- United States

- /

- Media

- /

- NasdaqGS:IAS

What Integral Ad Science Holding (IAS)'s Upgraded Earnings Outlook Means For Shareholders

Reviewed by Simply Wall St

- Earlier this week, Integral Ad Science (IAS) received a favorable outlook from analysts, citing a strong Zacks Rank, above-industry earnings growth expectations, and recent positive earnings estimate revisions.

- This upgraded consensus reflects optimism around IAS's earnings power and highlights increasing buy-side interest as analysts align on improved near-term fundamentals for the company.

- Let's examine how this analyst optimism and upward earnings revisions may shape Integral Ad Science's broader investment story.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Integral Ad Science Holding Investment Narrative Recap

To be a shareholder in Integral Ad Science, you need to believe in the growing importance of independent ad verification, compliance, and transparency as digital ad spend migrates to new platforms. While this week’s analyst optimism supports stronger near-term earnings power, the biggest short-term catalyst remains continued revenue growth in social and CTV. However, this does not fundamentally change the biggest risk: that IAS’s revenue diversity is threatened as open web segments decline and its reliance on large platform partners increases.

The company’s recent Ethical AI Certification, announced in July, is particularly relevant, as it spotlights IAS’s push to differentiate its solutions through responsible, transparent technology. With regulatory scrutiny rising and advertisers demanding greater brand safety, this certification could further support IAS in maintaining premium pricing power, feeding directly into the revenue growth catalyst highlighted by analysts.

But even with increased earnings forecasts, investors should also be aware that if a major platform partner shifts away from third-party measurement providers...

Read the full narrative on Integral Ad Science Holding (it's free!)

Integral Ad Science Holding's projections indicate $787.4 million in revenue and $104.9 million in earnings by 2028. This outlook assumes an 11.4% annual revenue growth rate and an $49.1 million increase in earnings from the current $55.8 million.

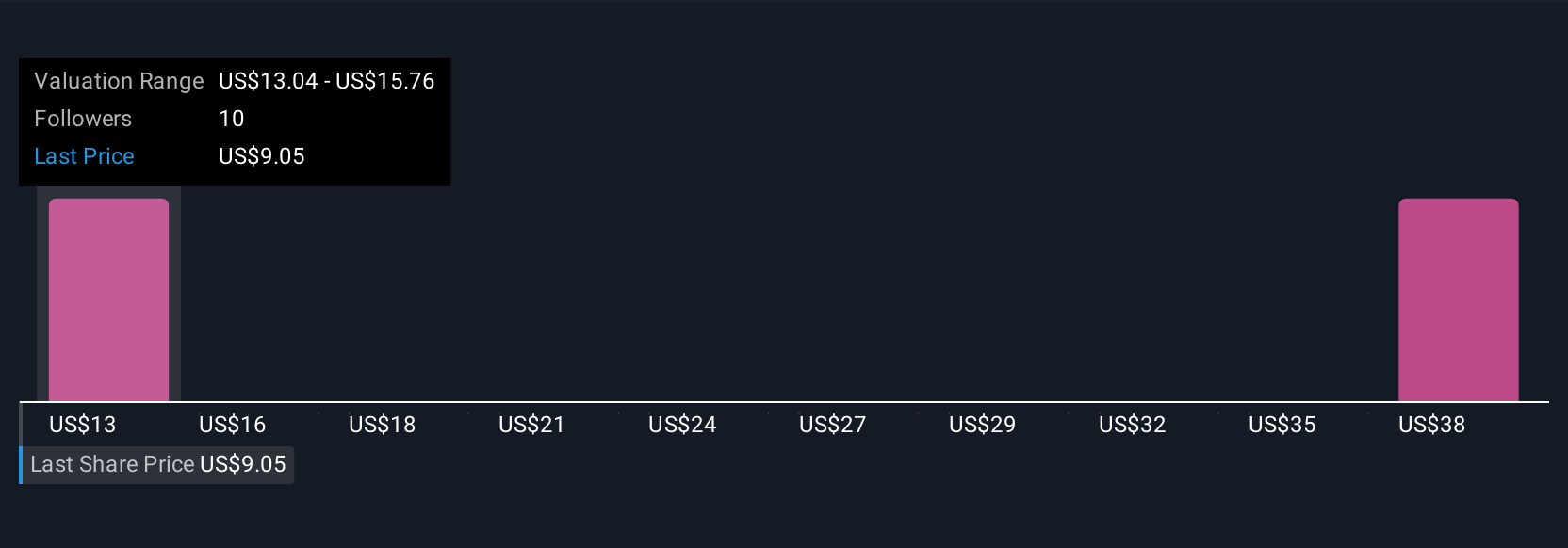

Uncover how Integral Ad Science Holding's forecasts yield a $13.04 fair value, a 43% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have shared two distinct fair value estimates for IAS, ranging from US$13.04 to US$40.32 per share. With such differing views in the community, it is clear that concerns about future revenue diversity and platform partner reliance remain key to the company’s story.

Explore 2 other fair value estimates on Integral Ad Science Holding - why the stock might be worth over 4x more than the current price!

Build Your Own Integral Ad Science Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Integral Ad Science Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Integral Ad Science Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Integral Ad Science Holding's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IAS

Integral Ad Science Holding

Operates as a digital advertising verification company in the United States, the United Kingdom, Ireland, France, Germany, Spain, Italy, Singapore, Australia, Japan, India, and the Nordics.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives