- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

How META's Role at IAB Summit Has Changed Its Investment Story

Reviewed by Simply Wall St

- Meta Platforms recently participated in the IAB Measurement Leadership Summit in New York, where Diana Lucas, Director of Marketing Science for North America, was a featured speaker.

- This appearance underscores Meta’s increasing influence in digital advertising standards and measurement, signaling its intent to shape industry best practices.

- We'll explore how Meta's visibility in digital advertising measurement could reinforce its long-term focus on AI-driven ad solutions and revenues.

Meta Platforms Investment Narrative Recap

To be a shareholder in Meta Platforms, you need to believe in the company’s ability to sustain leadership in digital advertising and successfully monetize its AI-driven solutions across a massive global user base. The recent IAB Measurement Leadership Summit appearance strengthens Meta’s industry relationships, but by itself, does not materially shift the near-term catalyst: delivery of accelerated AI-powered ad revenue growth. The greatest current risk remains Meta's heavy up-front investment in AI and infrastructure, which could pressure profitability if returns do not materialize quickly.

Among the latest announcements, Meta’s efforts to raise US$29 billion in private equity and debt for its artificial intelligence initiatives stand out. This massive fundraising plan, involving top global financiers, directly connects to the company's focus on AI-enabled advertising, reinforcing the catalyst of enhanced monetization potential and underlining the significant capital requirements and expectations around return on investment.

Yet, on the other hand, investors should also consider the growing financial strain from these escalating AI investments…

Read the full narrative on Meta Platforms (it's free!)

Meta Platforms' forecast projects $245.5 billion in revenue and $85.4 billion in earnings by 2028. This is based on a 13.0% annual revenue growth rate and a $18.8 billion increase in earnings from the current $66.6 billion.

Uncover how Meta Platforms' forecasts yield a $738.87 fair value, a 4% upside to its current price.

Exploring Other Perspectives

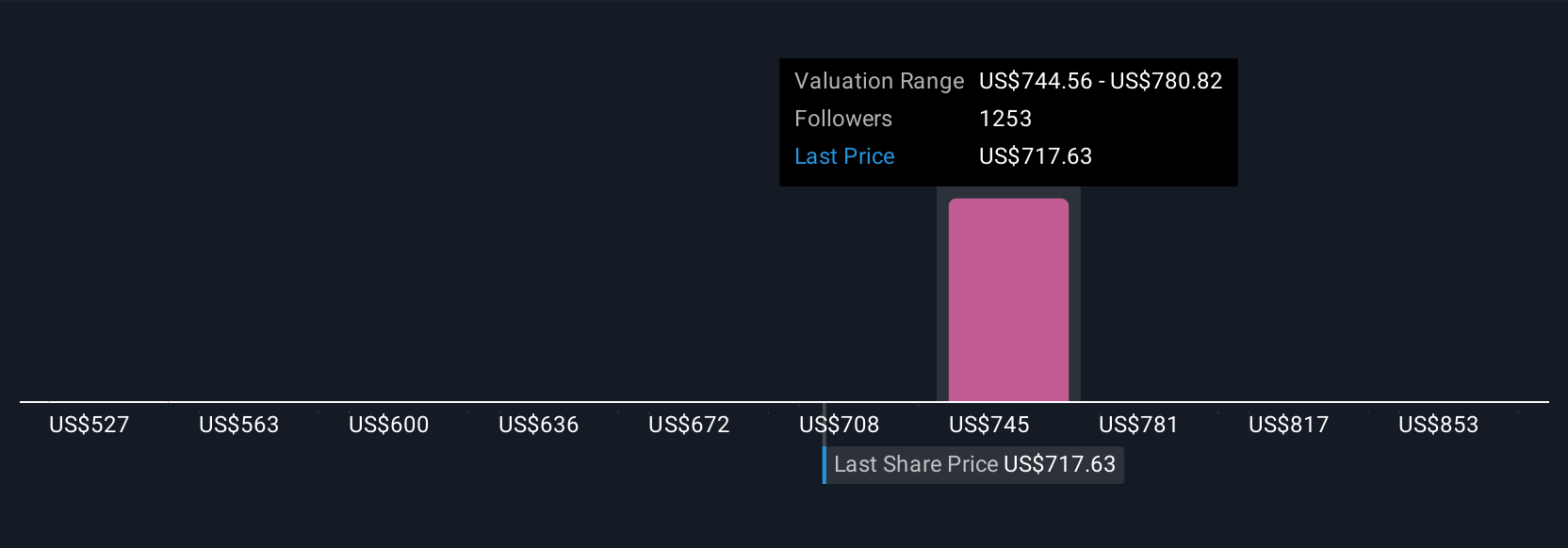

Seventy-two members of the Simply Wall St Community have offered fair value estimates for Meta Platforms ranging from US$527.02 to US$882.87 per share. Opinions on Meta’s value are widely varied, reflecting how sizable commitments to AI and infrastructure could influence future returns and profitability in many different ways.

Build Your Own Meta Platforms Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Meta Platforms research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Meta Platforms research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Meta Platforms' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives