- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

How Investors May Respond To Meta Platforms (META) Dividend Hike And Shift From Metaverse To AI

Reviewed by Sasha Jovanovic

- In recent days, Meta Platforms’ board declared a quarterly cash dividend of US$0.525 per share, payable on December 23, 2025 to shareholders of record on December 15, 2025, while also announcing substantial cuts to Reality Labs’ metaverse budget and heavier investment in artificial intelligence and AI wearables, including the acquisition of startup Limitless and the launch of its Segment Anything Model 3.

- These moves signal a shift away from long-running metaverse losses toward AI-driven products and infrastructure that aim to strengthen Meta’s core advertising and wearable technology ecosystems.

- Against this backdrop, we’ll explore how Meta’s decision to trim metaverse spending while accelerating AI infrastructure and wearable investments reshapes its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Meta Platforms Investment Narrative Recap

To own Meta today, you generally need to believe its AI driven advertising and wearables can support ongoing revenue and profit growth while heavy infrastructure spending stays under control. The latest dividend affirmation and Reality Labs budget cuts largely reinforce that near term focus, but higher capital expenditure on AI and continued regulatory scrutiny remain important risks to watch, even as the recent share price pullback has sharpened attention on earnings resilience.

Among the recent updates, the roughly 30% reduction in Reality Labs’ metaverse budget stands out, given its US$73 billion in cumulative losses. By reallocating resources toward AI models like Segment Anything Model 3 and AI enabled wearables via the Limitless acquisition, Meta is putting more emphasis on initiatives that tie directly into its existing ad and engagement engine, which many investors already view as the key short term catalyst for the stock.

Yet even with these shifts, rising AI related capital expenditures could still pressure margins in ways investors should be aware of...

Read the full narrative on Meta Platforms (it's free!)

Meta Platforms’ narrative projects $275.9 billion revenue and $92.1 billion earnings by 2028.

Uncover how Meta Platforms' forecasts yield a $841.42 fair value, a 25% upside to its current price.

Exploring Other Perspectives

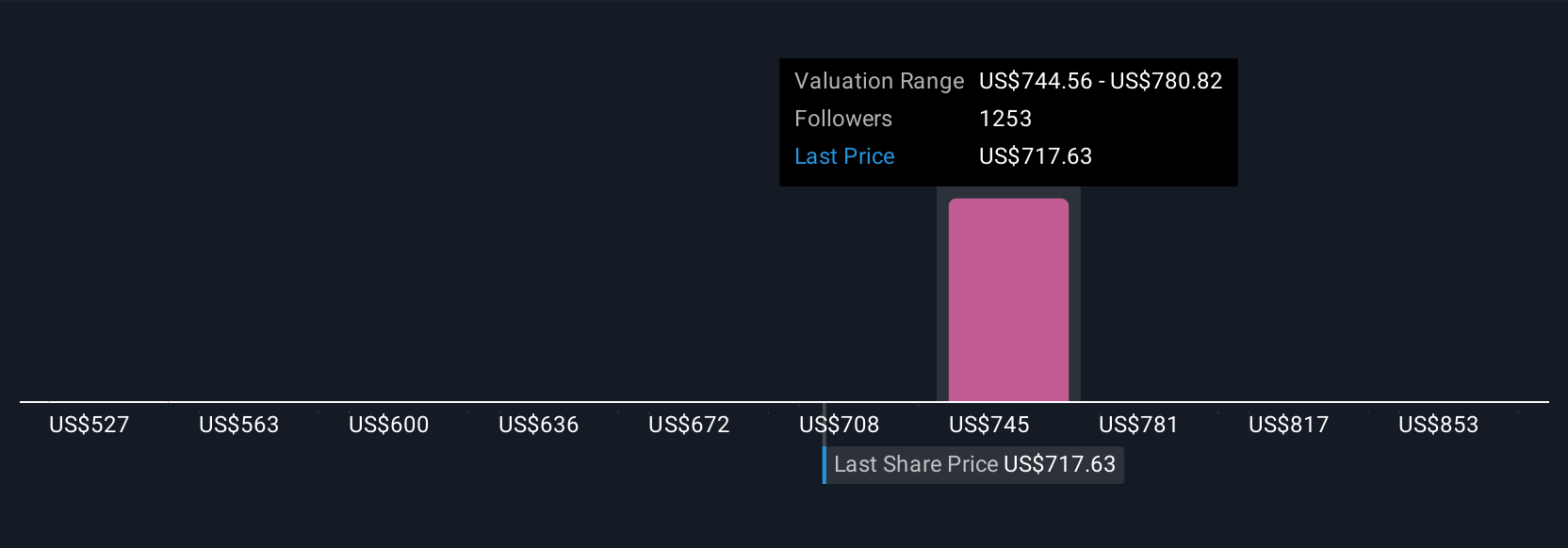

Simply Wall St Community members offer 87 fair value estimates for Meta, spanning roughly US$538 to US$908 per share, reflecting very different expectations. When you weigh these against Meta’s heavier AI spending plans and Reality Labs’ trimmed but still material losses, it becomes clear that understanding several viewpoints can help frame how these choices might affect future profitability.

Explore 87 other fair value estimates on Meta Platforms - why the stock might be worth 20% less than the current price!

Build Your Own Meta Platforms Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Meta Platforms research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Meta Platforms research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Meta Platforms' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026