- United States

- /

- Entertainment

- /

- NasdaqGS:IQ

How iQIYI’s (IQ) Global Animation Deal With KADOKAWA Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- On October 13, 2025, KADOKAWA Corporation announced a partnership with iQIYI to distribute iQIYI’s original Chinese animated series, "The Fated Magical Princess" and "The Forbidden City: Cat Imperial Study," to global markets including Japan, the Americas, and Europe.

- This collaboration marks a significant milestone as it is the first time KADOKAWA is releasing a premium Chinese animation from a Chinese streaming platform simultaneously worldwide, underscoring iQIYI’s expanding international influence in high-quality animation.

- We'll explore how iQIYI's global content partnership with KADOKAWA could enhance its international growth ambitions and content leadership.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

iQIYI Investment Narrative Recap

For investors to be bullish on iQIYI, they need confidence that the company can consistently deliver highly engaging original content and broaden its international footprint, despite operating in a fiercely competitive streaming sector with rising costs. The recent partnership with KADOKAWA boosts iQIYI’s global visibility, but this move alone may not meaningfully offset the short-term volatility in core membership and advertising revenues, which remain sensitive to content cycles and macro headwinds.

Among recent developments, iQIYI’s unveiling of over 400 new titles earlier this year stands out as particularly relevant, reinforcing the company’s content creation ambitions. This sustained investment supports the critical catalyst of growing audience engagement, which is needed to stabilize both subscriber and advertising revenue streams as iQIYI expands overseas.

However, with international growth still facing risks from competition and regulatory barriers, investors should be aware that while content partnerships offer clear potential, the most pressing challenge could be...

Read the full narrative on iQIYI (it's free!)

iQIYI's narrative projects CN¥29.2 billion revenue and CN¥1.3 billion earnings by 2028. This requires 1.8% yearly revenue growth and a CN¥1.2 billion earnings increase from CN¥88.5 million.

Uncover how iQIYI's forecasts yield a $2.44 fair value, a 11% upside to its current price.

Exploring Other Perspectives

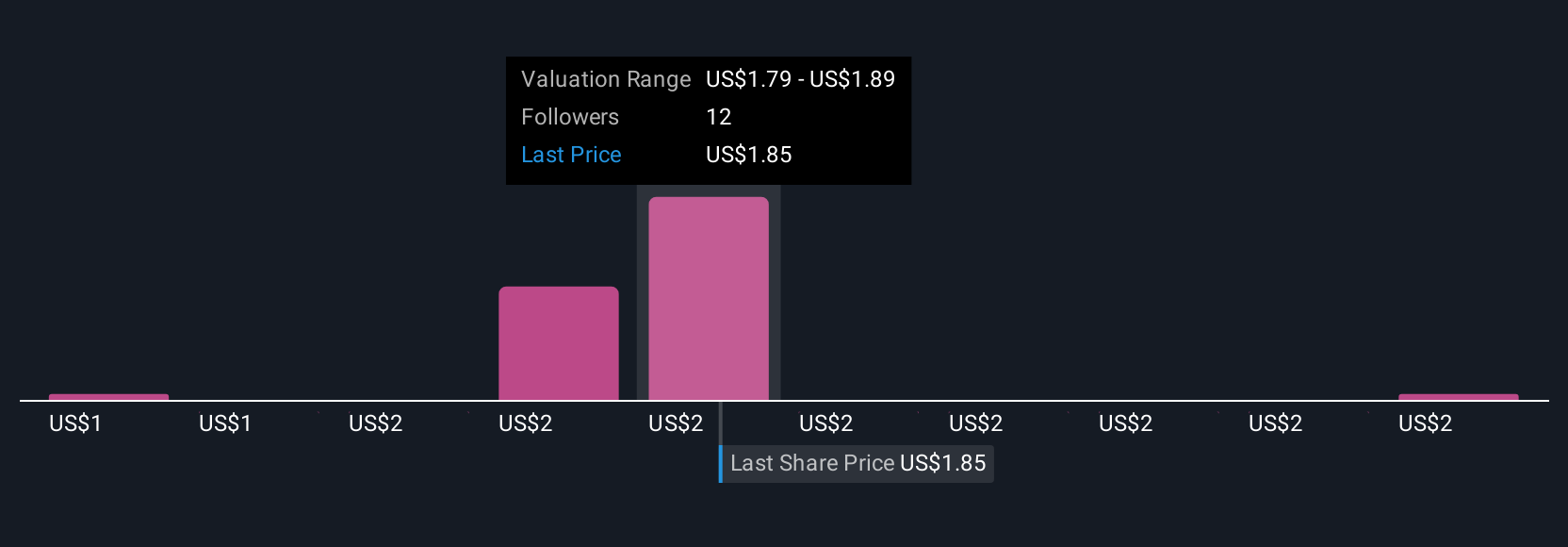

Five members of the Simply Wall St Community have shared fair value estimates for iQIYI ranging from CN¥0.87 to CN¥3.34 per share. While some see opportunity, the ongoing revenue pressure and dependence on hit content highlight why opinions can differ so widely, consider comparing these contrasting views as you assess the company’s future.

Explore 5 other fair value estimates on iQIYI - why the stock might be worth as much as 52% more than the current price!

Build Your Own iQIYI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your iQIYI research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free iQIYI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate iQIYI's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iQIYI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IQ

iQIYI

Through its subsidiaries, provides online entertainment video services in the People’s Republic of China.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives