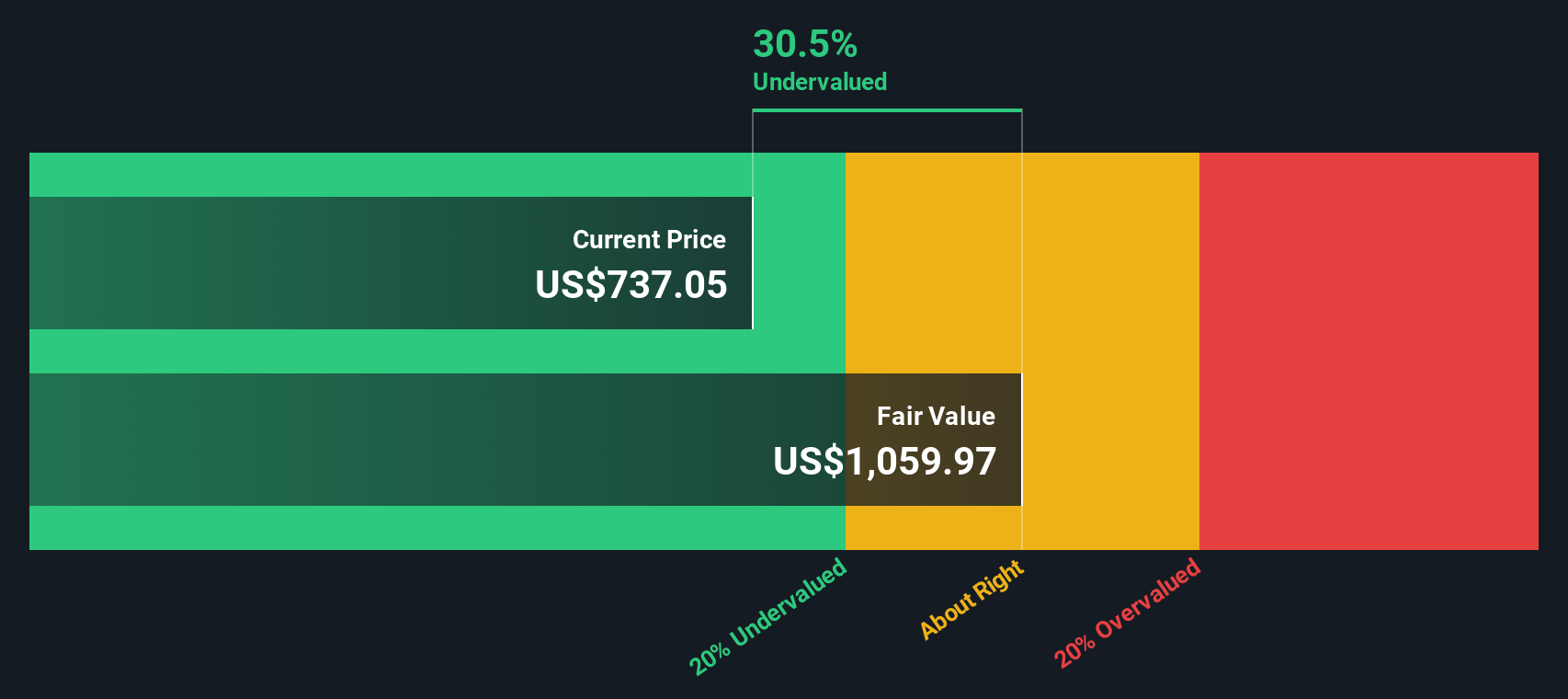

- Right now, Meta scores a solid 5/6 valuation check, which suggests it looks undervalued on most traditional metrics. In the next sections we will walk through those valuation methods, then finish by exploring an additional way to think about what Meta is really worth.

Find out why Meta Platforms's 5.8% return over the last year is lagging behind its peers.

Approach 1: Meta Platforms Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today in $ terms. For Meta Platforms, the latest twelve month free cash flow is around $58.8 billion, already a very strong base.

Analysts and extrapolated estimates suggest this free cash flow could rise to about $90.1 billion by 2029, and continue climbing to roughly $162.0 billion by 2035. These projections are captured in a 2 Stage Free Cash Flow to Equity model, where earlier years lean more on analyst forecasts and later years on algorithmic growth assumptions from Simply Wall St.

When those future cash flows are discounted back to today, the model arrives at an intrinsic value of about $836.87 per share. Compared with the current share price of roughly $647.10, the DCF implies the stock is about 22.7% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Meta Platforms is undervalued by 22.7%. Track this in your watchlist or portfolio, or discover 933 more undervalued stocks based on cash flows.

Approach 2: Meta Platforms Price vs Earnings

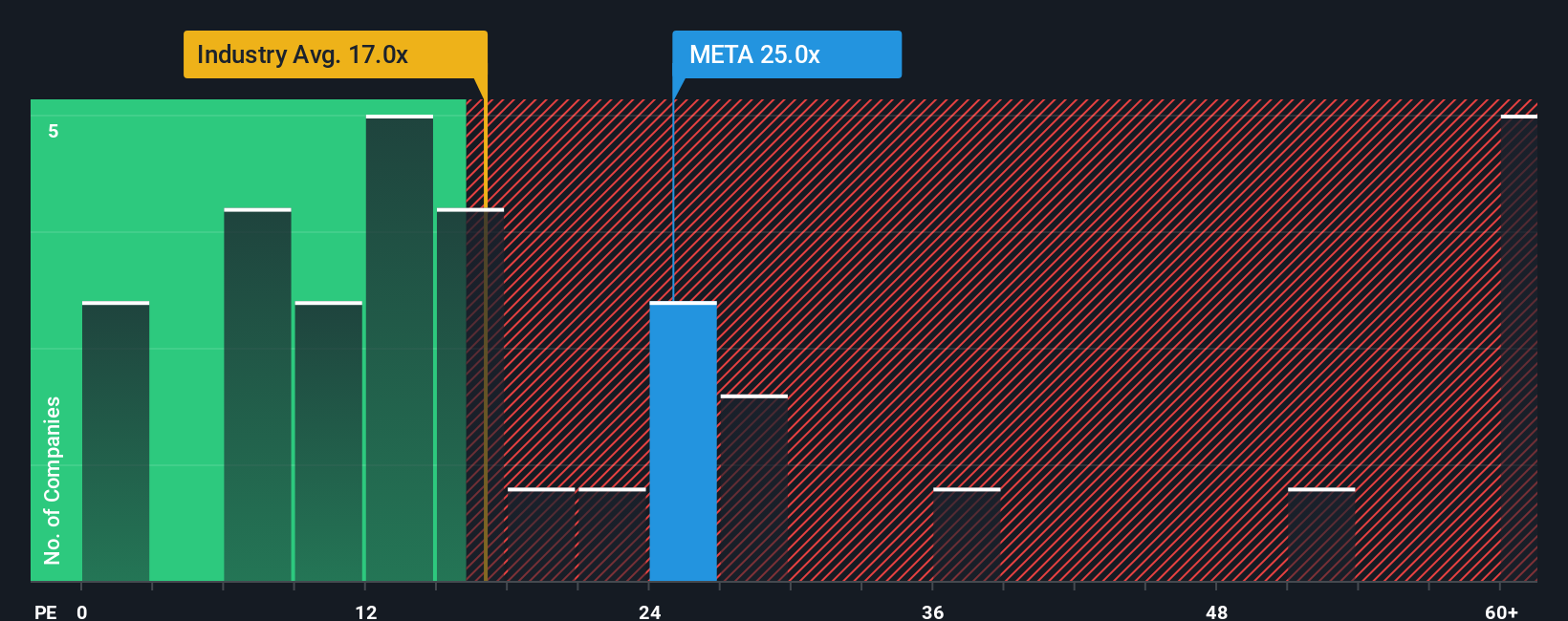

For profitable businesses like Meta, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay for each dollar of current profits. A higher PE usually reflects stronger growth expectations or lower perceived risk, while a lower PE can signal slower growth, higher uncertainty, or a potential bargain.

Meta currently trades on a PE of about 27.9x. That is well above the Interactive Media and Services industry average of roughly 16.4x, but sits at a discount to the broader peer group, which is around 36.9x. To move beyond simple comparisons, Simply Wall St uses a proprietary Fair Ratio framework, which estimates the PE you might reasonably expect for a company based on its earnings growth outlook, profitability, size, industry, and risk profile.

On this basis, Meta’s Fair Ratio is calculated at approximately 37.1x, which is higher than its current 27.9x multiple. That indicates the market may not be fully reflecting the company’s characteristics in its present valuation.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

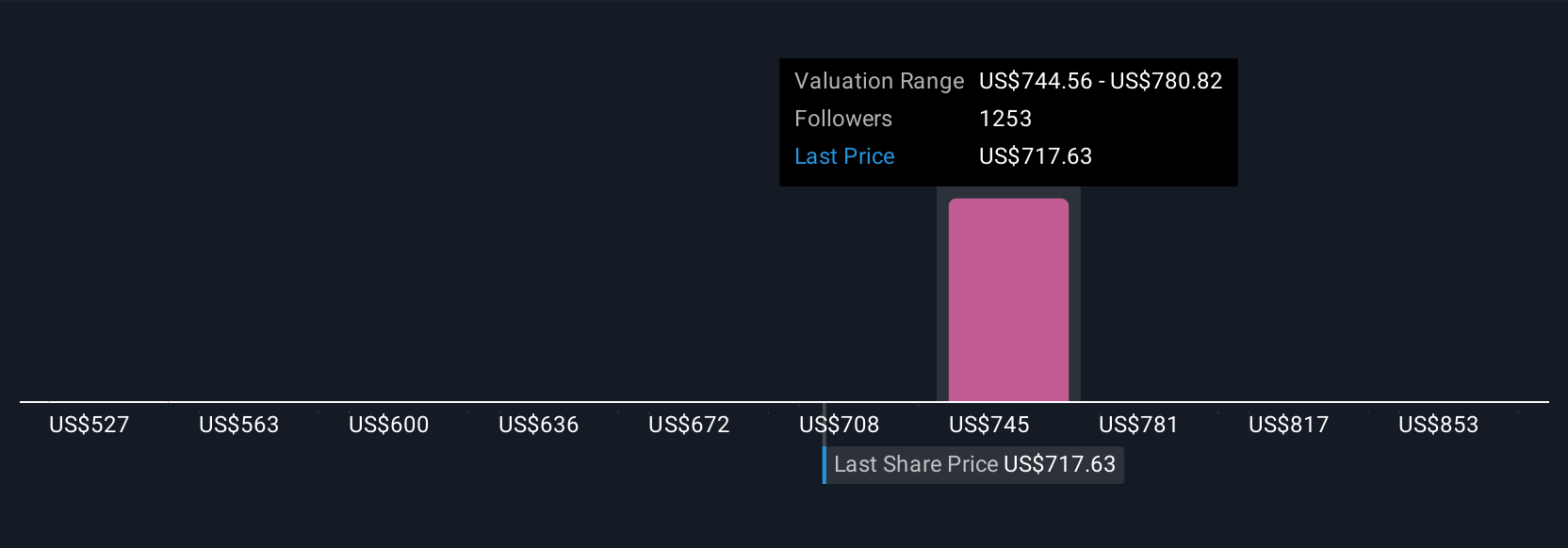

Upgrade Your Decision Making: Choose your Meta Platforms Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you attach a story to the numbers by laying out your view of a company’s future revenue, earnings and margins. This turns that storyline into a financial forecast and then into a Fair Value you can compare with today’s share price to decide whether to buy, hold or sell. The narrative automatically updates as new news or earnings arrive. For Meta, one investor might build a bullish narrative around fast AI driven advertising growth, rising ARPU and successful AR or VR monetization that supports a Fair Value above $1,000 per share. Another investor might build a cautious narrative that assumes metaverse losses persist, AI capex keeps margins under pressure and regulatory risks weigh on growth, leading to a Fair Value closer to $540. This shows how different perspectives on the same company translate into different, but clearly reasoned, valuation outcomes.

For Meta Platforms however we will make it really easy for you with previews of two leading Meta Platforms Narratives:

Fair Value: $841.42

Implied Undervaluation vs Current Price: 23.1%

Forecast Revenue Growth: 16.45%

- Views heavy AI infrastructure spending and personalization as potential catalysts for revenue growth and stronger engagement across ads, video and messaging.

- Expects monetization of WhatsApp, Messenger and business messaging to add more diversified, higher margin revenue streams on top of the core ad business.

- Sees regulatory, metaverse and capex risks as manageable trade offs for potential long term upside, with analyst targets and narrative fair value both above today’s price.

Fair Value: $538.09

Implied Overvaluation vs Current Price: 20.3%

Forecast Revenue Growth: 10.5%

- Assumes Meta maintains social media leadership but argues that even solid AI, advertising and AR or VR growth may not justify today’s valuation.

- Highlights execution and demand risk in metaverse and hardware initiatives, where large capex and years of losses could dilute overall returns.

- Flags regulatory, macro and ad cycle uncertainty, along with continued dependence on advertising, as reasons the stock could trade closer to this lower fair value.

Do you think there's more to the story for Meta Platforms? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026