- United States

- /

- Media

- /

- NasdaqGS:MCHX

Marchex, Inc. (NASDAQ:MCHX) Stock Rockets 27% As Investors Are Less Pessimistic Than Expected

Marchex, Inc. (NASDAQ:MCHX) shares have continued their recent momentum with a 27% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

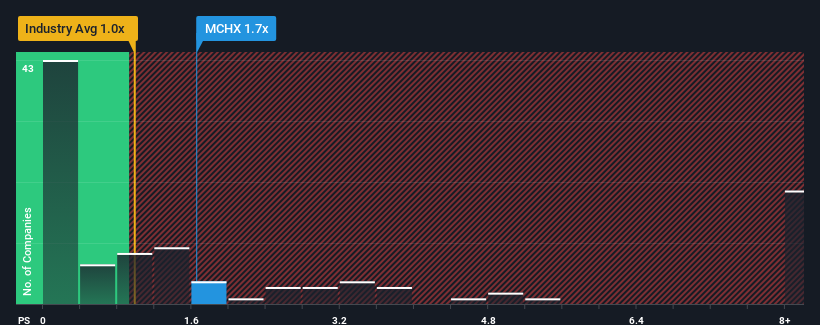

Following the firm bounce in price, you could be forgiven for thinking Marchex is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.7x, considering almost half the companies in the United States' Media industry have P/S ratios below 1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Marchex

How Has Marchex Performed Recently?

Marchex could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Marchex will help you uncover what's on the horizon.How Is Marchex's Revenue Growth Trending?

In order to justify its P/S ratio, Marchex would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 3.8% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 5.6% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 0.9% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 3.8%, which is noticeably more attractive.

In light of this, it's alarming that Marchex's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Marchex shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Marchex trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 2 warning signs for Marchex that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHX

Marchex

A conversation intelligence company, provides conversational analytics and related solutions in the United States, Canada, and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives