- United States

- /

- Biotech

- /

- NasdaqGS:SLRN

May 2025's Rising Stars: Three Penny Stocks To Consider

Reviewed by Simply Wall St

The market is up 2.7% over the last week and 9.6% over the past year, with earnings forecast to grow by 14% annually. Penny stocks, though often seen as relics of a bygone era, still offer intriguing opportunities for growth when backed by strong financials and solid fundamentals—especially in a rising market environment. This article explores several penny stocks that stand out for their potential to deliver impressive returns while balancing value and growth prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.39 | $354.37M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.35 | $1.19B | ✅ 3 ⚠️ 3 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $0.9894 | $17.95M | ✅ 4 ⚠️ 4 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.30 | $9.9M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.77 | $49.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Waterdrop (NYSE:WDH) | $1.31 | $481.01M | ✅ 4 ⚠️ 0 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.85 | $367.28M | ✅ 5 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.819475 | $5.97M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.625 | $81.25M | ✅ 3 ⚠️ 2 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.785 | $72.17M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 755 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

LiveOne (NasdaqCM:LVO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LiveOne, Inc. is a digital media company focused on acquiring, distributing, and monetizing live music, Internet radio, podcasting/vodcasting, and music-related streaming and video content with a market cap of $84.00 million.

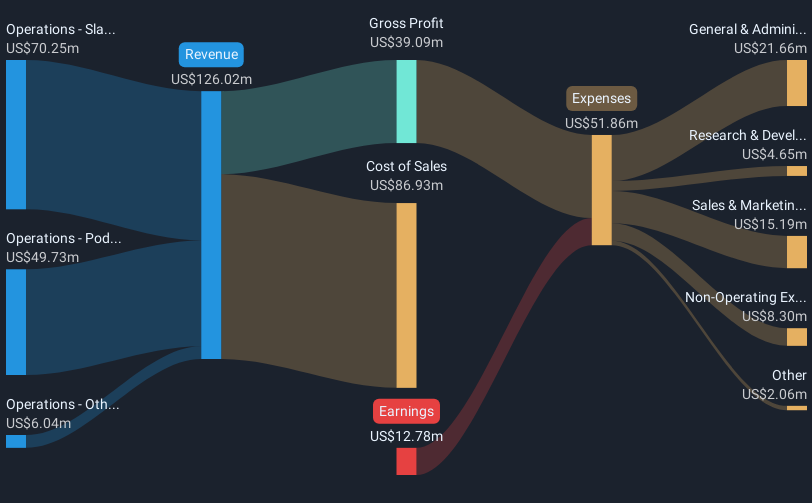

Operations: The company's revenue is primarily generated from its Slacker operations at $70.25 million and PodcastOne at $49.73 million.

Market Cap: $84M

LiveOne, Inc., with a market cap of US$84 million, faces challenges typical of penny stocks. Despite generating substantial revenue from its Slacker and PodcastOne operations, it remains unprofitable and isn't expected to achieve profitability in the next three years. The company has a stable cash runway exceeding three years due to positive free cash flow but struggles with short-term liabilities exceeding its assets by US$18 million. Recently, LiveOne received a Nasdaq notification for non-compliance with the minimum bid price rule, risking potential delisting if not rectified within 180 days.

- Unlock comprehensive insights into our analysis of LiveOne stock in this financial health report.

- Understand LiveOne's earnings outlook by examining our growth report.

Acelyrin (NasdaqGS:SLRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Acelyrin, Inc. is a clinical biopharma company dedicated to identifying, acquiring, and accelerating the development and commercialization of transformative medicines, with a market cap of $246.74 million.

Operations: No revenue segments are currently reported.

Market Cap: $246.74M

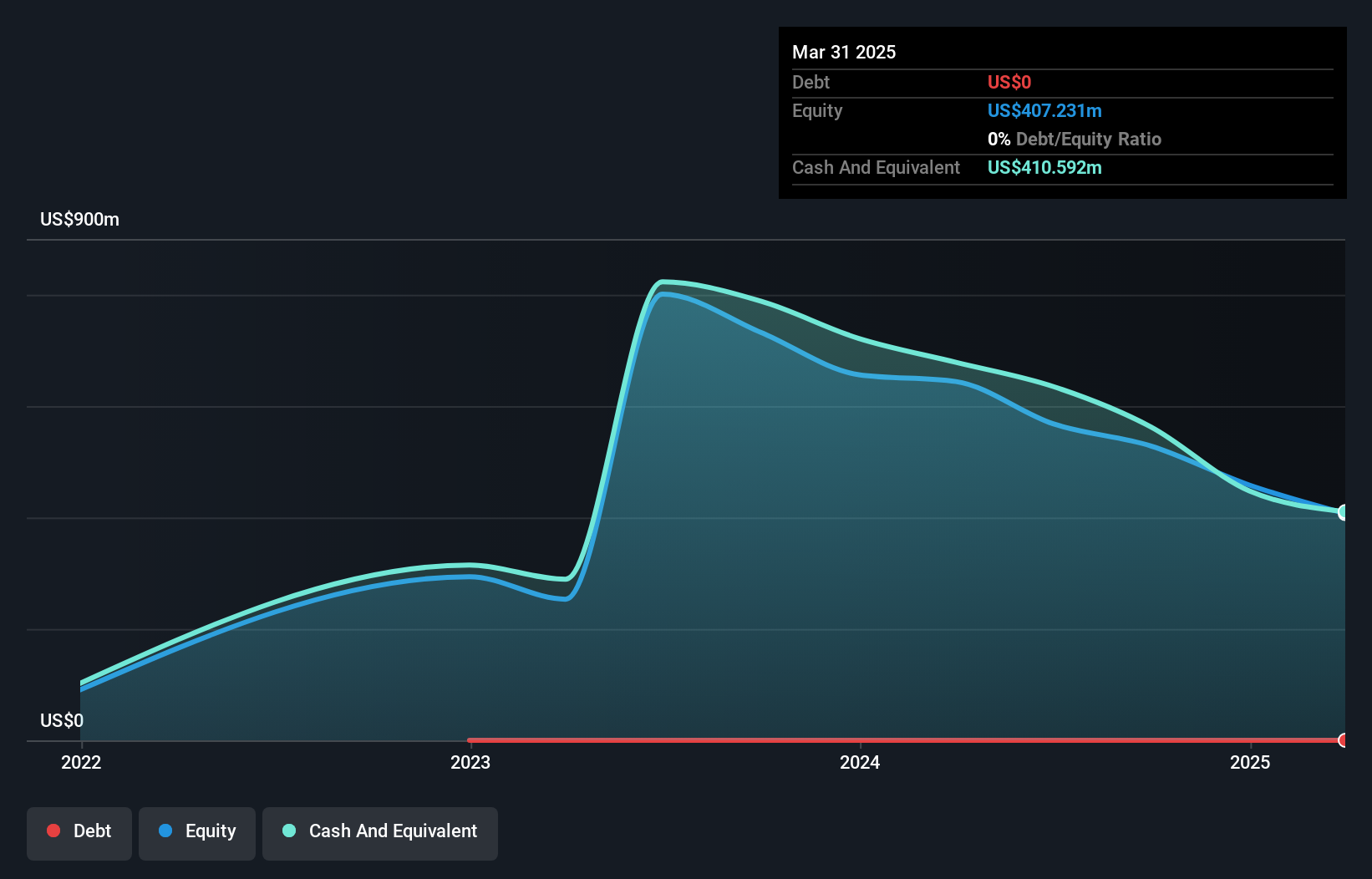

Acelyrin, Inc., with a market cap of US$246.74 million, is a pre-revenue clinical biopharma company navigating the complexities of penny stocks. Despite its unprofitability and no significant revenue streams, Acelyrin maintains a robust cash position with short-term assets of US$481 million exceeding liabilities significantly. The company is debt-free and has sufficient cash runway for over two years even if free cash flow declines sharply. Recent developments include an impending merger with Alumis Inc., which will see Acelyrin shareholders owning 48% of the combined entity post-transaction, subject to customary closing conditions expected in Q2 2025.

- Click to explore a detailed breakdown of our findings in Acelyrin's financial health report.

- Review our growth performance report to gain insights into Acelyrin's future.

Waterdrop (NYSE:WDH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Waterdrop Inc. operates as an online insurance brokerage in China, connecting users with insurance products, and has a market cap of approximately $481.01 million.

Operations: The company's revenue primarily comes from its insurance segment, which generated CN¥2.56 billion, followed by its crowd funding segment at CN¥155.80 million.

Market Cap: $481.01M

Waterdrop Inc., with a market cap of approximately $481.01 million, presents an intriguing case within the penny stock landscape. The company reported robust earnings growth, with net income rising significantly to CN¥367.51 million in 2024 from CN¥167.22 million the previous year, indicating strong operational performance. Waterdrop's short-term assets notably exceed both its short and long-term liabilities, ensuring financial stability amidst its modest debt levels and favorable interest coverage ratio. Recent board changes include the appointment of Mr. Chen Lin as an independent director, potentially enhancing governance through his extensive financial expertise and industry experience.

- Click here and access our complete financial health analysis report to understand the dynamics of Waterdrop.

- Examine Waterdrop's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Take a closer look at our US Penny Stocks list of 755 companies by clicking here.

- Want To Explore Some Alternatives? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLRN

Acelyrin

A clinical biopharma company, focuses on identifying, acquiring, and accelerating the development and commercialization of transformative medicines.

Flawless balance sheet and good value.

Market Insights

Community Narratives