- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

Alphabet (NasdaqGS:GOOGL) Expands Advertising and Infrastructure Solutions With New Partnerships

Reviewed by Simply Wall St

Alphabet (NasdaqGS:GOOGL) experienced a 5% rise last week, in alignment with broader market trends marked by a sharp rebound. The company's recent collaborations, such as Shirofune's integration with Google's DV360 and Bentley Systems' use of Google Maps for asset analytics, could enhance Alphabet's advertising and geospatial offerings. Meanwhile, the tech-heavy Nasdaq saw a substantial 12% increase amid tariff-related news, providing a favorable environment for heavyweight tech firms. Despite these developments being supportive to Alphabet's narrative, the price move largely mirrored robust market motions driven by tariff pauses, indicating broader market factors at play.

Buy, Hold or Sell Alphabet? View our complete analysis and fair value estimate and you decide.

Alphabet's recent collaborations with Shirofune and Bentley Systems highlight significant advancements in advertising and geospatial offerings, potentially impacting future revenue streams. These collaborations align well with Alphabet's focus on AI and Google Cloud, enhancing user engagement and driving robust revenue growth. While these developments support Alphabet's growth narrative, the recent 5% share price increase largely mirrored broader market trends, reflecting the influence of tariff-related news on tech stocks, particularly within the Nasdaq, which saw substantial gains.

Over the longer term, Alphabet has experienced a 153.64% total return over the past five years, signaling strong performance. However, compared to the tech-heavy Nasdaq's 12% increase over the past year, Alphabet's underperformance indicates some recent challenges in keeping pace with industry dynamics.

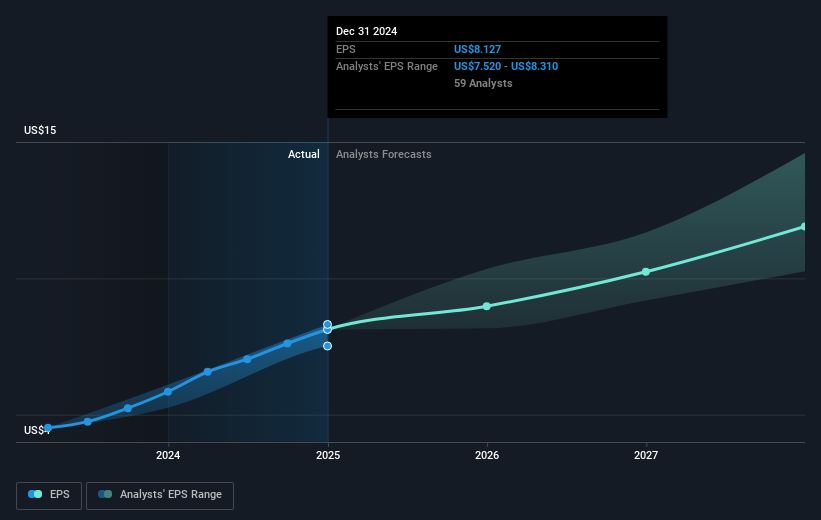

The partnerships announced may positively impact Alphabet's revenue and earnings forecasts. Analysts project revenue growth at 9.8% annually, supported by AI advances and cloud expansions. However, they also foresee a slight reduction in profit margins, posing potential risks. The current market price of US$144.7 reflects a significant discount to the analyst price target of US$214.58, suggesting possible upside if analysts' assumptions on earnings growth and improved margins materialize. It remains crucial for investors to assess whether current revenue projections justify the price target, especially considering the changing market dynamics and ongoing competitive pressures.

Click here to discover the nuances of Alphabet with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Alphabet, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives