- United States

- /

- Media

- /

- NasdaqGS:LBRD.K

Liberty Broadband (LBRD.K): Taking Stock of Valuation After Recent Volatility

Reviewed by Simply Wall St

If you have been tracking Liberty Broadband (LBRD.K) lately, the stock’s recent moves may be giving you pause. There has not been a big headline-grabbing event triggering the latest shift, but even these quieter stretches can be revealing. Investors are now left to wonder whether the current price reflects a hidden signal or simply market noise—this kind of moment can make a real difference in long-term returns for those paying attention.

Looking at the bigger picture, the stock’s modest 6% gain over the past year stands out given the more dramatic swings seen over the past few months, where shares have dropped more than 34% since March. That volatility comes on the back of Liberty Broadband’s revenue inching up yet net income slipping, a combination that sparks debate about whether management’s strategies are delivering lasting value. Unlike competitors facing similar industry headwinds, this company’s long-term trajectory has been choppier, with substantial declines across three- and five-year spans.

So the real question now is this: Is Liberty Broadband quietly setting up for a turnaround, or are investors already factoring in all realistic growth prospects at today’s price?

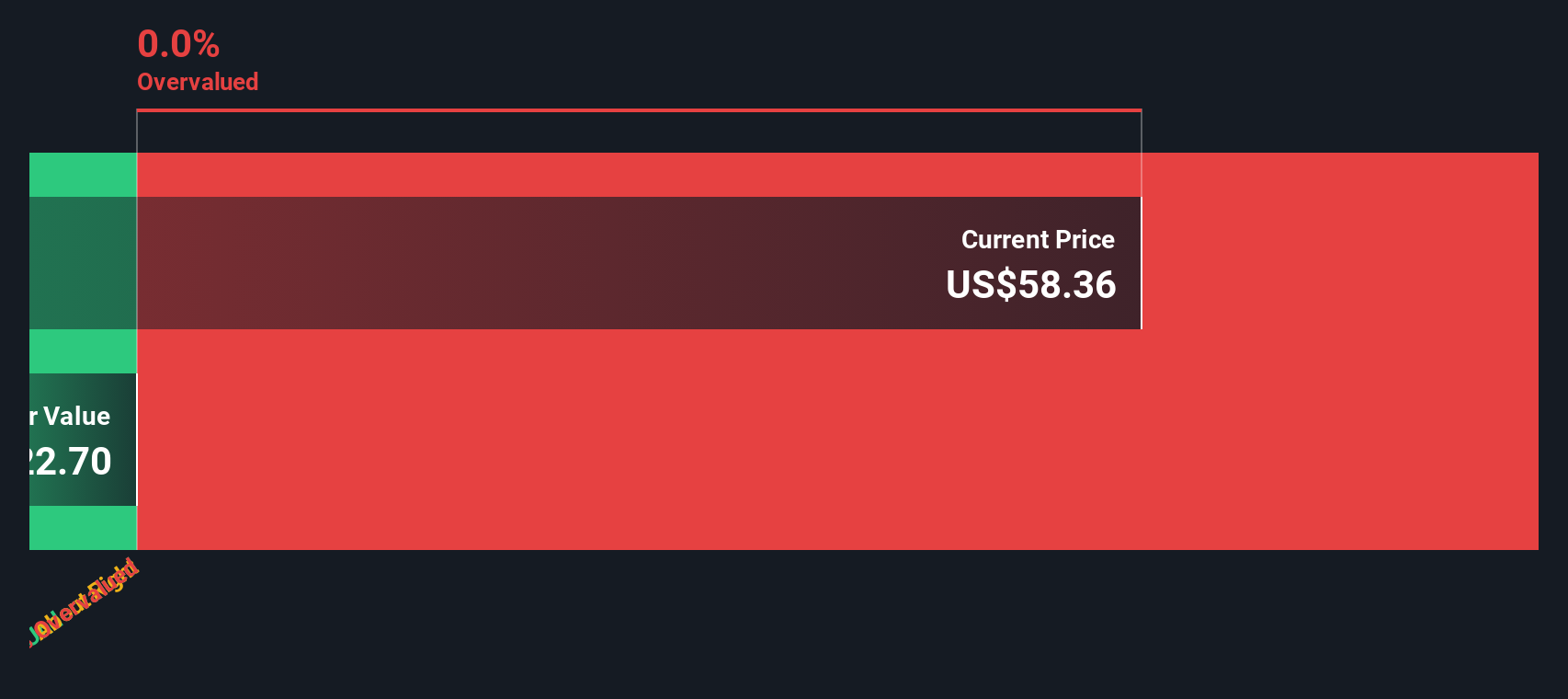

Most Popular Narrative: 39% Undervalued

According to the most widely followed narrative, Liberty Broadband is trading at a significant discount compared to its estimated fair value. This is driven by expectations for future earnings and ongoing infrastructure upgrades.

Substantial, ongoing investments in fiber infrastructure and last-mile connectivity, along with recent launches of high-speed broadband in underserved markets like rural Alaska, position underlying assets to capture the rising demand for fast, reliable internet and bolster long-term revenue growth potential.

Is Wall Street missing the real story behind Liberty Broadband’s price target? This thesis hinges on ambitious projections for profit margins and a future valuation multiple that outpaces most media stocks. Want to uncover which assumptions fuel this underappreciated upside, and whether the narrative’s bold math stands up to scrutiny? Dive in to decode the catalysts behind this attention-grabbing fair value.

Result: Fair Value of $99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as heavy reliance on Charter and potential regulatory changes could quickly challenge this optimistic thesis and reshape the company’s valuation story.

Find out about the key risks to this Liberty Broadband narrative.Another View: Testing the Value with a Different Lens

Looking beyond analyst price targets, our DCF model takes a different approach by focusing on expected future cash flows rather than earnings multiples. Its verdict also suggests Liberty Broadband might be undervalued, but does it capture the full story, or could hidden risks alter the outcome?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Liberty Broadband Narrative

If you have a different perspective or want to dig deeper into Liberty Broadband’s outlook, you can easily shape your own view in just a few minutes by using Do it your way.

A great starting point for your Liberty Broadband research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Some of the most exciting investment trends are just a click away. Use these powerful screeners to spot companies with compelling potential before everyone else does:

- Jump on high-potential trends with AI penny stocks and tap into companies harnessing artificial intelligence breakthroughs for tomorrow's growth leaders.

- Secure steady income by checking out dividend stocks with yields > 3% focused on businesses delivering reliable, above-average dividend yields to strengthen your portfolio.

- Find bargains waiting to surge by using undervalued stocks based on cash flows spotlighting stocks trading below their intrinsic value, perfect for value-minded investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LBRD.K

Liberty Broadband

Engages in a range of communications businesses in the United States.

Solid track record and fair value.

Market Insights

Community Narratives