- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:IAC

IAC (IAC) Valuation in Focus After Revenue Miss and Tough Digital Media Quarter

Reviewed by Simply Wall St

IAC (IAC) revealed disappointing quarterly results, with revenue dropping 8% compared to last year and falling short of Wall Street expectations. The miss highlights ongoing hurdles for its digital media and content platforms.

See our latest analysis for IAC.

After this underwhelming quarter, IAC’s shares have shown some short-term resilience, posting a 7.25% gain over the past week and a 10.49% climb for the month. Still, the momentum has not reversed the bigger picture. The year-to-date share price return is down 17.7%, and the total shareholder return for the past year is -10.06%. Long-term holders have seen even greater declines, as the five-year total shareholder return stands at -56.01%, reflecting ongoing challenges for IAC and persistent skepticism about the value of its digital media portfolio.

If you’re weighing your next move after these earnings, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a meaningful discount to analyst targets after a tough quarter, investors now face a critical question: Is IAC undervalued after its slide, or has the market already priced in its future prospects?

Most Popular Narrative: 23.1% Undervalued

IAC closed at $35.07. The most popular narrative places its fair value much higher, suggesting the current price does not capture the company’s underlying potential. This gap highlights both optimism about IAC’s strategy and uncertainty about its execution, inviting a closer examination of the underlying assumptions.

The D/Cipher+ product significantly increases IAC's total addressable advertising market by enabling cross-platform ad targeting using proprietary first-party data and intent signals. This capability is becoming an increasingly valuable asset as privacy changes disrupt third-party data. It may drive both digital advertising revenue growth and profitability as advertisers continue to favor platforms with strong audience data.

The real secret behind this narrative centers on surprising transformation rates and a future profit multiple typically associated with sector favorites. Interested in which financial forecasts could support that premium target? Click through to see the numbers analysts are considering but the market still questions.

Result: Fair Value of $45.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing dependence on Google for traffic and rising competition from tech giants could quickly challenge this optimistic narrative if trends shift further.

Find out about the key risks to this IAC narrative.

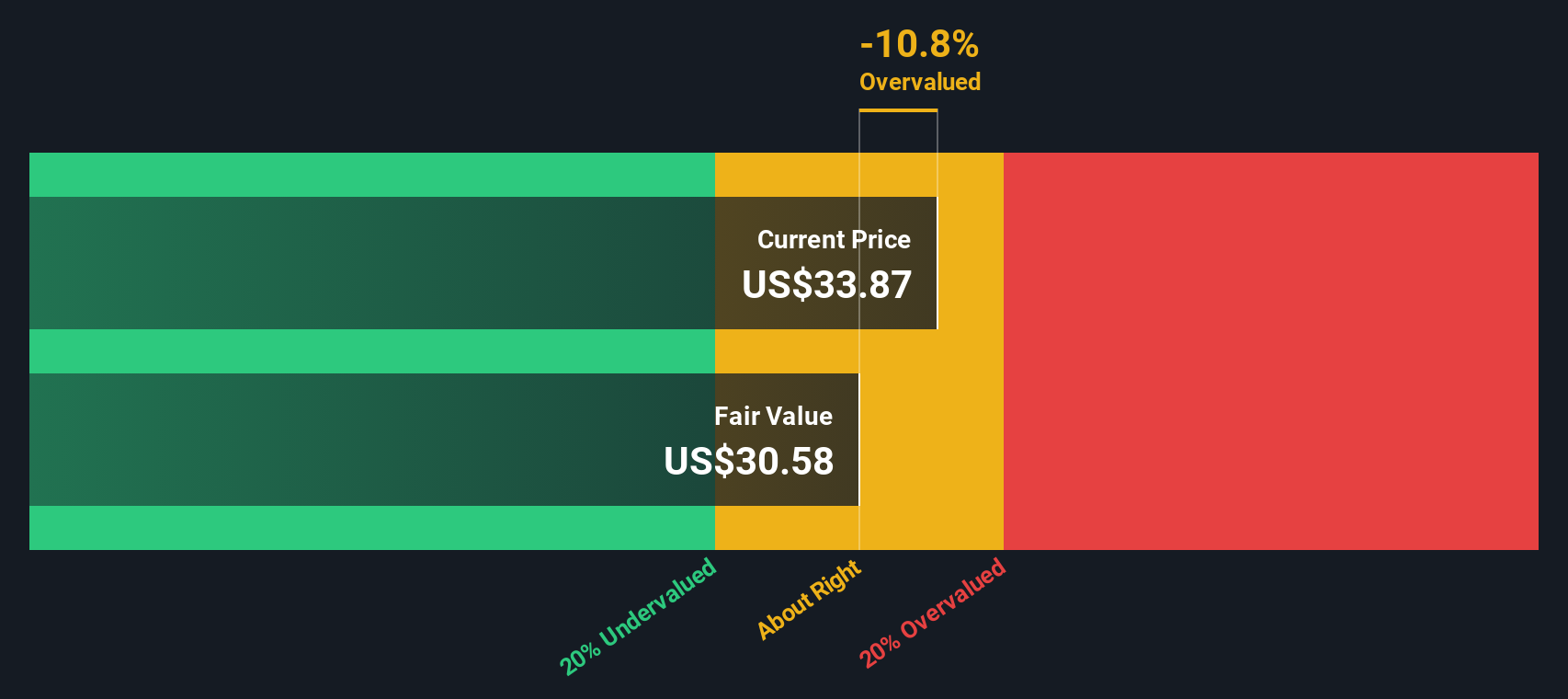

Another View: Discounted Cash Flow Model Offers a Different Take

Looking at IAC from the perspective of our SWS DCF model provides a less optimistic picture. The DCF model estimates fair value at $30.74, which is actually below the current price. This suggests that, based on future cash flows alone, IAC might still be slightly overvalued in the market.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out IAC for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own IAC Narrative

If these interpretations do not quite fit your perspective or if you would rather dig into the numbers yourself, you'll find that building your own case for IAC takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding IAC.

Looking for More Investment Ideas?

Unlock new opportunities in today’s market by moving beyond familiar names and focusing on fast-growing trends. Don’t let tomorrow’s leaders pass you by while you wait.

- Target steady income streams and see which companies are offering impressive yields with these 15 dividend stocks with yields > 3%.

- Catch the momentum of artificial intelligence and position yourself to benefit from the surge by checking out these 25 AI penny stocks.

- Spot undervalued gems that the market has overlooked and get ahead of the crowd with these 920 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IAC

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.