- United States

- /

- Media

- /

- NasdaqGS:LSXM.K

Investors Aren't Entirely Convinced By The Liberty SiriusXM Group's (NASDAQ:LSXM.K) Earnings

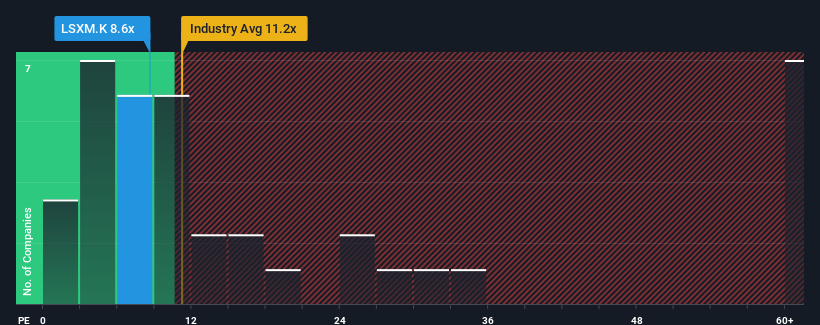

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may consider The Liberty SiriusXM Group (NASDAQ:LSXM.K) as an attractive investment with its 8.6x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Liberty SiriusXM Group as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Liberty SiriusXM Group

How Is Liberty SiriusXM Group's Growth Trending?

In order to justify its P/E ratio, Liberty SiriusXM Group would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 29%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 28% each year during the coming three years according to the six analysts following the company. With the market only predicted to deliver 9.9% per year, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Liberty SiriusXM Group's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Liberty SiriusXM Group's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Liberty SiriusXM Group currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Liberty SiriusXM Group you should be aware of.

Of course, you might also be able to find a better stock than Liberty SiriusXM Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LSXM.K

Liberty SiriusXM Group

Through its subsidiaries, engages in the entertainment business in the United States, the United Kingdom, and internationally.

Good value with acceptable track record.

Market Insights

Community Narratives