- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

How Investors Are Reacting To Alphabet (GOOGL) Expanding AI Partnership With Salesforce and Nvidia Integration

Reviewed by Sasha Jovanovic

- Google and Salesforce recently announced an expanded partnership bringing Google's Gemini AI models to Salesforce's Agentforce 360 Platform, aimed at transforming enterprise productivity by integrating advanced AI with Google Workspace and Salesforce tools.

- This collaboration uniquely positions both companies to deliver seamless, context-aware AI experiences across major enterprise workflows, highlighting Google's continued push to embed Gemini-powered capabilities throughout the cloud ecosystem.

- We'll explore how the integration of Nvidia's cutting-edge GPUs into Google Cloud's new AI offerings could reshape Alphabet's growth outlook in cloud and enterprise markets.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Alphabet Investment Narrative Recap

To own Alphabet stock, investors need confidence that AI-driven innovation, strong cloud growth, and diverse revenue streams will more than offset margin pressures from rising capital expenditures and legal risks. The newly expanded Google-Salesforce AI partnership highlights Alphabet’s execution in embedding Gemini models across enterprise workflows, yet does not materially alter the immediate catalysts, AI adoption in search, and cloud revenue growth, or the prevailing risk of regulatory actions threatening its core business models.

Among recent announcements, Google Cloud's integration of Nvidia’s latest GPUs stands out, equipping Alphabet with advanced infrastructure to support next-generation AI workloads. This move is especially relevant as sustained investment in AI hardware and cloud capabilities remains central to Alphabet’s efforts to secure long-term growth, providing necessary scale, though not immediately diminishing the pressure of ongoing capital expenditure on net margins.

On the other hand, growing legal and regulatory scrutiny could impact Alphabet’s future more than many investors anticipate, especially if...

Read the full narrative on Alphabet (it's free!)

Alphabet's outlook suggests revenues are expected to reach $512.6 billion and earnings $148.4 billion by 2028. This would entail annual revenue growth of 11.3% and an increase in earnings of $32.8 billion from the current $115.6 billion.

Uncover how Alphabet's forecasts yield a $252.73 fair value, in line with its current price.

Exploring Other Perspectives

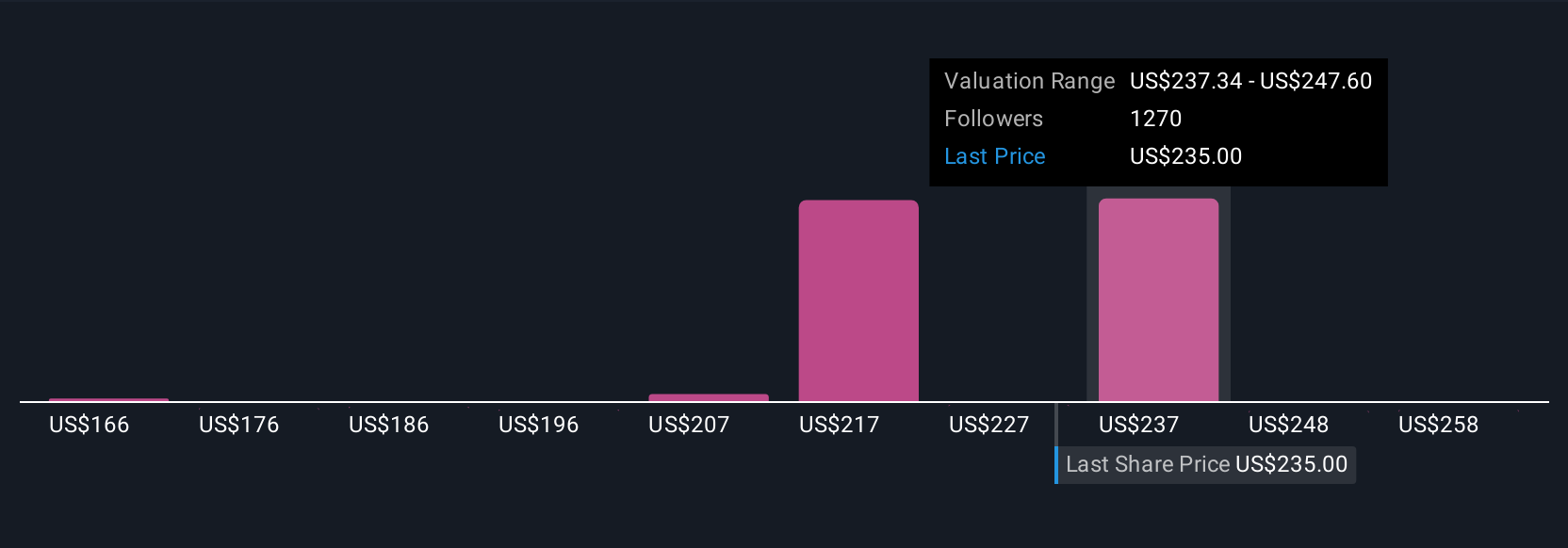

Fair value estimates from 183 Simply Wall St Community members span US$171.36 to US$291.20 per share, reflecting a broad mix of optimism and caution. While many focus on AI expansion as a key growth driver, the risk of regulatory actions remains a critical factor in shaping Alphabet’s longer-term performance, reminding you that investor opinions can differ widely and it pays to explore several viewpoints.

Explore 183 other fair value estimates on Alphabet - why the stock might be worth as much as 14% more than the current price!

Build Your Own Alphabet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alphabet research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Alphabet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alphabet's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives