- United States

- /

- Entertainment

- /

- NasdaqGS:IQ

iQIYI (NasdaqGS:IQ) Valuation Spotlight After New Global Content Deal and Viewership Surge

Reviewed by Simply Wall St

iQIYI (NasdaqGS:IQ) shares surged after it announced a partnership with KADOKAWA to distribute Chinese animated series globally. The news sparked renewed investor interest as the company reported a marked rise in platform viewership during China’s National Holiday.

See our latest analysis for iQIYI.

iQIYI’s new partnership with KADOKAWA and a spike in viewer engagement fueled a short-term rally after a tough stretch, but momentum remains mixed. The share price has advanced 8.5% year-to-date; however, a one-year total shareholder return of -16.3% and a five-year figure of -91% show it is still well below former highs despite occasional bursts of optimism.

If a global content push like iQIYI’s has you rethinking your strategy, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

Despite recent excitement around global expansion and content breakthroughs, iQIYI’s persistent long-term underperformance leaves investors wondering if the current rebound is a real buying opportunity or if the market has already priced in future growth.

Most Popular Narrative: 11.5% Undervalued

With the consensus fair value now at $2.44 compared to the recent close of $2.16, the narrative points to meaningful upside potential. The stage is set for a lively debate on whether iQIYI can pivot regulatory and content tailwinds into sustained value.

Newly streamlined digital content regulations in China are shortening content production cycles and increasing creator flexibility. This allows iQIYI to bring relevant, diverse content to market quicker and at lower costs, which should positively impact margins and working capital efficiency.

Just what is fueling this valuation optimism? Tantalizing margin upgrades, big expectations for earnings growth, and some bold calls on global content success make this fair value calculation anything but conservative. Can iQIYI really deliver on all these fronts? Click to uncover the pivotal numbers and projections shaping the consensus.

Result: Fair Value of $2.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in membership and ad revenue, along with high production costs, could undermine iQIYI’s ambitious global growth plans.

Find out about the key risks to this iQIYI narrative.

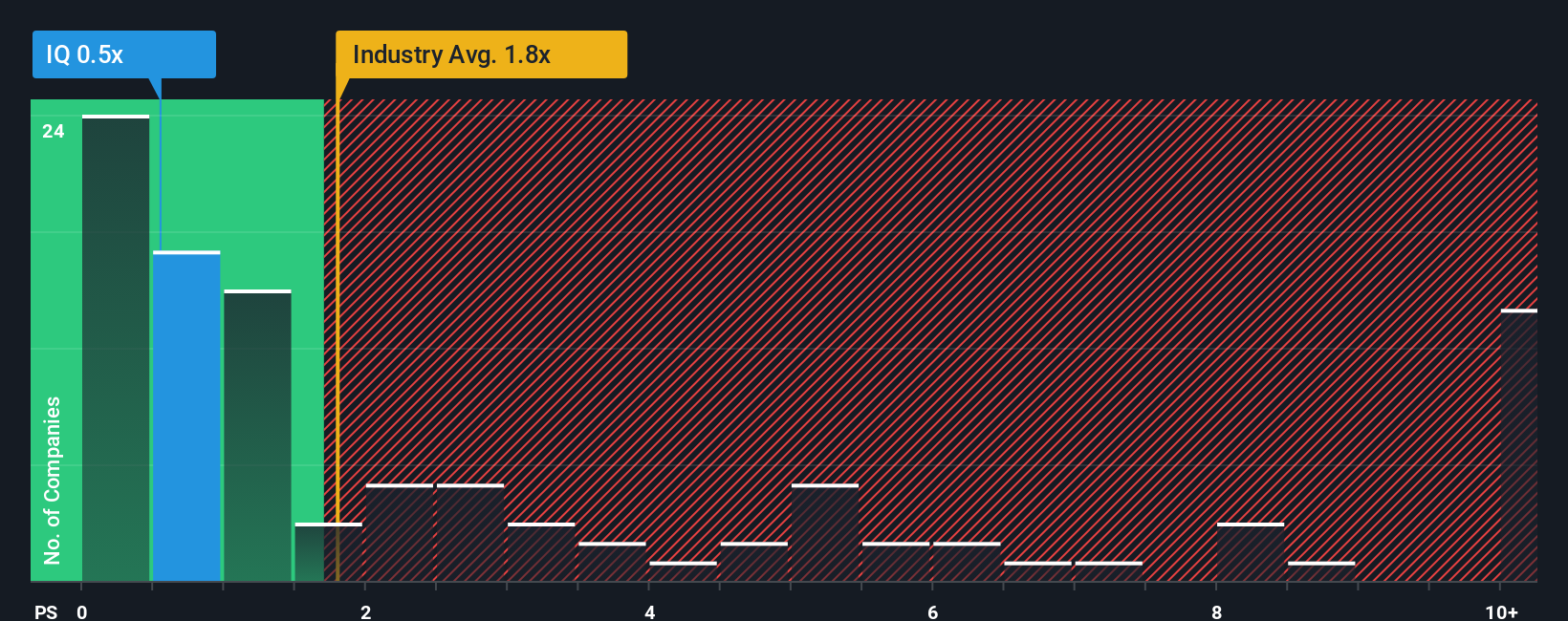

Another View: Market Ratios Add Perspective

Looking from a different angle, iQIYI trades at just 0.5x sales, far below the US Entertainment industry average of 1.9x, the peer average of 2.8x, and even its fair ratio of 0.8x. This significant discount could point to opportunity, or reveal ongoing market skepticism. Which side will prove right when the dust settles?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out iQIYI for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own iQIYI Narrative

If you see these numbers differently or want to dig into the details yourself, it takes less than three minutes to build your own view. Why not Do it your way

A great starting point for your iQIYI research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your potential to just one stock? The best investors always scan for new opportunities, and the Simply Wall Street Screener gives you a smarter edge.

- Tap into game-changing technologies and find hidden gems in artificial intelligence by starting with these 24 AI penny stocks.

- Lock in compelling yields by pursuing steady income opportunities with these 17 dividend stocks with yields > 3%.

- Supercharge your growth portfolio with tomorrow’s breakthroughs through these 27 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iQIYI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IQ

iQIYI

Through its subsidiaries, provides online entertainment video services in the People’s Republic of China.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives