- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

Alphabet (NasdaqGS:GOOGL) Expands Infrastructure And Ad Integration With Google Maps And DV360

Reviewed by Simply Wall St

Alphabet (NasdaqGS:GOOGL) experienced a notable price move of 5% over the last week, highlighting resilience amidst turbulent market conditions. During the same period, major indices like the Dow and Nasdaq faced significant declines of 4% and 6%, respectively. The improvements in Bentley Systems’ asset analytics capabilities and Shirofune’s integration with Google technologies could be relevant due to Alphabet's continued investment in its vast tech ecosystem. These developments may have offered support against broader market declines, as Alphabet's diverse business interests, including its robust technology partnerships, potentially cushioned its stock performance.

Buy, Hold or Sell Alphabet? View our complete analysis and fair value estimate and you decide.

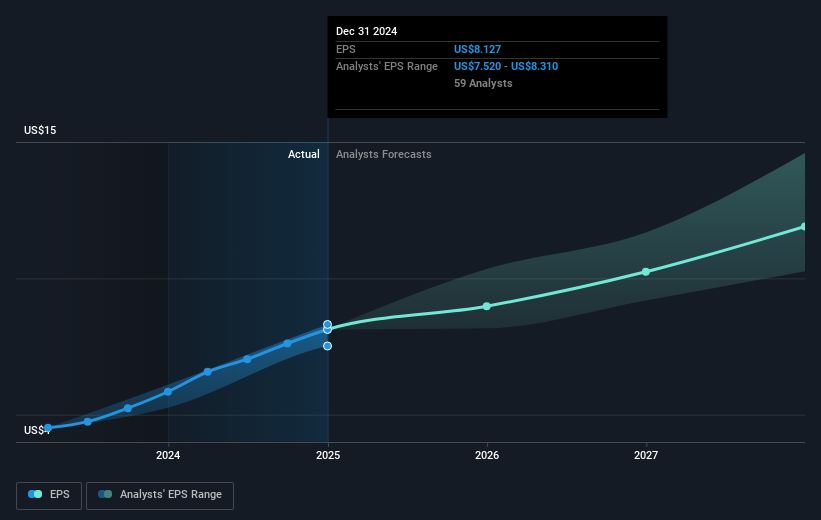

The recent developments involving Alphabet, such as enhancements in Bentley Systems’ asset analytics and Shirofune’s integration with Google technologies, are relevant in the context of Alphabet's expanding technology ecosystem. These innovations are likely to enhance user engagement and bolster Alphabet’s market position, potentially leading to higher future revenues. The emphasis on AI and strategic Google Cloud expansion aligns with the ongoing narrative of leveraging advanced technologies for user engagement and margin improvements. These dynamics could contribute positively to Alphabet’s revenue projections and earnings forecasts.

Over a five-year period, Alphabet's total shareholder return, including share price appreciation and dividends, was 153.64%. This performance highlights significant value creation for shareholders, comparing favorably to the past year's performance against the US Market and Interactive Media and Services industry, where Alphabet underperformed both, indicating a potential rebound or corrected trajectory. As of today, Alphabet's share price still sits below the consensus analyst price target of US$213.08, reflecting a price movement that is 34.26% under this target. If the growth trajectory continues in line with analyst forecasts, the share price may be supported into a range closer to the target.

Gain insights into Alphabet's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives